SATA: The Second Perpetual Preferred in Bitcoin Treasury Finance

Strive Asset Management — SATA Perpetual Preferred Equity

I. Executive Summary

The emergence of perpetual preferred equity within Bitcoin Treasury Companies (BTCTCs) marks a structural transition in digital-asset corporate finance. Following Strategy Inc.’s pioneering issuance earlier this year, Strive’s SATA (Variable Rate Series A Perpetual Preferred Stock) becomes the second-ever perpetual preferred instrument in the BTCTC sector, and the first to be issued by a firm with no financial debt, no margin borrowing, and no encumbered Bitcoin.

SATA is designed as:

- A perpetual, non-convertible preferred equity instrument

- Supported by Bitcoin reserve assets and asset-management cashflows

- Featuring a 12% initial cash dividend, paid monthly

- With a variable dividend system designed to support stability between $95 and $105

- Offering 3.8x BTC coverage at issuance

- Protected by a 12-month pre-funded dividend reserve

- Embedding cumulative dividends with compounding penalty rates up to 20%

This article integrates each relevant section of Strive’s SATA Update deck (Slides 11–18), providing a fully institutional presentation of the security’s structure, credit profile, risk considerations, and strategic role within the evolving Bitcoin treasury landscape.

II. The Emergence of Perpetual Preferreds in BTCTC Finance

The introduction of perpetual preferred instruments into BTCTC capital stacks reflects a meaningful maturation of the sector.

Bitcoin is a long-duration monetary asset. A perpetual preferred is a long-duration corporate liability.

The duration match is structurally elegant and financially appropriate. Strategy Inc.’s instrument earlier this year established the blueprint. SATA now validates the model as a recurring financing tool capable of attracting institutional yield-seeking capital to Bitcoin-backed balance sheets.

SATA is the second issuance of its kind — but the first issued from a clean, unlevered balance sheet. This distinction positions SATA as a low-fragility, high-coverage perpetual preferred designed specifically for institutional consumption.

III. Issuer Overview: Strive’s Treasury Architecture

Strive operates a dual business model:

- Bitcoin Treasury Operations

- 7,525 BTC held directly

- ~$761M value at ~$101k/BTC

- Asset-Management Revenues

- $2.0B AUM

- Ongoing, recurring fee income

Strive has:

- No outstanding debt

- No senior credit instruments

- No liens or encumbrances on Bitcoin

- No margin or derivative financing

The corporate architecture is intentionally conservative, enabling SATA to function as the senior-most economic claim on the balance sheet.

