Smarter Web Company (SWC PC) – Equity Research Report

Welcome to Roxom Research Report - 3R, the weekly digest where we analyze assets and companies shaping the Bitcoin economy. At Roxom, our mission is to build and develop the first capital market fully denominated in Bitcoin, giving investors the tools to trade, hedge, and allocate capital through a Bitcoin lens. With this report, we aim to provide high-quality market intelligence that helps our community navigate this emerging landscape and understand the strategies of the pioneers already adopting Bitcoin at scale.

In this issue, we explore Smarter Web Company (SWC), a London-listed web services provider that has transformed itself into one of the most aggressive Bitcoin treasury companies in the public markets. Since its April 2025 IPO, SWC has scaled from holding just 2 BTC to over 2,400 BTC, fueled by innovative financing tools such as equity raises, an ATM-style issuance facility, and the launch of the first BTC-denominated convertible bond in the UK (“Smarter Convert”)

This Week's OVERVIEW

- Since SWC's April 2025 IPO, SWC has rapidly scaled from just 2 BTC to over 2,440 BTC, now worth ~£198M.

- Innovative financing moves including equity raises, an ATM-style facility, and a BTC-denominated convertible bond have fueled this growth.

- The stock trades at 1.81× its Bitcoin NAV, down from 7–10× earlier, giving investors leveraged BTC exposure at a more grounded premium.

- Analysts remain bullish with a 12-month target of 600p, citing strong upside if Bitcoin rallies and SWC continues its aggressive accumulation.

