Wall Street Needs a New Benchmark The S&P 500 Is Collapsing in Bitcoin Terms

For decades, the S&P 500 served as the unquestioned barometer of U.S. wealth. Pension funds, 401(k) allocators, sovereign wealth desks, and retail households alike treated it as a conservative, diversified claim on long-term prosperity. “Buy the index, hold for 30 years, and you’ll be fine” became the default wealth strategy of the global middle class.

That playbook is now cracking and the chart priced in Bitcoin makes that reality brutally clear.

Since 2021, the S&P 500 has lost nearly 80% of its value when measured against Bitcoin, a drawdown that makes every traditional bear market in fiat terms look trivial by comparison. And unlike past corrections, this isn’t a cyclical rotation. It is a denominator revolution.

The Illusion of Performance in a Melting Unit of Account

Nominally, the S&P looks sturdy: gradual upward slope, dividends reinvested, stability via diversification. But that stability rests entirely on one implicit assumption that the U.S. dollar remains a credible unit of account.

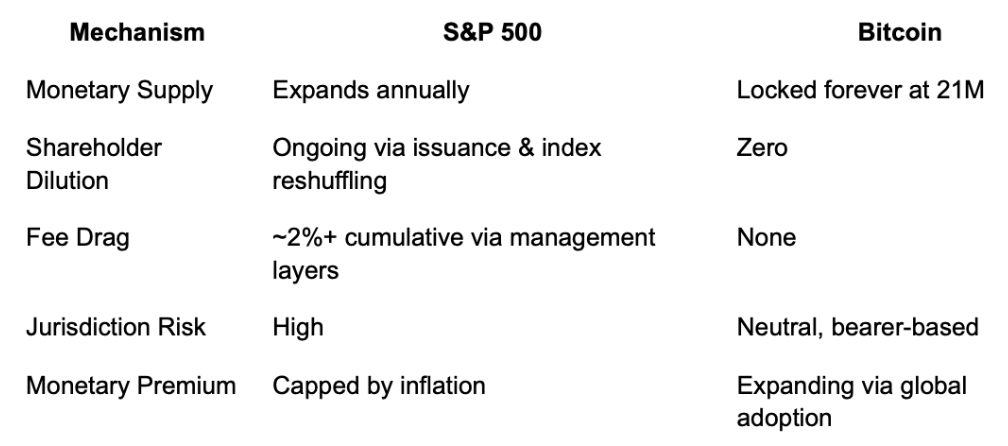

In a fiat regime where monetary inflation averages 7% annually, a stock index that returns 7–8% is not a generator of wealth it is merely a wealth-preservation instrument relative to a debasing currency.

Bitcoin with its fixed 21 million cap and global settlement finality introduces a monetary base asset that does not inflate to accommodate equity valuations. When expressed in that harder unit, the S&P 500 does not preserve wealth, it bleeds it.

Index Funds: The Middle-Class Vault Built on Fiat Sand

Private equity firms buy sports teams, Gulf royalty buys London property, family offices accumulate art. These assets serve as hard-asset vaults for high-net-worth capital.

The middle class never got access to that. Their “vault” became the index fund: low-fee, rules-based, dollar-denominated equity pools. But vaults only matter if the unit they’re measured in is stable.

When priced in Bitcoin, the S&P 500 isn’t a vault it’s a slow leak.

Four Failing Assumptions Behind the S&P 500

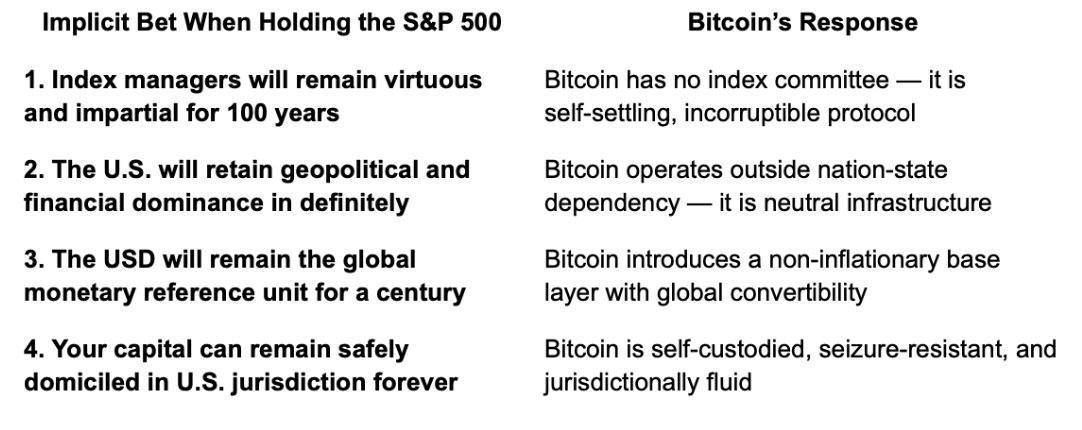

Owning the S&P 500 means implicitly accepting four long-duration geopolitical and monetary assumptions:

Bitcoin simultaneously breaks all four assumptions, offering a bearer instrument with no management fee, no dilution, no political dependency, and infinite monetary duration. As this realization scales, every fiat equity index — including the S&P 500 — begins to reprice downward in BTC terms.

A Structural Headwind: Bitcoin Doesn’t Dilute Equities Must

The index you’re buying is not static. Constituents are added and removed, shares are issued, fees are perpetually extracted, and dollar liquidity is inflated to lubricate corporate valuations. With every Federal Reserve expansion cycle, index valuations inflate not because corporate productivity soared, but because the measuring stick was stretched.

Bitcoin does not stretch. It forces the market to express value adjusted for monetary entropy.

Against a unit with perfect monetary integrity, even premier equity indices mathematically converge downward.

The “Magnificent 7” Mirage

Wall Street narratives highlight the Magnificent 7 the hyper-cap tech monopolies driving index performance. Strip those out, and the S&P 500 resembles a low-yield bond basket. But even those seven names, with all their network dominance, are still denominated in fiat equity units. They issue stock, buy back stock, rely on liquidity windows, and remain subordinate to the monetary base asset they’re priced in.

Bitcoin does not require an earnings call to maintain relevance.

Wall Street’s Quiet Risk: The Benchmark Is Shifting

Institutional allocators pride themselves on relative performance. “Beat the benchmark” is the mandate. For 50 years, that benchmark was the S&P 500.

Here’s the uncomfortable truth now emerging on trading desks: The real benchmark is no longer the S&P 500. It’s Bitcoin.

- A dollar-based index may still climb on Bloomberg terminals.

- But in Bitcoin terms, it is a melting ice cube attached to a melting measuring stick.

What happens when capital allocators begin pricing performance in BTC instead of USD? That transition doesn’t require majority adoption only a critical minority with clarity.

The Endgame: A New Monetary Yardstick

The S&P 500 once represented American ingenuity packaged into a financial product. But once a superior monetary instrument enters the system, all financial abstractions sitting above it must reprice.

The decline of the S&P 500 in Bitcoin terms is not a warning signal it is the repricing mechanism itself.

Bitcoin is not rising. Fiat benchmarks are being marked down.

As Bitcoin treasury companies, Bitcoin-denominated credit instruments, and sovereign BTC reserves expand, the world’s capital stack will slowly reprice around BTC as the neutral global denominator.

And when that happens, the S&P 500 doesn’t just underperform it becomes a high-beta derivative on a failing monetary system.