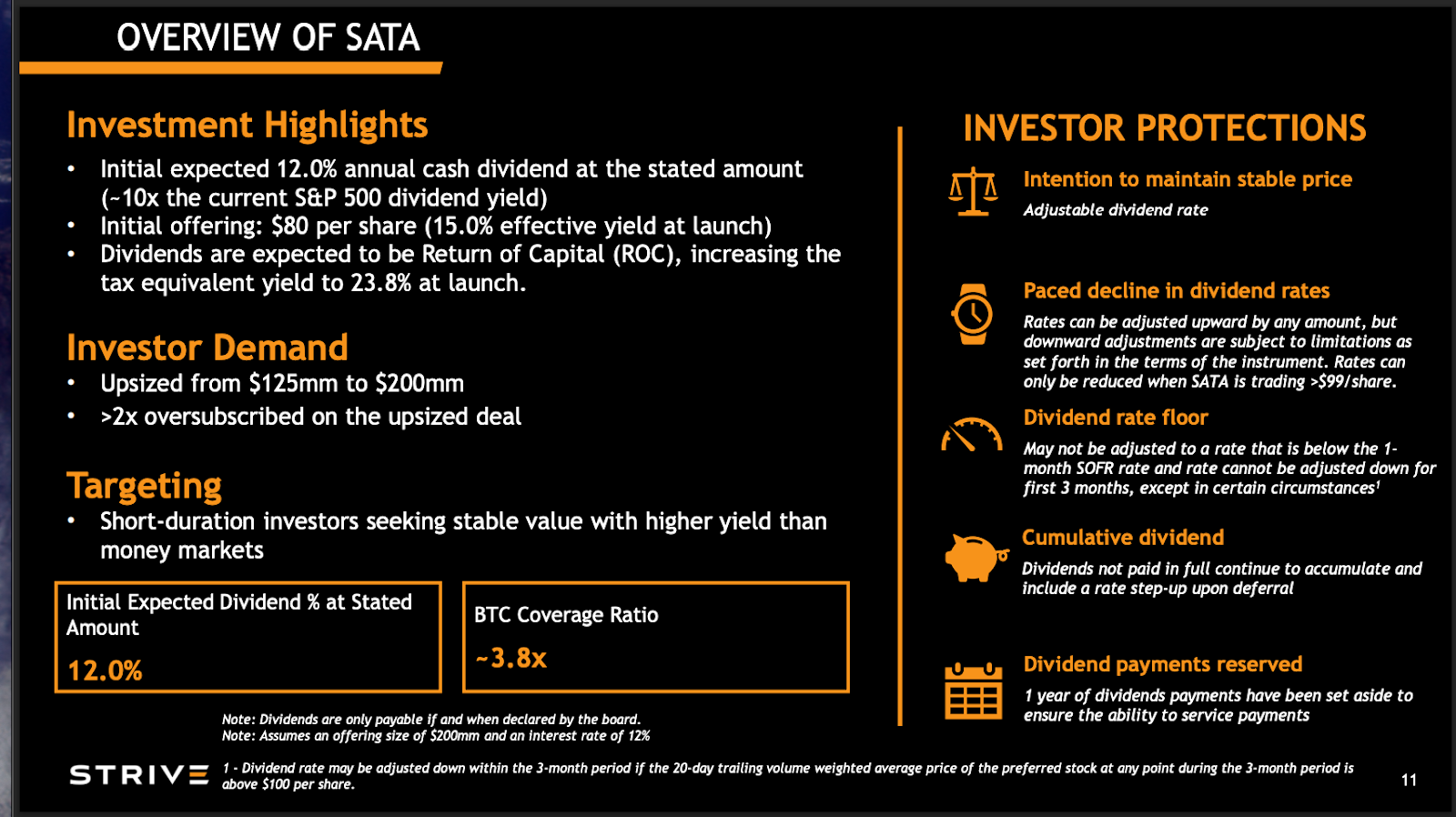

IV. Overview of SATA

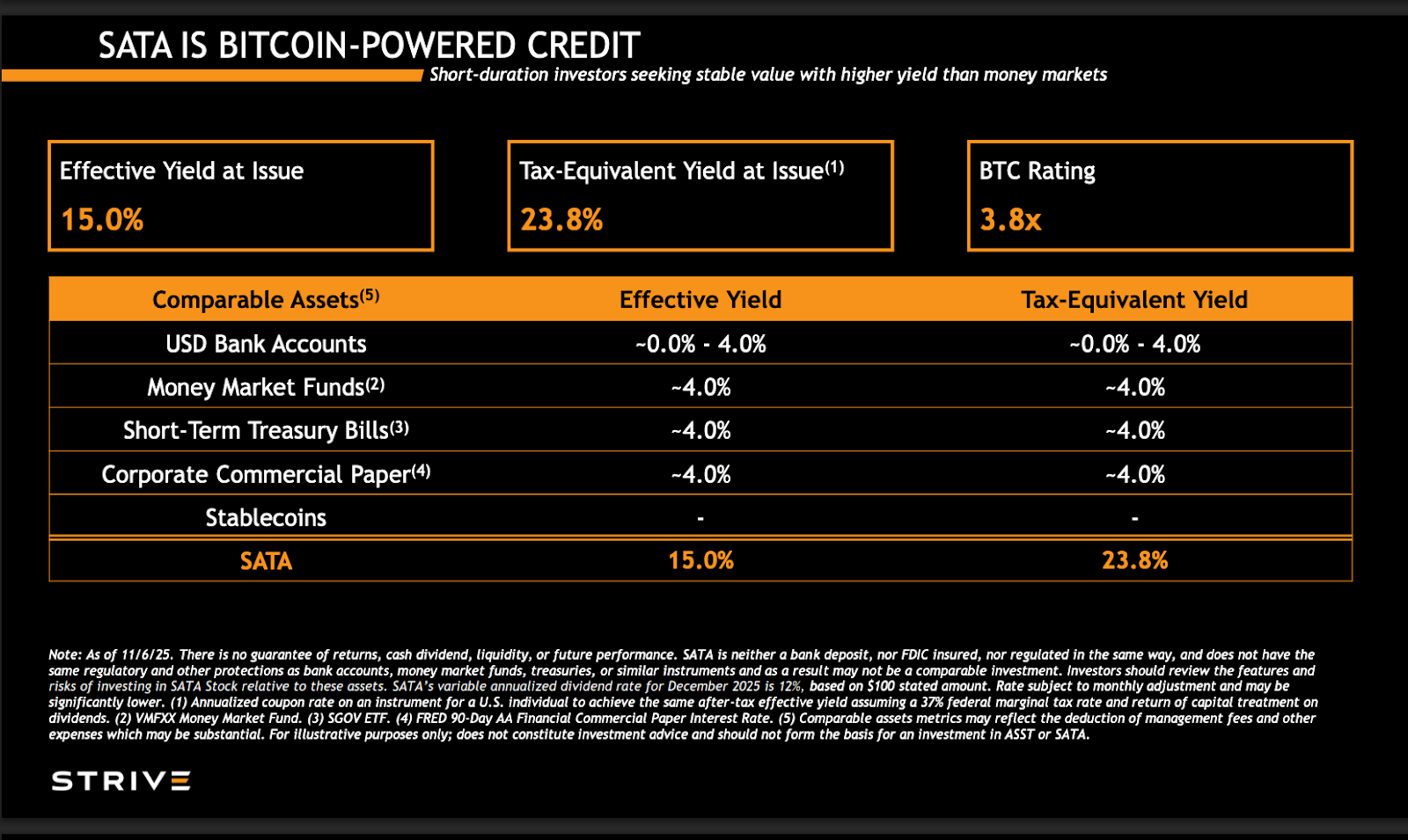

Slide presents the foundational economic characteristics of SATA. Key points include:

