What Is a Bitcoin Treasury Company?

Introduction The Shift in Corporate Finance

When inflation melts corporate cash faster than boards can replenish it, treasurers have two choices: chase yield or change the unit of account. In 2020, MicroStrategy made the second choice transforming $500 million of idle dollars into Bitcoin. That single act re-defined corporate finance and gave birth to a new archetype: the Bitcoin Treasury Company (BTCTC).

Unlike traditional firms that hold Bitcoin for “diversification,” these enterprises make Bitcoin the core of their balance sheet strategy. They are not speculators, they are capital-markets machines designed to accumulate and compound Bitcoin over time.

Their mission?To increase Bitcoin per share (BTC/share) for shareholders in the long term turning equity into a conduit for Bitcoin adoption.

Why the Need for a Bitcoin Treasury Model Arose

For decades, the corporate treasury was built around three assets: cash, bonds, and short-term credit. After 2008 and again after 2020, monetary expansion pushed real yields negative. A $100 million cash reserve, left untouched, now loses purchasing power every year. At the same time, Bitcoin emerged as the first digital monetary asset with absolute scarcity 21 million units, globally transferable, and secured by proof-of-work. It offered what no fiat instrument could: credible monetary integrity.

For CFOs and boards facing melting balance sheets, Bitcoin became less of a speculation and more of a defensive strategy. Holding Bitcoin was not about risk-taking, it was about risk management in a world of perpetual currency debasement.

Definition What Is a Bitcoin Treasury Company?

A Bitcoin Treasury Company (BTCTC) is a publicly listed enterprise that:

“Allocates a significant portion of its treasury reserves to Bitcoin as its primary store-of-value asset and uses its corporate balance sheet to expand Bitcoin ownership through equity or debt financing.”

In essence, a BTCTC is a bridge between fiat capital markets and the Bitcoin network.

It is distinct from:

- Miners, who produce BTC as inventory.

- Exchanges / ETFs, which custody BTC for clients.

- Fintech wallets, which facilitate transactions.

A BTCTC, instead, is an allocator and accumulator a corporation whose equity functions as a Bitcoin acquisition engine.

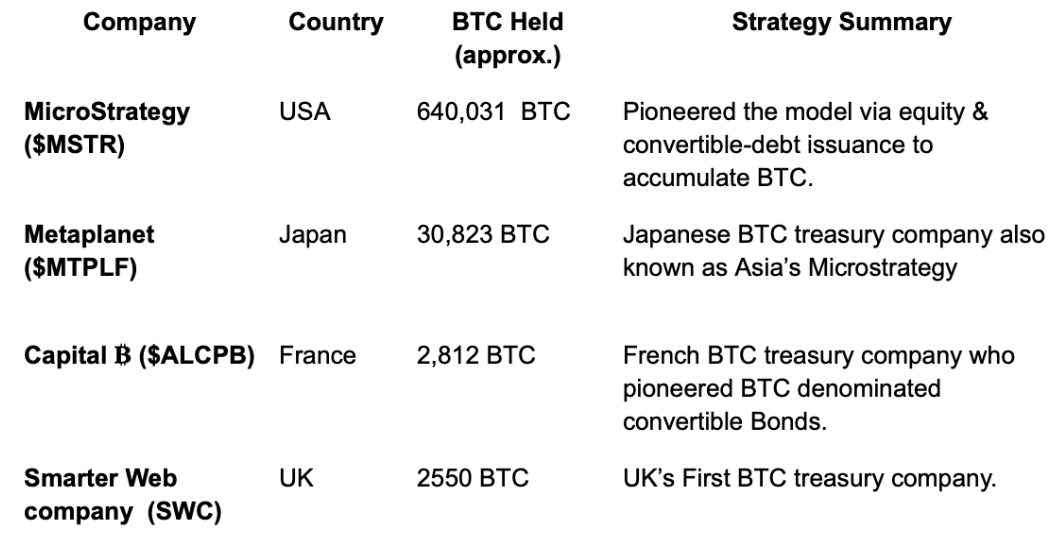

Pioneers & Case Studies

MicroStrategy proved that a corporate balance sheet could be transformed into a Bitcoin accumulation vehicle.

Metaplanet replicated the playbook in Japan, bridging Asian capital markets to Bitcoin.

Each of them shares one objective: compound Bitcoin ownership faster than any individual could achieve alone.

How They Operate The Bitcoin Flywheel

At the heart of every BTCTC lies a simple but powerful loop:

- Raise Capital — Issue equity, convertible notes, or preferred shares.

- Buy Bitcoin — Deploy proceeds into BTC at market prices.

- Appreciation — As BTC rises, the company’s mNAV and market cap increase.

- Raise more capital — Use higher equity valuation to raise more capital.

- Repeat — Continuously increase BTC holdings and BTC per share.

This reflexive loop often called the Bitcoin Flywheel creates a feedback system where Bitcoin appreciation and corporate finance reinforce each other.The metric that tracks this effect is simple but vital BTC per share.If this number rises year after year, the company is successfully compounding Bitcoin ownership for its shareholders.

Why Investors Care

Investors view BTCTCs as a hybrid between a Bitcoin ETF and a growth stock.They offer:

- Embedded Leverage to BTC: Equity typically moves 2–3× Bitcoin’s percentage change.

- Access Without Custody Risk: Exposure through traditional brokerage accounts.

- Potential for Yield: Some issue BTC-denominated preferred shares or structured credit.

- Premium/Discount Arbitrage: Market prices often diverge from underlying mNAV.

- Strategic Beta: Participation in the financial infrastructure forming around Bitcoin.

For traditional funds barred from holding BTC directly, BTCTCs serve as an on-ramp, a regulatory wrapper for hard-money exposure.

Risks & Challenges

- Volatility: Equity magnifies BTC’s moves both up and down.

- Dilution: Aggressive capital raises can reduce BTC per share if timed poorly.

- Regulatory Complexity: Varying treatment across jurisdictions (US, Japan, EU).

- Custody & Security: Safeguarding hundreds of millions in BTC requires institutional-grade controls.

- Investor Education: Markets still conflate BTC treasuries with “crypto plays.”

As with any financial innovation, execution discipline separates visionaries from speculators.

The Bigger Picture The Corporate Layer of Bitcoin

Bitcoin Treasury Companies are emerging as the corporate nodes of the Bitcoin network.They absorb fiat capital through equity markets, bond issuances, and convert it into digital energy on-chain.

Over time, they could evolve into Bitcoin banks, credit issuers, and yield providers, creating the foundation for a Bitcoin-denominated capital market.

“If Bitcoin is digital energy, then Bitcoin Treasury Companies are the power plants converting corporate capital into that energy.”

Their existence blurs the line between monetary policy and corporate strategy ushering in the era of the Corporate Bitcoin Standard.

Conclusion The Dawn of the Corporate Bitcoin Standard

Bitcoin Treasury Companies represent a fundamental evolution in finance.They are not just holding Bitcoin they are engineering a new monetary base within corporate structures.Their primary goal is simple yet profound to increase Bitcoin per share for their owners over time.

As these entities grow, they will absorb trillions in fiat capital seeking refuge from inflation and monetary debasement. Every share issued, every bond sold, every BTC acquired is another step in connecting Wall Street to the open monetary network of the 21st century.

In Part 2 of this series “How BTCTC's are bringing capital from different pools of capital into BTC.”