MSCI Targets Strategy: Bitcoin Treasury Model Faces Index Exclusion

Wall Street’s benchmark machinery is undergoing a rare ideological stress test and Bitcoin is at its core.On October 10, global index provider MSCI launched a consultation proposing to remove companies whose primary business is digital-asset treasury activity and whose crypto holdings exceed 50% of their total assets. The move, if finalized by mid-January 2026, would result in the exclusion of companies like Strategy, Inc. from MSCI’s Global Investable Market Indexes (GIMI), one of the most widely tracked equity benchmarks in the world.The implications are stark. According to JPMorgan, passive index funds could be forced to dump as much as $2.8 billion in Strategy stock if the rule takes effect and up to $11 billion across all crypto-treasury stocks if other index providers follow suit.What was once hailed as a novel arbitrage using public equity to buy Bitcoin is now facing its moment of reckoning at the hands of the same financial institutions that helped validate it.

MSCI’s Move: Risk Control or Ideological Line-Draw?

MSCI’s proposal centers around a classification question: Should companies that primarily exist to hold Bitcoin firms MSCI terms "Digital Asset Treasury Companies" be treated more like funds than operating businesses?“Some market participants consider these companies to exhibit characteristics similar to investment funds,” MSCI wrote in its consultation paper, citing concerns that they distort index neutrality and are overly exposed to volatile balance-sheet assets. The proposed criteria would exclude companies where digital assets make up 50% or more of total assets a line Strategy, Inc. crosses easily.Asset managers have reportedly voiced support, with some warning that Bitcoin-treasury companies resemble “proxy ETFs” and create tracking error for passive equity funds. Charlie Sherry, an index specialist, notes: “MSCI only opens a consultation like this if it’s already leaning toward implementation.”But critics argue the proposal violates the very neutrality it claims to protect.

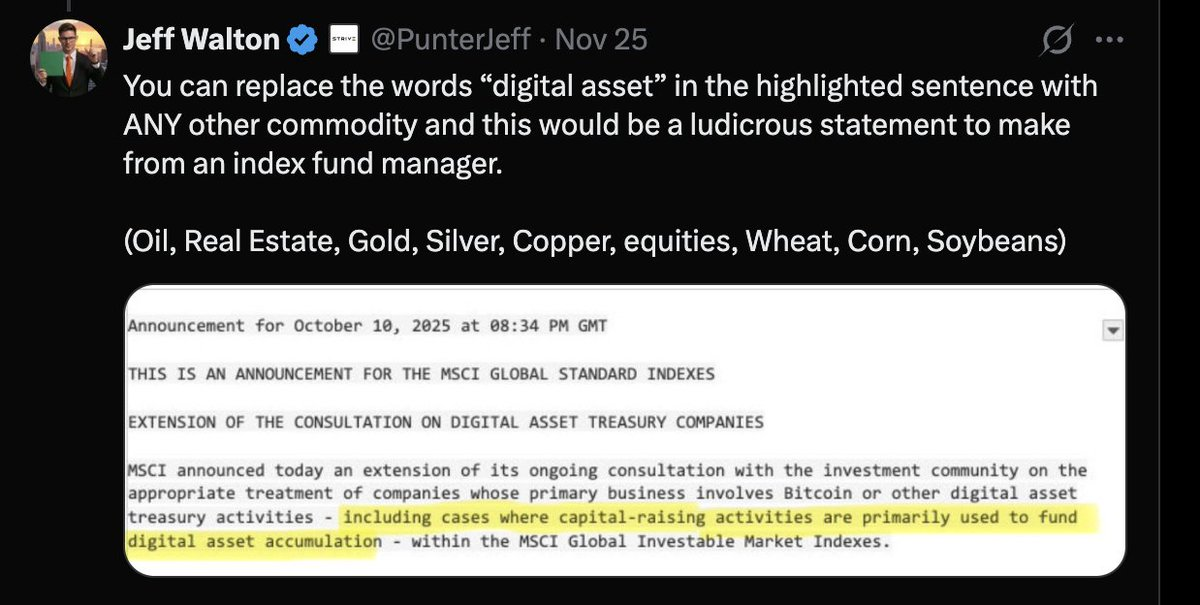

A Selective Crackdown?