Initial Dividend & Yield

- 12% cash dividend at the $100 stated amount

- Effective 15% yield at the initial $80 offering price

- Dividends expected to be treated as Return of Capital (ROC), corresponding to 23.8% tax-equivalent yield (U.S. top bracket)

Investor Demand

- Deal upsized from $125M to $200M

- >2x oversubscribed, demonstrating institutional appetite

Target Investor Base

- Short-duration income allocators

- Buyers seeking higher yield than money markets, but with stable price characteristics

Coverage

- BTC coverage ratio: ~3.8x

- Highest effective coverage in the BTCTC preferred market to date

Investor Protections

- Adjustable dividend rate

- Restrictions on downward adjustments

- Cumulative unpaid dividends

- 1-year dividend reserve pre-funded

This slide establishes SATA as a high-yield, high-coverage perpetual preferred designed for conservative income investors.

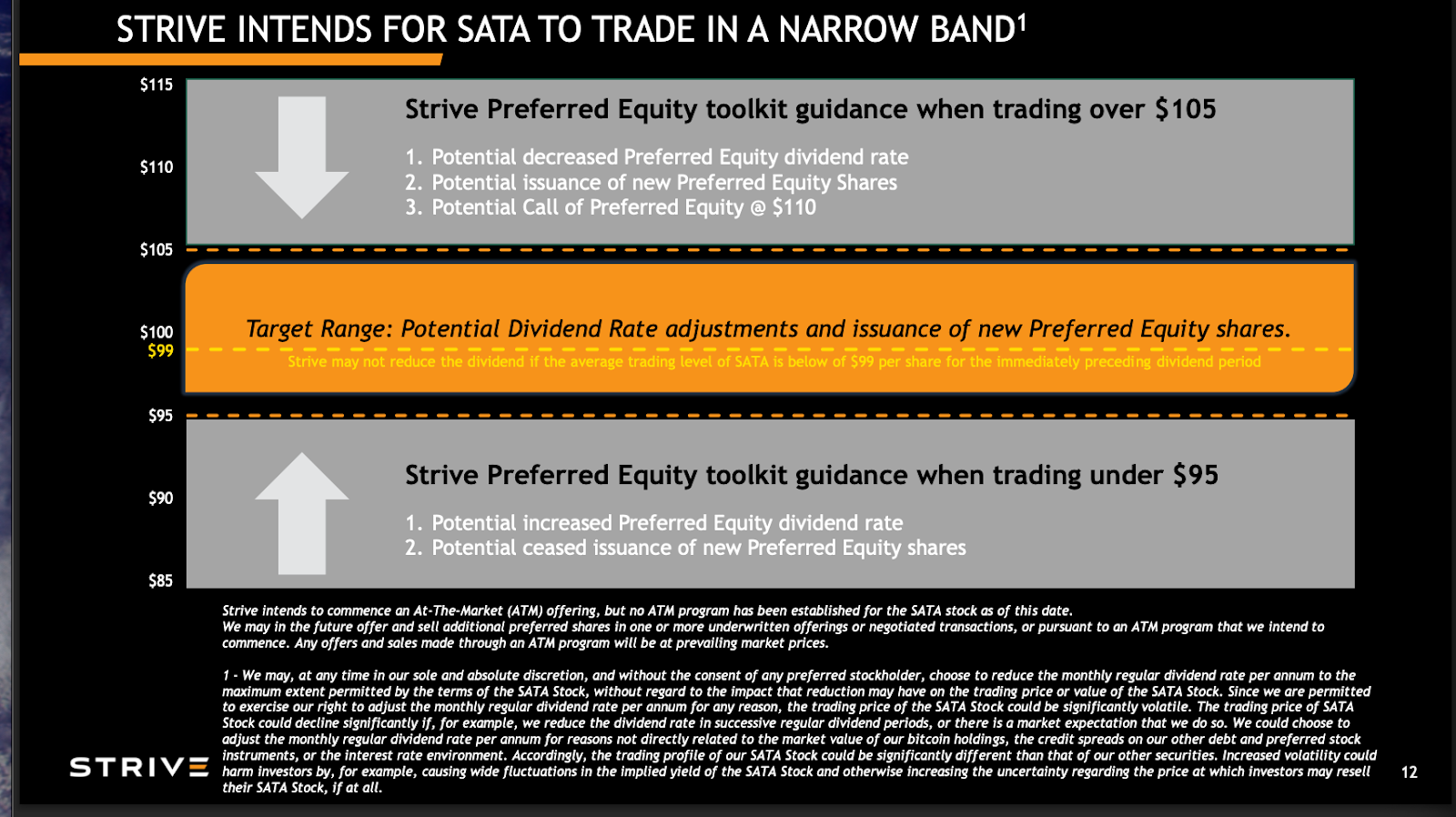

V. Dividend Band & Price Stability Mechanism

Slide details Strive's intent to maintain SATA’s trading level within a $95–$105 band, applying a variable-rate framework.

