STRE: Strategy Inc. Launches Euro-Denominated Digital Credit for Investors In Europe

Introduction: A Bitcoin-Backed Euro Yield Play

Strategy Inc.'s new euro-denominated perpetual preferred security, STRE (Stream), offers a unique solution. With a fixed 10% annual dividend and deep overcollateralization via Bitcoin (BTC), the Stream instrument is more than just another yield product it's the European debut of Strategy's evolving digital credit ecosystem.

The offering is set to list on Luxembourg’s Euro MTF exchange and marks the fifth preferred issuance from Strategy this year, following the U.S.-listed STRK, STRD, STRF, and STRC. Where the U.S. preferreds delivered dollar-denominated rock dividends with various volatility-return tradeoffs, STRE brings a euro-denominated, tax-efficient fixed income profile to an underserved segment of the market.

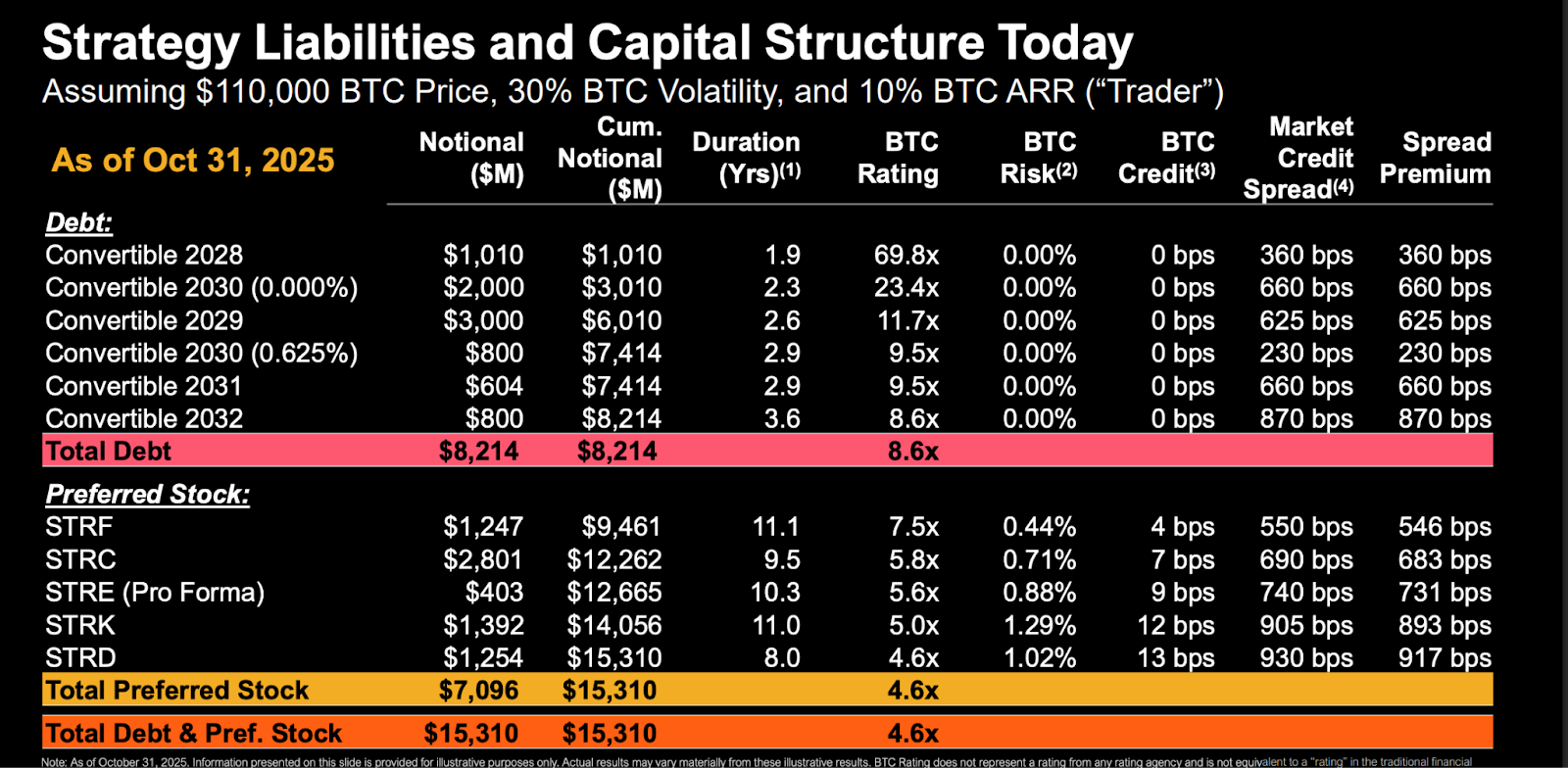

Capital Stack and Structural Positioning

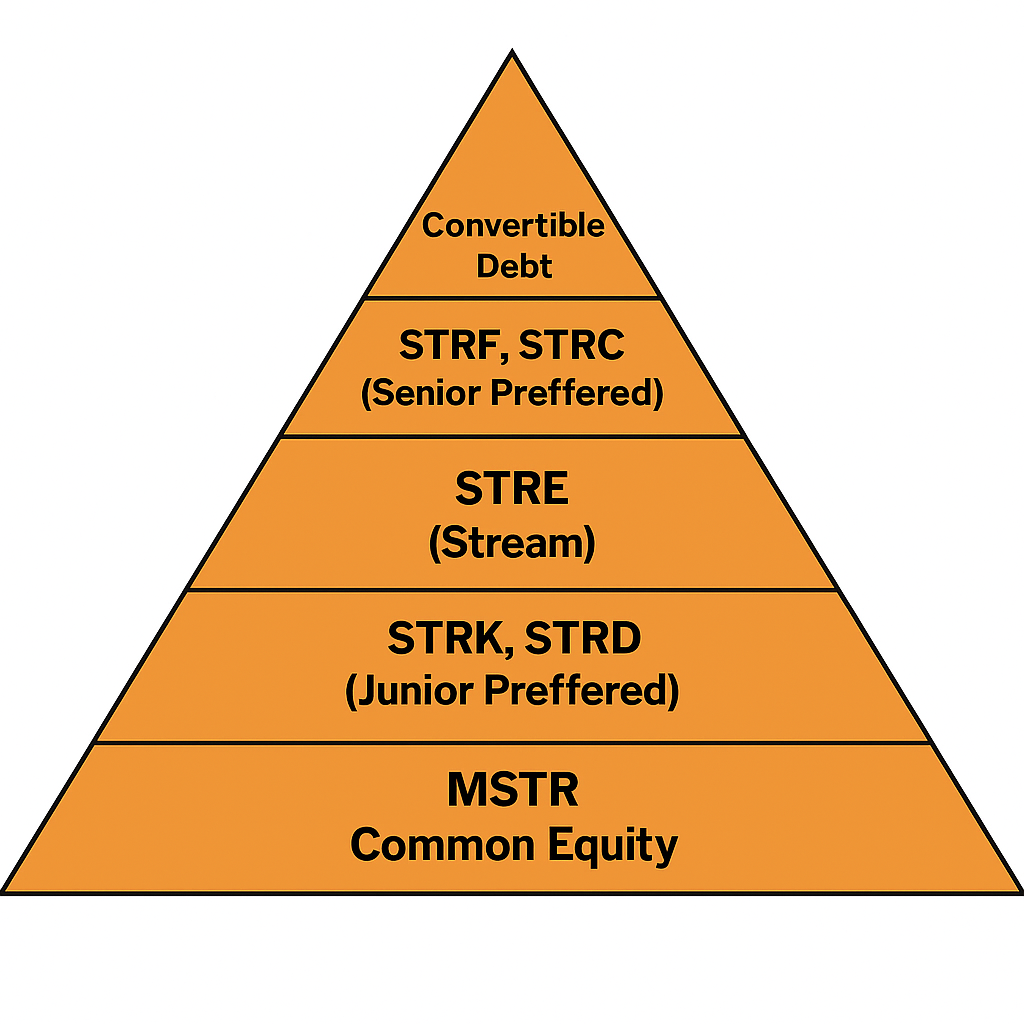

STRE is senior to Strategy’s MSTR common equity and its junior preferreds (STRK, STRD, STRD) but ranks subordinate to the U.S.-based STRF (Strife) and STRC (Stretch) securities, as well as to $8.2 billion in convertible debt.