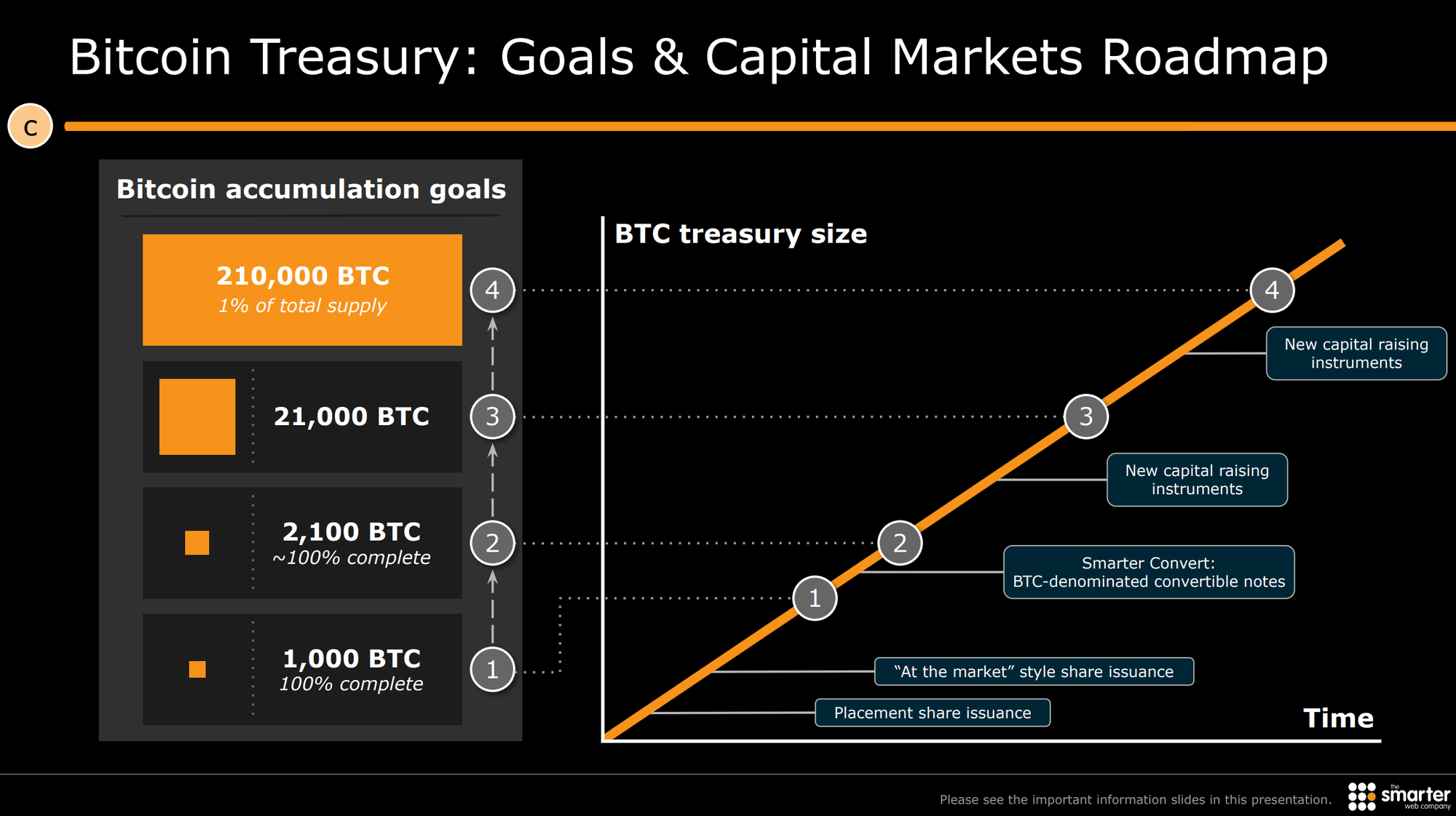

Bitcoin Treasury Strategy and “10 Year Plan”

Bitcoin is a “core part of the future of the global financial system.”

In early 2025, SWC launched a transformative Bitcoin Treasury strategy as part of its “10 Year Plan,” integrating Bitcoin into its balance sheet and capital strategy.

Under this plan, SWC is effectively leveraging its equity and now debt to accumulate Bitcoin, based on the thesis that Bitcoin is a “core part of the future of the global financial system.”

The company’s board considers Bitcoin an appropriate store of value for excess reserves despite UK regulators deeming cryptoassets high risk, preferring to deploy capital into BTC rather than hold idle cash. SWC continually acquires Bitcoin for its treasury, turning the company into a hybrid operating business and Bitcoin holding vehicle.

➡ Key elements of SWC’s Bitcoin strategy include:

Ongoing BTC Accumulation

SWC follows a standing treasury policy of acquiring Bitcoin whenever feasible. This policy was formalized at IPO (April 2025) and communicated via regulatory news service, committing to transparent updates on BTC holdings. Management views Bitcoin as a long-term treasury reserve supporting “longer-term business value” via a Bitcoin Treasury Standard.

Equity-Funded Purchases

The company raised capital through high-valued equity issuances to buy Bitcoin. This leveraged share performance to grow BTC holdings.

- Post-IPO (April 2025 at 5p), SWC made several placements as stock surged.

- May 2025: Shares at ~25p → issued ~14M new shares → raised funds for BTC buys.

- Mid-June: Shares at ~180p → raised £29.3M.

- Late June: £41.2M placing at 290p/share → boosted BTC purchasing power.

Each raise was highly accretive, with the June placement at 10.9× NAV, converting funds to BTC dropping mNAV to 6.9×, increasing BTC per share by ~55%.

By issuing shares above BTC asset value, SWC boosts every shareholder's “sats per share” a strategy called the “Nakamoto strategy.”

ATM-Style Facility: Structurally Accretive Innovation

On 19 June 2025, SWC launched a UK-first ATM-style (At-The-Market) equity program:

- Total limit: 21M shares (~£70M at 333p)

- Daily limit: ≤20% of prior trading day’s volume

- Pricing rule: Cannot issue below the previous day’s close

How It Works — Example:

- SWC closes at 300p, daily volume = 3M shares

- Max shares allowed next day = 600,000 (20%)

- Total raise = 600,000 × 300p = £1.8M

- BTC at £90,000 → ~20 BTC purchase

- If market cap increases >£1.8M for 20 BTC → BTC/share ↑, mNAV compresses

Result: Shareholders gain BTC exposure faster than dilution, creating net accretion in NAV/share.

Smarter Convert: BTC-Denominated Convertible Bond

In August 2025, SWC launched a groundbreaking financial instrument: a Bitcoin-denominated convertible bond dubbed "Smarter Convert."