When Price Trades Above $105

Strive may:

- Decrease dividend rate

- Issue additional preferred shares

- Call shares at $110 (post-listing)

When Price Trades Below $95

Strive may:

- Increase dividend rate

- Reduce or pause further issuance

Adjustment Constraints

- Dividends cannot be reduced if 20-day VWAP is below $99

- Cannot lower the rate during first 3 months except under precise conditions

- Cannot reduce below 1-month SOFR

This band-guidance mechanism is unique among preferred stocks. Its goal is to:

- Reduce volatility

- Provide orderly secondary market behavior

- Enable stable ATM issuance

- Align liability behavior with investor expectations

It is a defining structural innovation of SATA.

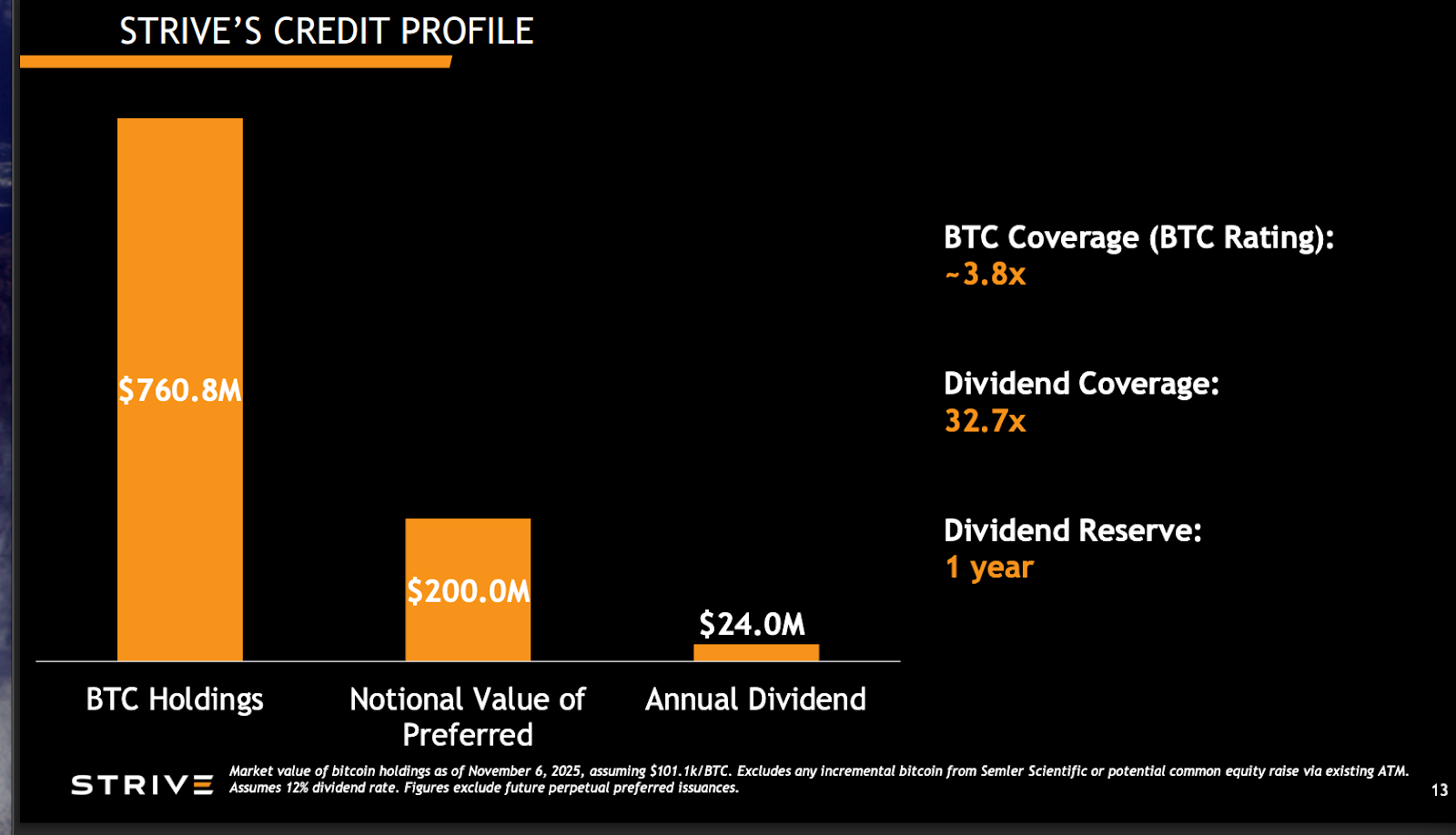

VI. Strive’s Credit Profile

Slide demonstrates SATA’s strong coverage profile:

Bitcoin Coverage

- BTC holdings: $760.8M

- SATA notional: $200M

- BTC coverage ratio: ~3.8x

Dividend Coverage

- Annual dividend requirement: $24M

- Dividend coverage ratio: 32.7x

Dividend Reserve

- 12 months fully pre-funded at closing

- Held in segregated account for near-term payment certainty

From an institutional credit perspective, this coverage profile is exceptional compared to preferred securities backed by:

- REIT cashflows

- bank hybrid capital

- corporate perpetuals

- fixed-income ETFs

BTC reserves are highly liquid and transparent, reinforcing SATA’s identity as a Bitcoin-backed perpetual income instrument with unusually strong coverage.