The €350 million targeted issuance will be overcollateralized with €5.60 in Bitcoin for every €1 of STRE, giving it an initial BTC rating of 5.6x implying robust downside protection against BTC volatility.

It is a perpetual, cumulative, non-callable preferred with a quarterly 10% cash dividend. Structural protections include step-up clauses for missed payments and dividend stoppers that restrict junior payments if STRE obligations are unmet. These provisions are unusual in European hybrid structures, making STRE resemble investment-grade preferreds more than speculative high yield.

Collateral, Coverage, and Dividend Capacity

With $64 billion in Bitcoin holdings, Strategy’s treasury represents approximately 3.1% of all Bitcoin that will ever exist, positioning it among the top five U.S. corporate treasuries by size surpassing Amazon and rivaling Google.

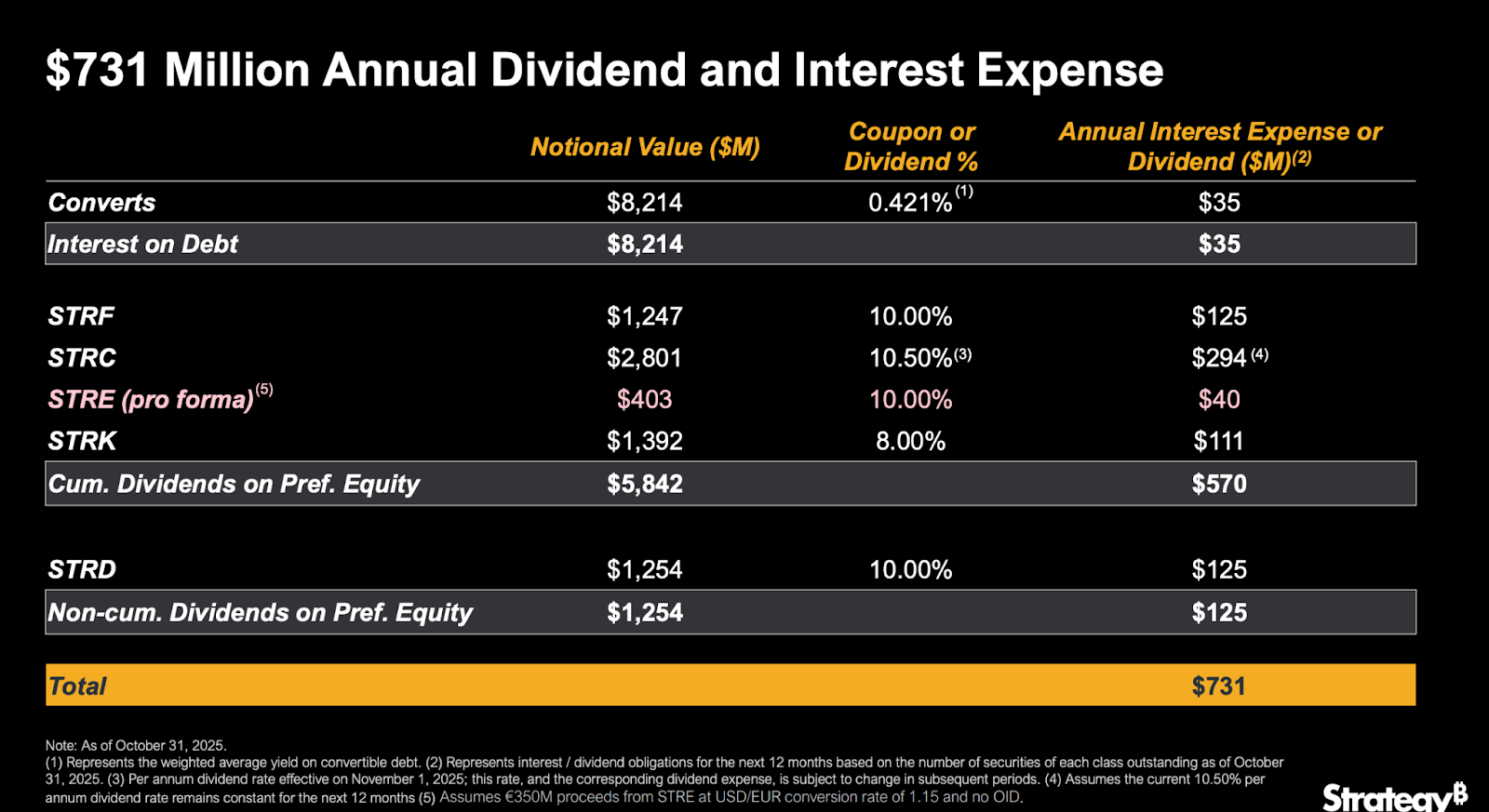

Annual dividend and interest obligations total $731 million, with STRE accounting for a fractional portion of this upon issuance. The company asserts it could cover this amount for 97 years using existing Bitcoin net asset value, and emphasizes that STRE’s dividend stream is backed not by operating cash flow but by capital market access and BTC appreciation.

