Strive–Semler: Decoding the “210% Premium” and the Real Bitcoin Economics

Before the market opened Monday, Strive, Inc. (NASDAQ: ASST) announced it will acquire Semler Scientific, Inc. (NASDAQ: SMLR) in an all-stock transaction that, at Friday’s prices, appeared to deliver a 210 % premium to SMLR holders.

But with ASST stock already down to $2.89 (from $4.30 Friday) and SMLR only up slightly to $31 (vs. a headline $90.52 “takeout”), the market is clearly rejecting the surface optics.

This transaction is about Bitcoin per share (BPS) accretion for Strive, dollar exit value for Semler holders, and the risk that PIPE issuance and dilution push ASST down toward book value (mNAV), killing the premium.

Deal Terms: Stock, Not Cash

- Fixed exchange ratio: 1 SMLR → 21.05 ASST

- Friday implied value:

21.05 × $4.30 = $90.52

- Implied value ( as on 25th Sept 2025 ) : 21.05 × $2.89 = $60.79

- SMLR market price: only $31, about half today’s implied $60 and one-third of Friday’s $90

Because this is not a cash offer, the “premium” disappears the moment ASST trades down.

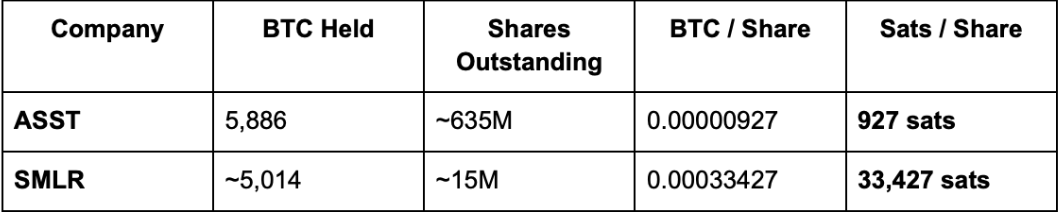

Pre-Deal Bitcoin Density

Post-Deal Mechanics

- New shares issued: 15M × 21.05 = 315M

- Total shares post-merger: 635M + 315M = 950M

- Combined BTC: 5,886 + 5,014 ≈ 10,900

BTC per ASST share=10,900/950M=0.00001147 BTC (1,147 sats/share).Impact:

- ASST holders: 927 → 1,147 sats (+24 % BPS accretion)

- SMLR holders: 21.05 × 1,147≈ 24,087 (28 % dilution in Bitcoin terms)

Takeaway:

The real gain is on the ASST side: more BTC per share.SMLR holders lose BTC density but are supposed to get compensated with a USD premium if ASST can hold its stock price.

Why Strive Uses Shares Instead of Cash

To buy SMLR’s 5,000 BTC via the open market:

- Would require raising $675M about 17 % of ASST’s market cap.

- Stock → cash → BTC means double slippage and front-running.

By issuing stock directly, Strive effectively trades equity for Bitcoin OTC, avoiding order book impact.

The PIPE Overhang — The Real Near-Term Risk

Strive has an open PIPE/ATM facility:

- Allows it to issue more common shares into the market.

- Suppresses ASST price (already down 33 % today).

- More supply also makes borrowing cheaper for arbitrageurs but drags the dollar value of the 21.05× ratio.

Valuation anchor:

- Street estimates ASST’s 1× mNAV at $1.13–$1.81.

- At those prices, the SMLR “takeout” is only:

- 21.05×1.13=$23.79

- 21.05×1.81=$38.10

If ASST slides to book value, SMLR gets $24–38, well below even today’s $31 and miles under the $90 headline.

What This Means for Each Side

ASST Shareholders

- BTC/share still accretive: 927 → 1,147 sats regardless of price.

- If you measure wealth in BTC (Strive’s stated playbook), you “win” even if the USD price of each share drifts down to mNAV.

- Risk: a depressed stock complicates future capital raising for more BTC.

SMLR Shareholders

- Bitcoin density drops ~28 %.

- Dollar value is only attractive if ASST holds well above mNAV.

- If PIPE issuance drags ASST to book, they’re effectively selling BTC cheap.

Strategic Vision Still Logical — Execution Is Everything

- Strive wants a bigger BTC collateral base and an income-producing diagnostics arm to backstop perpetual preferred stock issuance (instead of debt with maturity cliffs).

- Conceptually elegant: issue equity once, add 5k BTC, raise cheaper hybrid capital later.

- But if the market forces ASST to trade at or below mNAV, the promised premium to SMLR evaporates and shareholders may revolt.

⚖️ Bottom Line

- SMLR: The 210 % premium only exists if ASST can defend a much higher share price; at 1× mNAV the takeout is $24–38 and Bitcoin/share falls.

- ASST: Even at 1× mNAV, BTC per share rises ~24 %, so long-term Bitcoin-focused holders still “win,” but short-term USD value and financing capacity suffer.

- Market: Correctly skeptical — pricing in PIPE dilution, shareholder pushback, and crypto/healthcare regulatory risk.

Unless Strive can cap PIPE supply, stabilize its stock, and push through approvals, the deal may need to be re-cut or could fail altogether. The “210 % premium” was optical — the true battleground is Bitcoin per share versus dollar dilution.