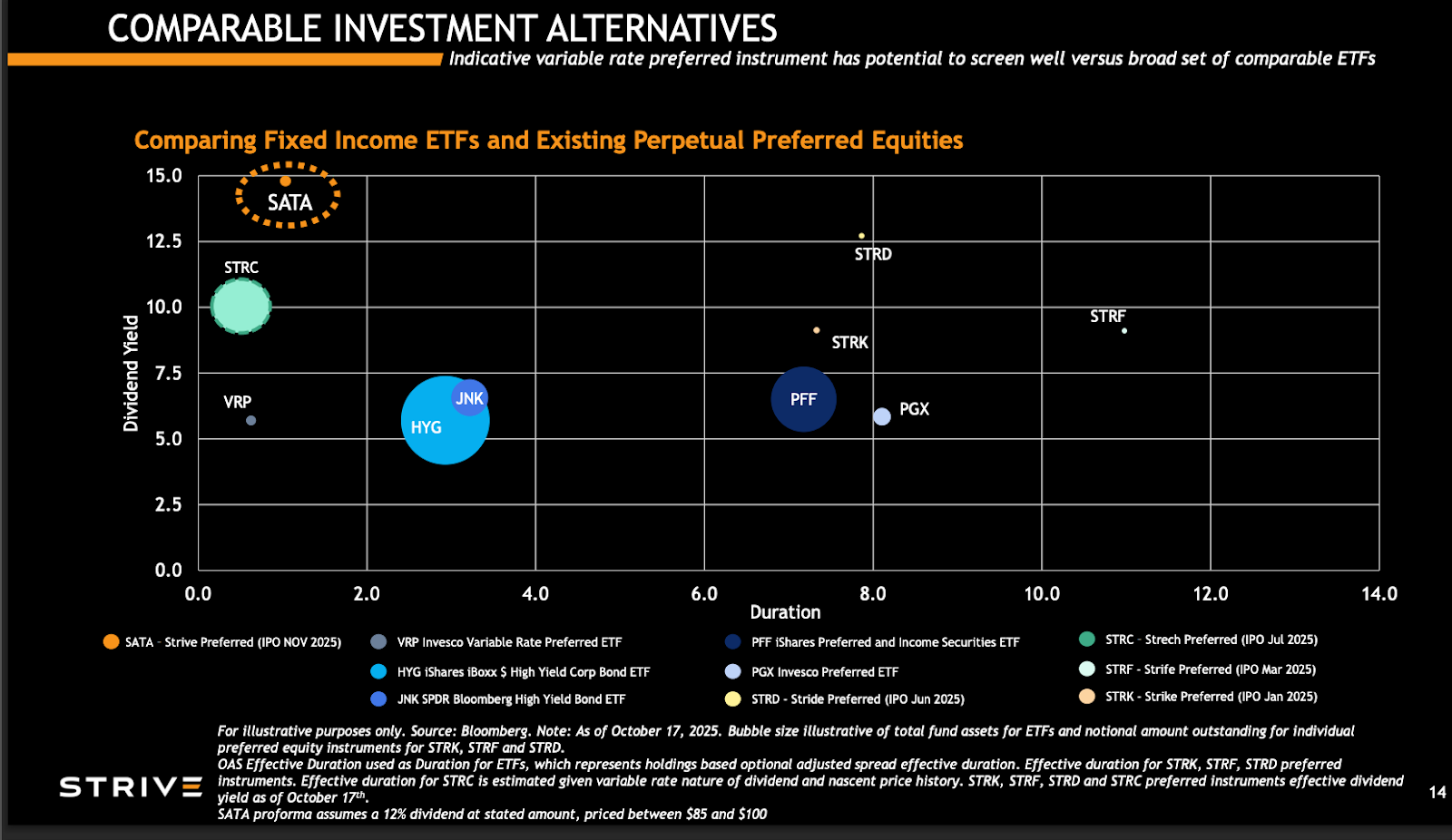

VII. Market Positioning & Bitcoin-Powered Credit

Slide visually positions SATA among comparable preferred equities and credit ETFs. SATA screens attractively with:

- 12% stated dividend

- 15% effective yield at IPO pricing

- Shorter implied duration than traditional perpetuals

It sits in the upper-left quadrant — high yield, low-to-moderate duration.