Pricing Context and Peer Comparison

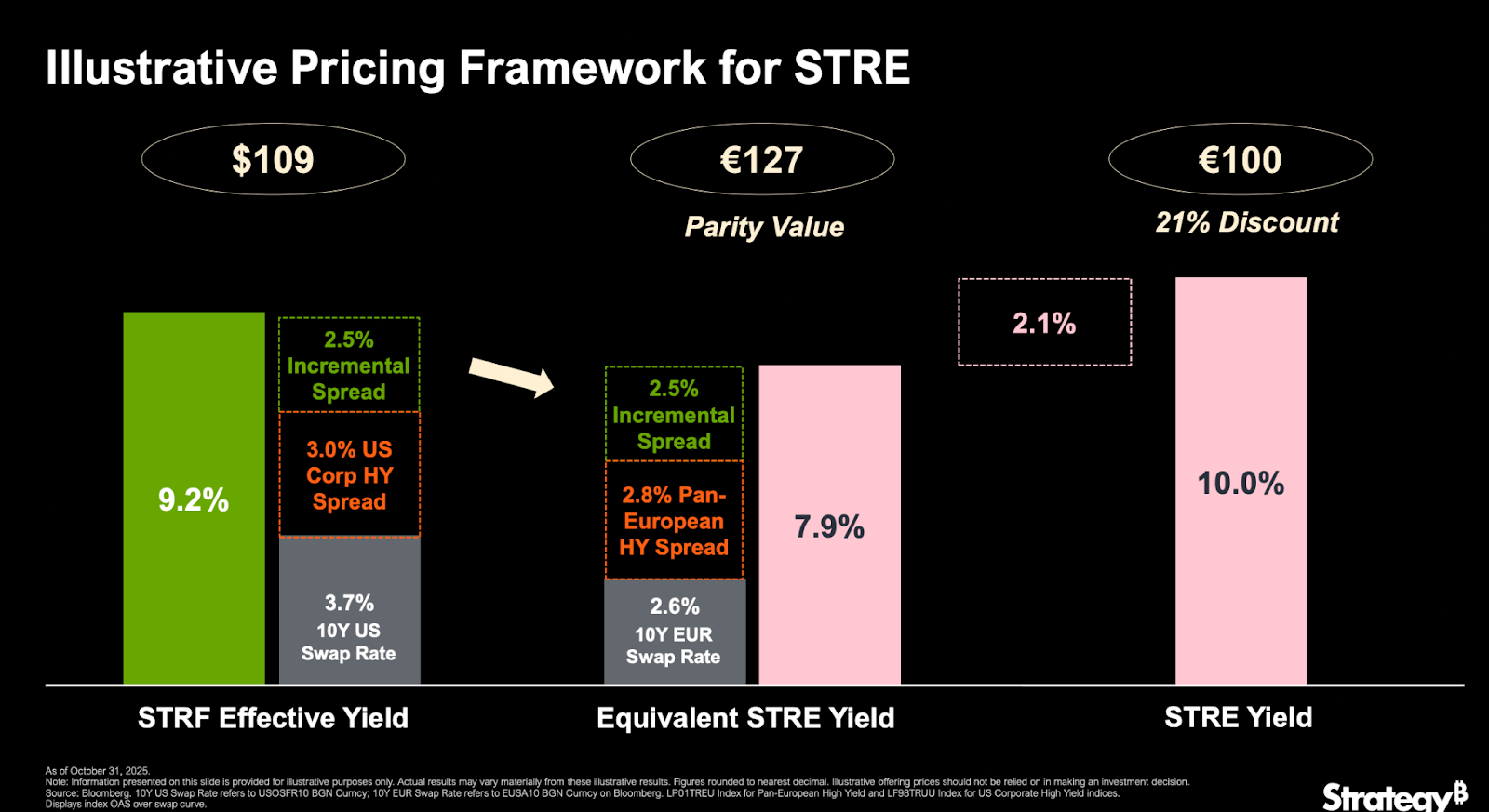

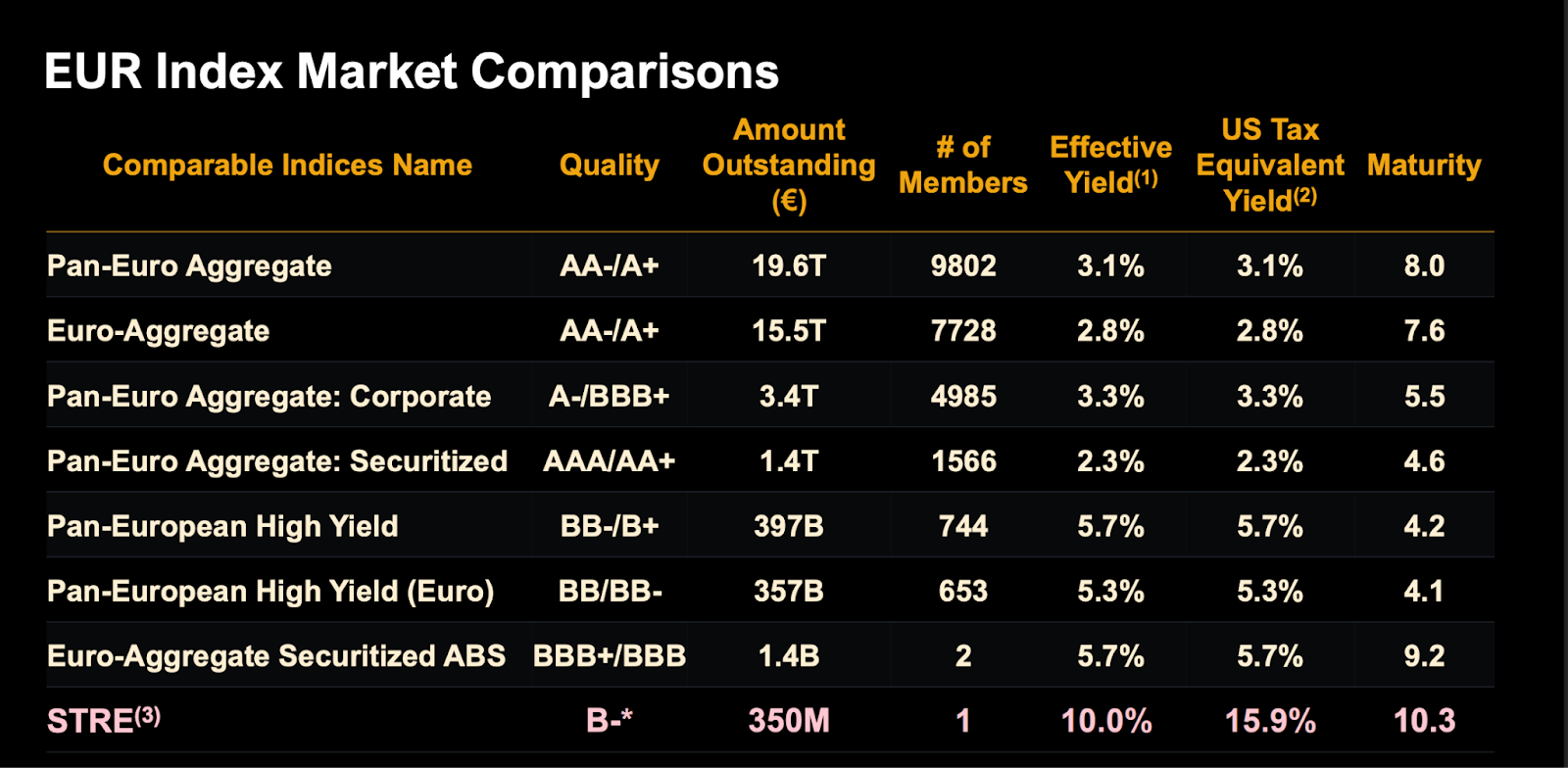

With a fixed 10% coupon and euro denomination, STRE’s implied yield-to-maturity, duration-adjusted spread, and risk-reward profile place it well above EUR corporate hybrids and investment-grade bonds.

Strategy’s illustrative spread model suggests a 530bps premium over European swap rates, exceeding the 280bps pan-European high yield average. This would imply a market clearing price of €127 for a comparable instrument STRE's discounted issuance (likely near par) offers a significant yield pick-up.

Key competitors include:

- Bayer and BASF EUR perpetual hybrids: 5.0–6.0% effective yield, 3–5 year durations, €1M daily liquidity

- Private credit: 6–9% yields, limited secondary market access, callable structures

- Investment-grade EUR bonds: 2–3% yields, high duration risk

STRE’s perpetual duration and non-callable nature offer strong long-term appeal for duration-focused investors seeking BTC exposure without the full volatility. Strategy estimates an effective maturity of 10.3 years for STRE.

Credit Risk: Bitcoin as Collateral

Strategy’s on-platform BTC credit risk model allows real-time monitoring of collateral sufficiency. Investors can plug in BTC price, volatility, and ARR assumptions to estimate coverage.

Under a base case of 10% ARR and 30% BTC volatility, STRE’s under-collateralization risk falls to <1%. Even at zero BTC growth and high volatility, risk remains in the 25–35% range still below many subordinated bank AT1 instruments.

The embedded option is clear as BTC volatility declines and price rises over time, the risk-adjusted yield on STRE becomes even more attractive. This convexity unavailable in traditional credit could drive secondary market price appreciation and tightening spreads.