This marks the first such BTC-linked debt offering by a UK-listed firm and reflects the company's deepening commitment to Bitcoin-native capital structuring.

- Structure: $21M raise, fully subscribed, denominated in Bitcoin. Convertible into equity at a 5% premium to prevailing share price.

- Maturity & Optionality: 12 months maturity. Holders can convert into equity. If stock rallies >50% above conversion, SWC may force conversion.

- Strategic Benefit: Raise capital with limited dilution, align creditors + equity. Modeled after MicroStrategy, but BTC-native in Europe.

- Deployment: Proceeds deployed directly into Bitcoin purchases.

👉 Smarter Convert exemplifies how Bitcoin-native treasury companies can innovate at the frontier of corporate finance, setting a precedent for BTC-denominated debt instruments.To understand more about BTC denominated Converts click here.

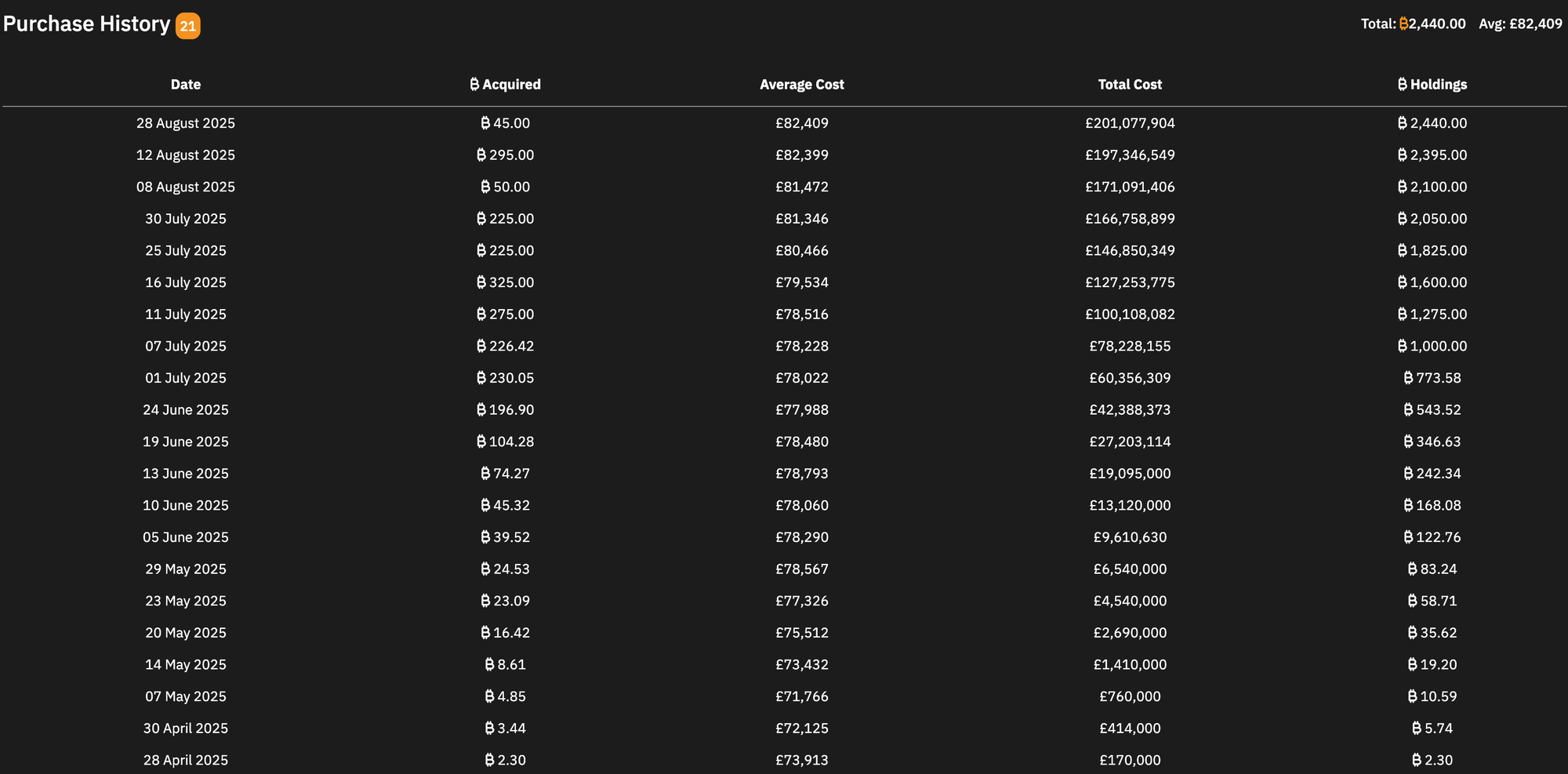

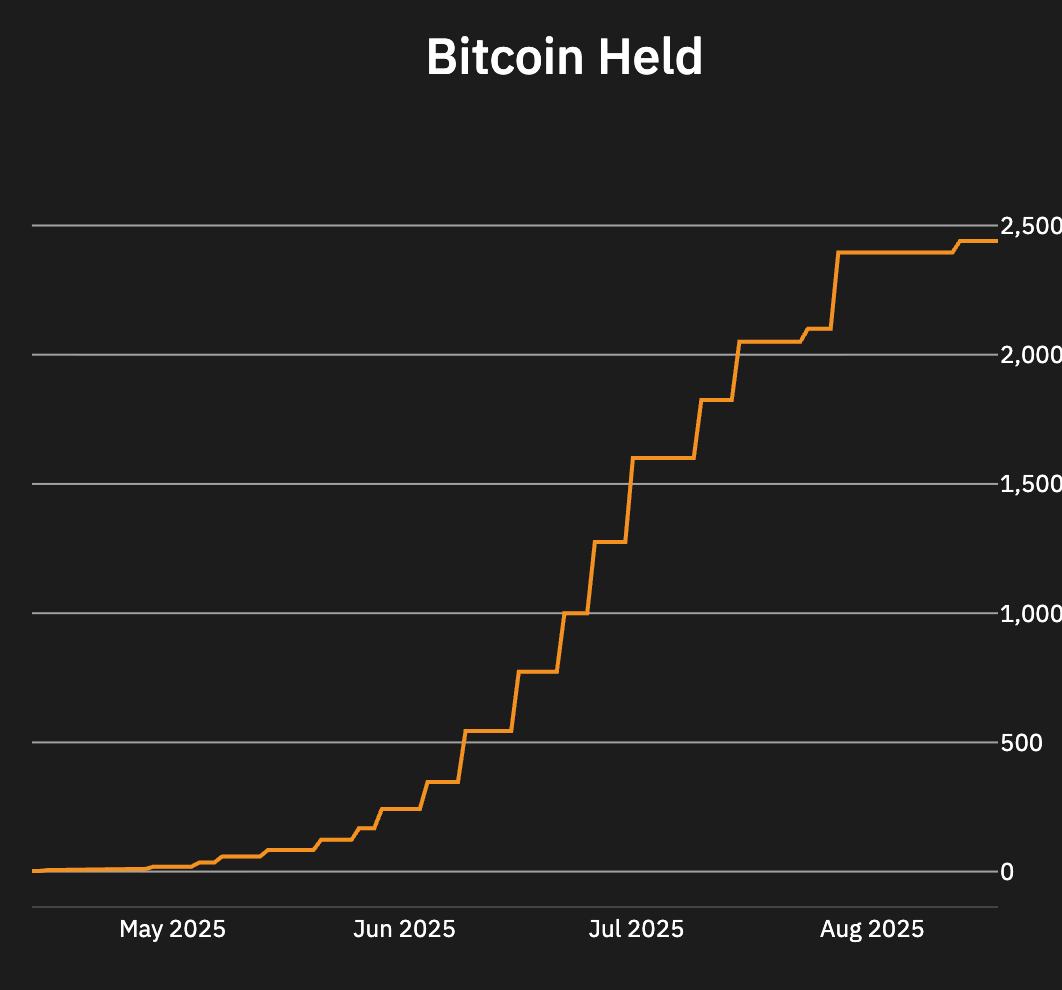

Rapid Bitcoin Accumulation: Progress To Date

Holding Growth:

- IPO (April 2025): ~2.3 BTC.