Slide frames SATA as Bitcoin-powered credit, with:

- 15% effective yield at issue

- 23.8% tax-equivalent yield

- 3.8x BTC rating (coverage)

Against USD bank deposits, money market funds, Treasury bills, and corporate paper (all yielding ~0–4%), SATA offers substantial yield pickup.

The combination of:

- Hard-asset backing

- Perpetual duration

- Exemption from banking-sector credit risk

- ROC tax structure

gives SATA an unusual risk-return profile that institutions cannot replicate elsewhere.

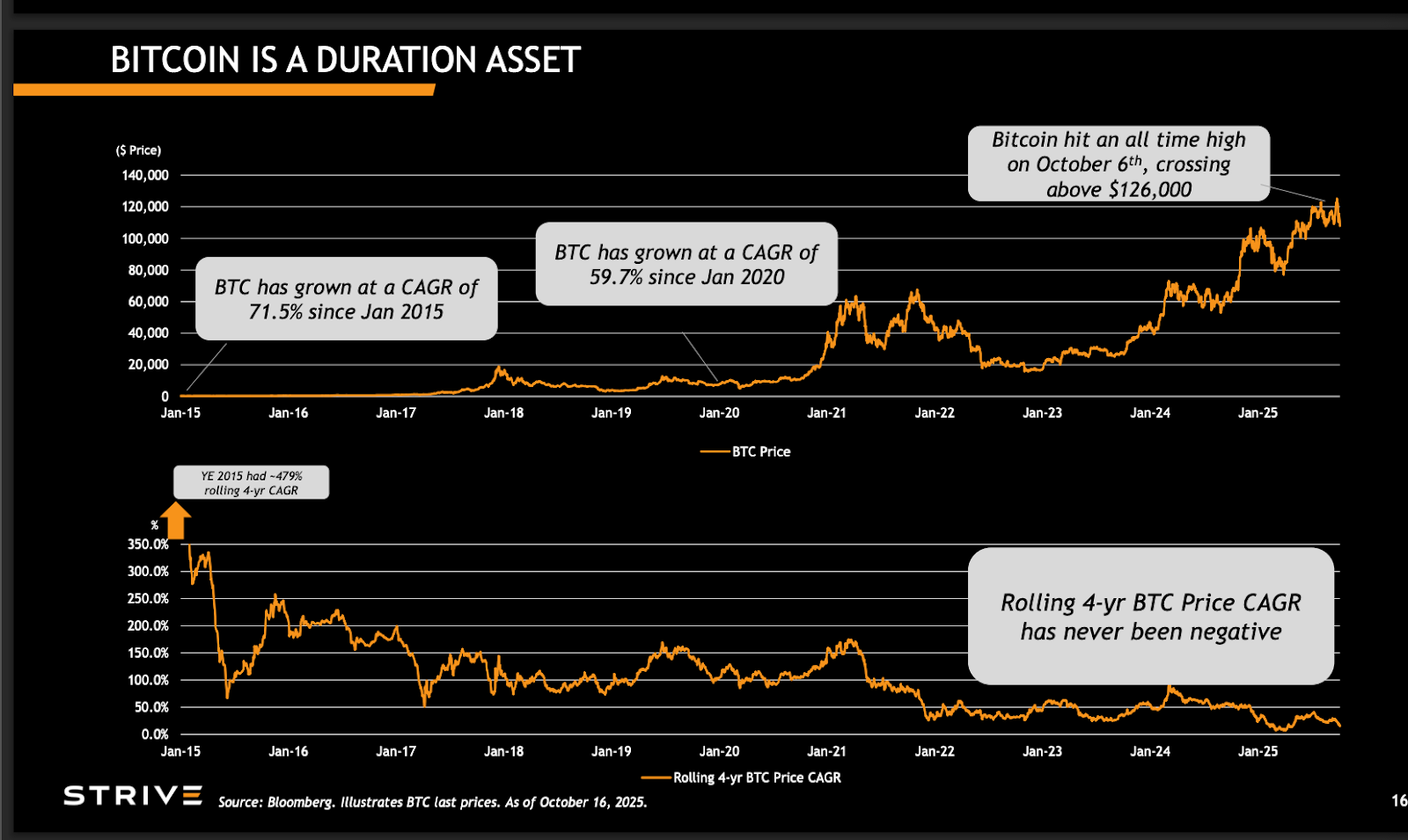

VIII. Bitcoin as a Duration Asset

Slide supports the thesis that Bitcoin is a long-duration monetary asset suitable for pairing with perpetual liabilities.

Key data points:

- BTC CAGR since Jan 2015: 71.5%

- BTC CAGR since Jan 2020: 59.7%

- 4-year rolling CAGR has never been negative

- BTC hit an all-time high of >$126,000 in October 2025

From a balance sheet perspective, BTC exhibits persistent long-term appreciation, supporting a treasury strategy where:

- Assets (BTC) have long-duration appreciation

- Liabilities (SATA) have perpetual duration and capped cash burden

This is duration matching in its purest institutional form.