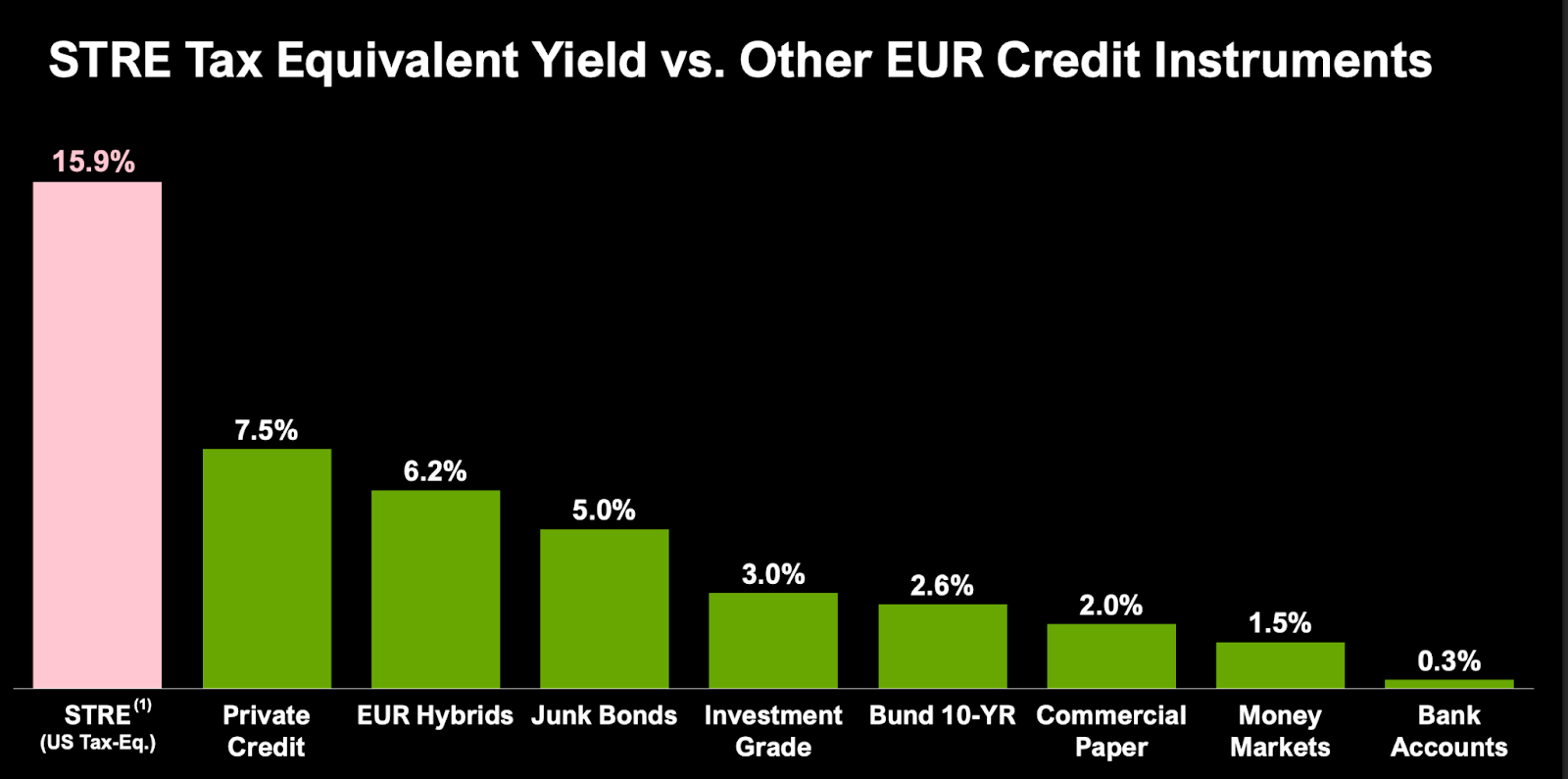

Return of Capital: Tax Treatment and Yield Advantage

One of STRE’s most compelling features is its return of capital (RoC) tax structure, similar to Strategy’s U.S. preferreds. These payments are not considered taxable income but rather reduce the cost basis of the security.

- U.S. investors: Tax deferral until sale; STRE's 10% coupon equals 15.9% tax-equivalent yield assuming a 37% federal rate

- EU investors: RoC treatment under review; if approved, STRE would enjoy a significant net-of-tax advantage over other yield instruments

Market Outlook and Investor Fit

Strategy’s prior preferreds (STRF, STRC) achieved trading volumes 5x higher than average listed preferreds, with daily liquidity of $18–72 million. If STRE achieves even half this profile in Luxembourg, it could become the most liquid EUR hybrid in the market.

STRE suits:

- Duration-focused credit funds seeking perpetual fixed income

- Tax-aware U.S. and EU investors looking for deferral strategies

- BTC-positive allocators wanting volatility-reduced exposure

- Sovereign wealth and insurance buyers targeting long-term yield

Conclusion: A New Paradigm for Euro Credit

STRE is not just a high-yield instrument it’s a challenge to conventional capital markets orthodoxy. It blends perpetual credit with digital asset backing, offers transparent credit monitoring, and delivers tax-efficient income in a euro-denominated format.

For institutions rethinking credit allocations amid monetary tightening and crypto institutionalization, STRE represents a rare convergence: high yield, perpetual duration, and macro-aligned optionality. Strategy’s digital credit factory is open for European business and STRE is its flagship issue.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.