The Bitcoin community and even some Wall Street analysts view MSCI’s move as both selective and arbitrary.“No company gets excluded for holding 70% of its assets in real estate,” says Jeff Walton of Strive Asset Management. “REITs, oil firms, gold miners all derive value from single assets. Bitcoin is being singled out.”

Indeed, MSCI allows REITs with massive real estate exposure and miners with near-total commodity dependence to remain index-eligible. Why draw the line at Bitcoin?

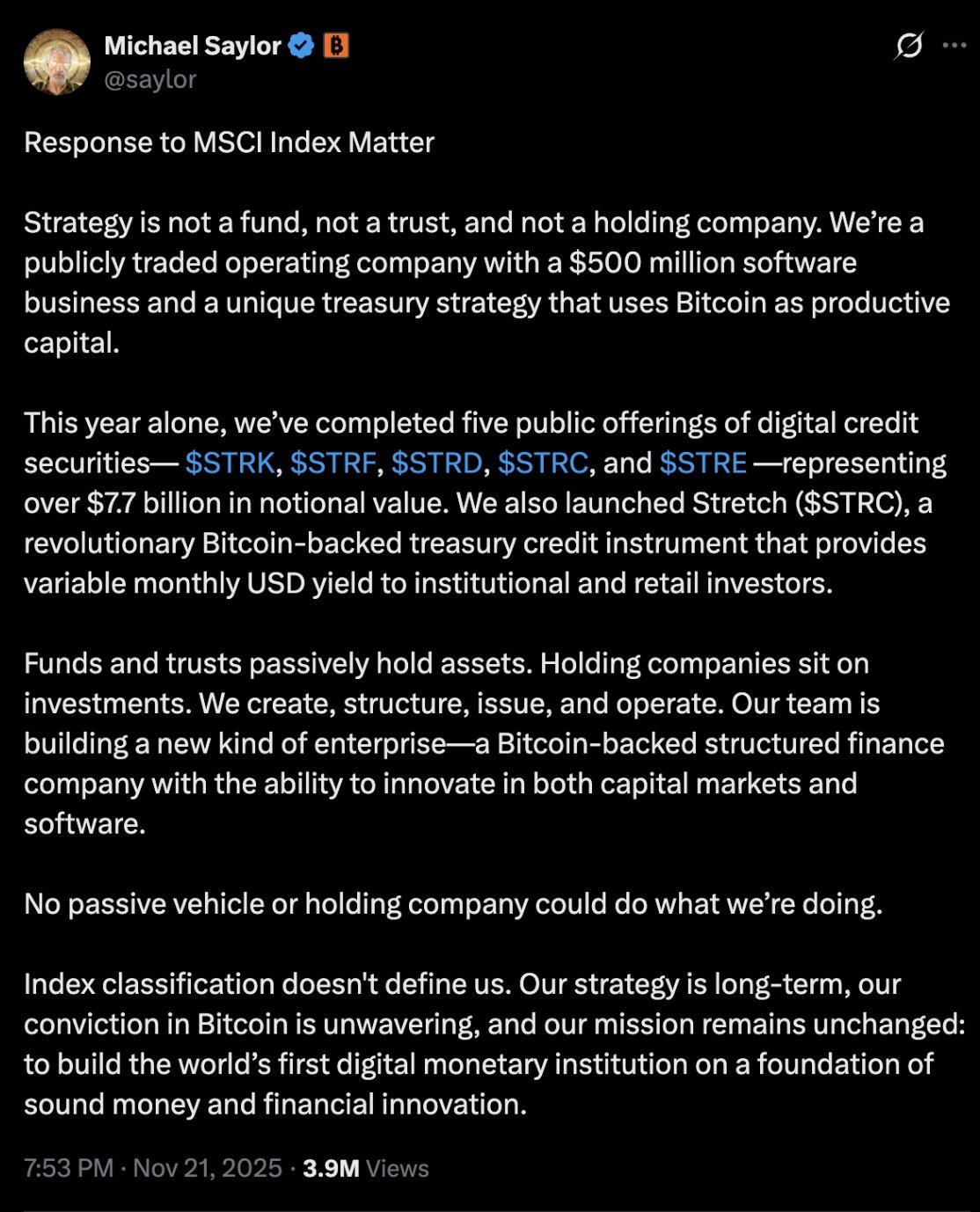

Michael Saylor, Strategy’s executive chairman, has been blunt: “We’re not a trust. We’re not a holding company. We’re a public operating company with a $500 million software business and a Bitcoin-native capital strategy.” He argues that Strategy is inventing new financial instruments including structured BTC debt like STRK and STRC that go far beyond passive asset management.

Others echo the concern that this amounts to “Operation Chokepoint 3.0” a coordinated effort to box Bitcoin out of public market legitimacy.

JPMorgan Rings the Bell

If MSCI proceeds, the mechanical selling could be swift and brutal.JPMorgan’s Nikolaos Panigirtzoglou estimates that $2.8 billion in passive outflows could hit Strategy stock in early 2026. Should other index providers mimic MSCI’s rule, the figure could triple. Strategy’s market cap roughly $59 billion is already under pressure, down over 45% from its July 2025 highs.Passive funds, according to JPMorgan, make up roughly $9 billion of MSTR’s float. Index expulsion would force those vehicles to offload shares regardless of fundamental outlook.Strategy’s core model issuing equity to buy BTC depends on market liquidity and capital access. Index expulsion could materially impact its ability to raise funds, especially with its preferred securities and convertible bonds maturing in the next few years.

Legal Voices Push Back