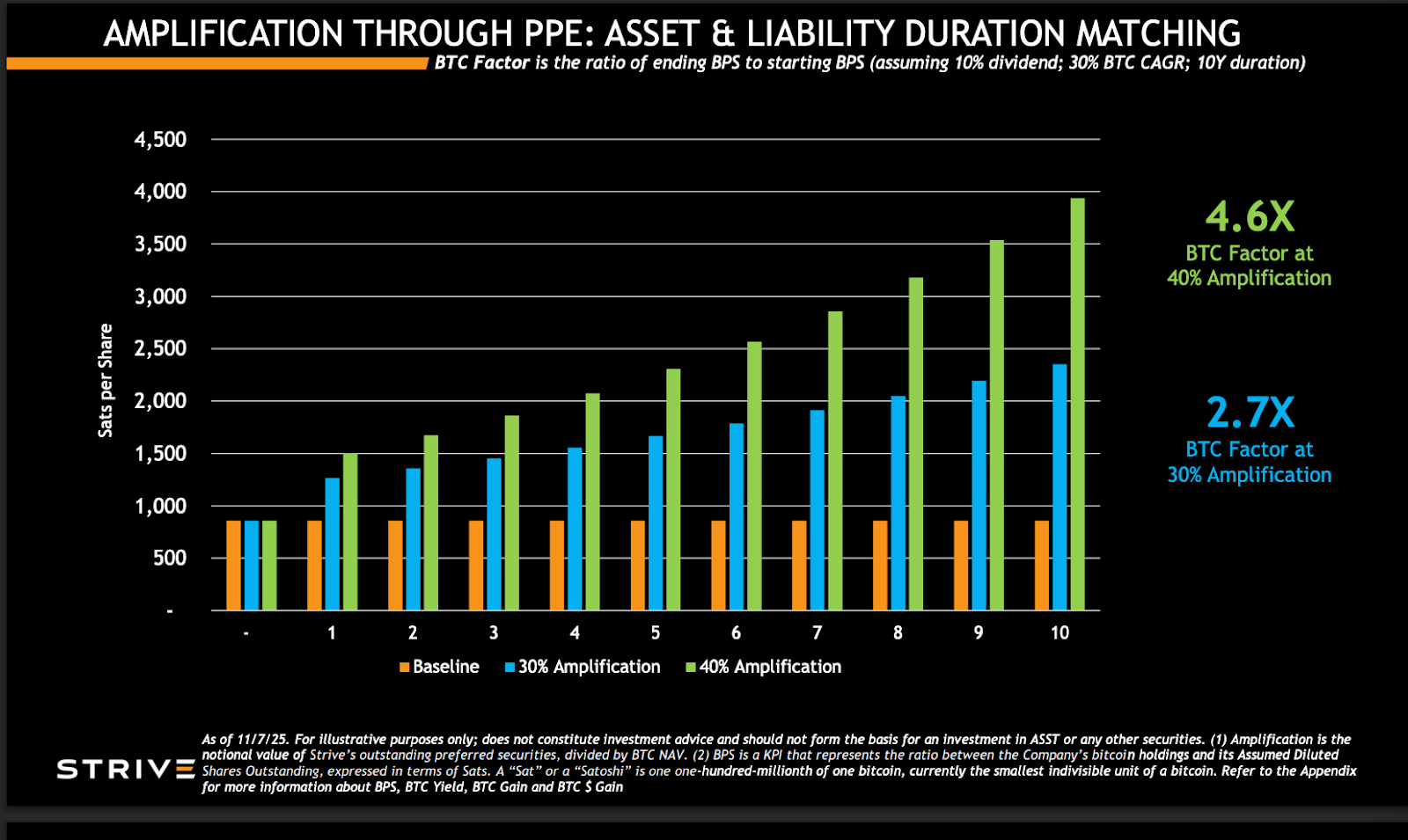

IX. Amplification Through Perpetual Preferred Equity

Slide quantifies the Bitcoin-per-share amplification achievable when perpetual liabilities finance perpetual BTC assets.

Assuming:

- 10% dividend cost

- 30% BTC CAGR

- 10-year horizon

BTC-per-share outcomes significantly outperform baseline treasury accumulation.

Amplification Factors

- 30% amplification → 2.7x BTC-per-share factor

- 40% amplification → 4.6x BTC-per-share factor

This demonstrates how perpetual preferred equity can magnify long-term BTC-denominated NAV per share.