- Late May 2025: ~58.7 BTC (25× increase).

- Mid-June 2025: 346.6 BTC (~£27.2M).

- Post late-June raise: guided to >1,000 BTC within days.

- July 1, 2025: 773.6 BTC at ~$107k avg cost, ~$52M cash left.

- July 7: >1,000 BTC.

- July 11: 1,275 BTC.

- July 16: 1,600 BTC.

- July 25: 1,825 BTC.

- July 31: 2,050 BTC.

- August 8, 2025: +50 BTC at £86,650 → treasury = ~2,100 BTC.

- August 12, 2025: 2395 BTC

- August 28, 2025: 2440 BTC

At ~£198M market value, SWC holds 2,440 BTC at an average cost of £82.5k. Current price (£80.3k) gives them a ~2.5% unrealized loss. As SWC started from a smaller base they gave a tremendous BTC yield of more than 56000%

mNav and valuation security

SWC’s market capitalization surged in Q2 2025, peaking near £1.1B as its stock traded at 20× Bitcoin NAV. After a capital raise, the multiple briefly fell to ~5×, then rebounded toward ~8× before normalizing. This premium reflected investor optimism in SWC’s “Nakamoto strategy” – issuing equity or bonds at a premium to NAV to buy BTC, boosting NAV/share and driving a virtuous cycle of price appreciation. Since IPO, sats per share have grown from near zero to hundreds.

Current Valuation: The stock now trades near £1.30 (market cap ~£360M), about 1.8× BTC holdings plus cash down from ~10× in June but still a 150% premium over assets. This aligns more with peers like Strategy (~1.5× NAV), suggesting a more grounded valuation. The lower multiple offers a more attractive entry point, though growth depends on management’s ability to raise capital at favorable valuations and deploy accretively. If Bitcoin sentiment improves, the mNAV multiple could expand again, providing upside leverage.

Key risks outlook

While the upside of SWC’s Bitcoin-centric strategy is significant, there are several key risks investors should weigh:

1. Bitcoin Price Volatility: SWC is a leveraged bet on Bitcoin. A 50% BTC drop could lead to a >75% fall in SWC’s share price as NAV contracts and the premium evaporates. Prolonged low BTC prices would also impair its ability to raise accretive capital.

2. Regulatory & Perception Risk: The UK FCA classifies crypto as “high risk,” and regulators could tighten rules (e.g., stricter disclosures, reclassification as an investment fund, limits on corporate crypto holdings). Negative sentiment toward Bitcoin equities or high-profile failures could collapse SWC’s premium.

3. Capital Market Dependence & Liquidity: SWC relies on raising equity at a premium to grow BTC holdings. In a weak market or crypto downturn, its stock could trade at or below NAV, stalling growth and creating a negative feedback loop. Dilution risk rises as BTC holdings scale, and Aquis/OTC listing means thin liquidity, amplifying volatility. Competition from larger peers could also draw investor capital away.

4. Execution & Operational Risks: Secure custody of BTC, timely raises, and efficient execution are critical. Missteps—such as mistimed financings or poor BTC purchase timing—could destroy value. Failure to sustain the core web services business or prolonged BTC stagnation could erode confidence in the strategy.

Conclusion

Smarter Web Company is likely to remain a talking point in the coming months. Beyond simple price appreciation, it effectively aims to create a form of “Bitcoin yield” — by using equity and debt financing to continually grow its BTC holdings per share.

This type of company might be best suited for investors who:

- Want exposure to Bitcoin without holding BTC directly.

- Are comfortable with volatility and regulatory uncertainty.

- Believe in Bitcoin’s long-term appreciation and want to amplify that upside through equity structures.

It will be fascinating to see how SWC evolves as markets shift, regulatory scrutiny increases, and Bitcoin adoption accelerates. Companies like this may set the precedent for a new class of Bitcoin-native equities.