Not all of Wall Street is on board with MSCI’s logic. Analysts argue the proposal is misguided.“This isn’t a fund it’s an operating company executing a strategy,” one analyst wrote. “It’s capricious to exclude them for holding Bitcoin when others are allowed massive exposure to single-asset classes.”In a private memo, one legal strategist warned: “Treating Bitcoin uniquely invites legal scrutiny. If MSCI doesn’t apply its fund classification logic consistently, it opens itself to reputational if not regulatory risk.”

A Shifting Frontier in Index Governance

The issue also reopens long-standing questions about the role of index providers in shaping or suppressing asset allocation trends.MSCI, S&P, and FTSE Russell have historically been seen as neutral compilers of market reality. But with trillions of dollars tracking their indices, even minor changes can trigger massive flows. In recent years, critics have accused index providers of taking ideological stances on ESG, governance, and now, monetary strategy.Bitcoin-focused analysts like Pierre Rochard frame MSCI’s proposal as “financial censorship”: “Bitcoin is now legitimate money. If corporate treasuries use it, the index shouldn’t penalize them.”Rochard argues that BTCTCs Bitcoin treasury companies are executing what he calls a “speculative attack on fiat”: issuing fiat-denominated capital to accumulate scarce, self-custodied monetary assets. “Excluding them from the indexes doesn’t make the strategy go away. It just forces it off-grid.”

A Post-Index Future?

If MSCI follows through and if other benchmarks join Bitcoin treasury companies may find themselves increasingly isolated from the mainstream equity ecosystem.Some will adapt by diversifying their balance sheets. Others, like Strategy, may lean into private credit or direct crypto-native funding away from public equity capital markets entirely.In the near term, forced selling may depress valuations and compress Bitcoin-per-share premiums. But longer-term, the index gatekeepers may find themselves on the wrong side of innovation.As Walton puts it: “You can exclude the stocks. You can’t exclude the trend. Bitcoin is becoming institutional. This is a speed bump not a stop sign.”

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.