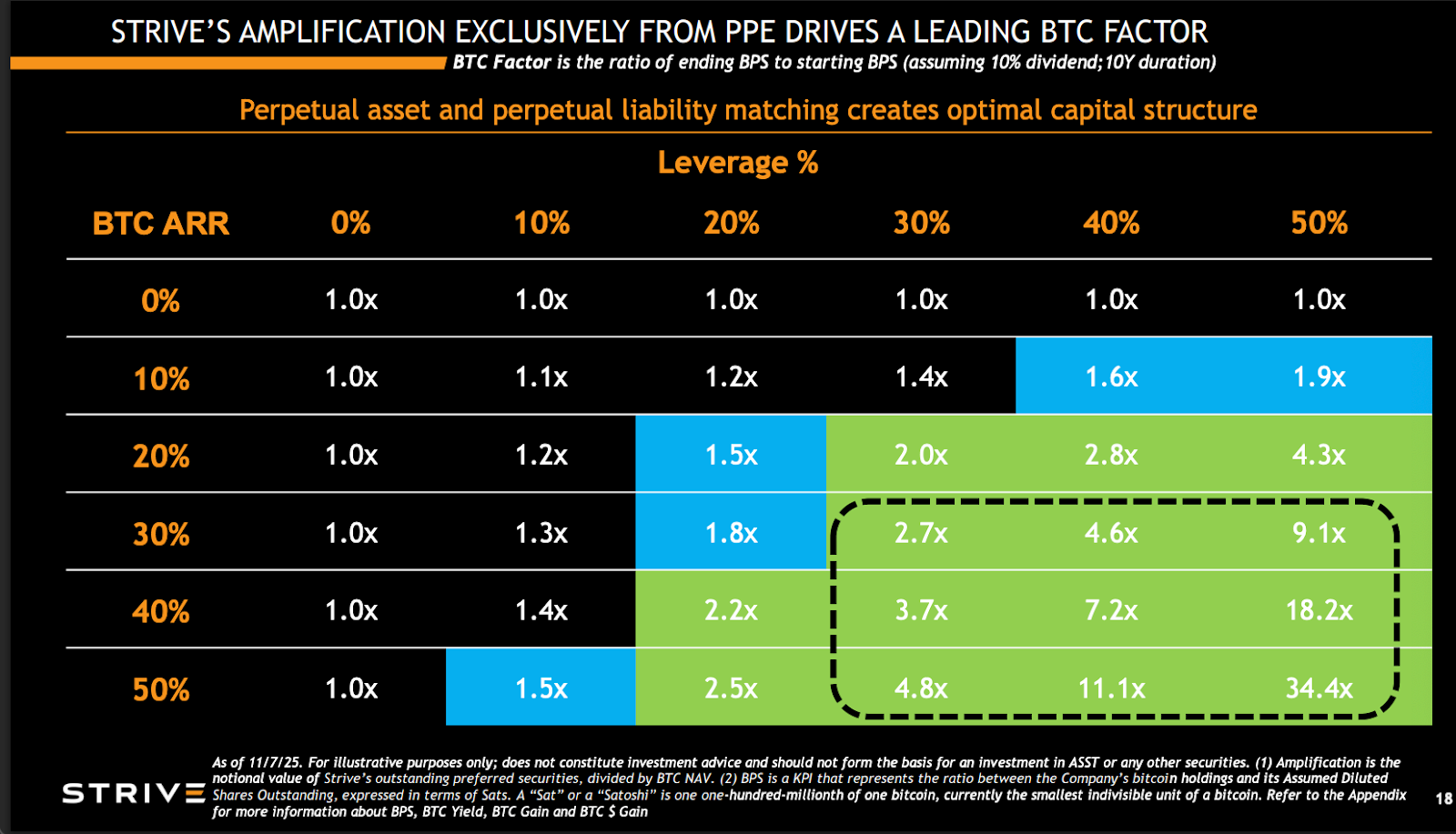

Slide illustrates various combinations of:

- BTC ARR (asset growth)

- Leverage (preferred issuance)

and the resulting BTC factor (ending BPS / starting BPS).

The green highlighted zone reflects where:

- BTC ARR is 30%+

- Long-term amplification is 30–40%

Here, BTC-per-share expands between 2.7x and 11.1x over 10 years.

This establishes SATA as a strategic lever for treasury-scale expansion with controlled cash expense and favorable duration alignment.

X. Key Risks

1. Bitcoin Price Volatility

Coverage ratios fluctuate with BTC price movements.

2. Dividend Adjustment Discretion

Issuer may adjust dividends monthly within defined constraints.

3. Capital Markets Dependence

Dividend obligations partially rely on the ability to issue additional preferred shares or common equity under its ATM.

4. Liquidity Dynamics

Market depth may take time to build post-listing.

5. Regulatory and Tax Treatment

ROC classification is jurisdiction-dependent.

XI. Conclusion SATA as the Second Perpetual Preferred in BTCTC History

SATA solidifies perpetual preferred equity as a credible and repeatable capital-markets instrument for Bitcoin treasury companies. As the second perpetual preferred ever issued in the BTCTC ecosystem, it introduces:

- High BTC coverage

- Zero senior debt

- A variable dividend band targeting stability

- Institutional-grade investor protections

- A fully perpetual structure aligned with the duration of Bitcoin

- Strategic utility in scaling BTC-denominated NAV

Where the first perpetual preferred established feasibility, SATA establishes legitimacy.

It is a structurally conservative, institutionally robust, yield-forward perpetual preferred anchored by Bitcoin a template for future issuance across the BTCTC landscape.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.