Michael Saylor’s “iPhone Moment”: Preferred Stock vs Convertible Bond

Introduction: A Transformative Financing Breakthrough

When Michael Saylor, Executive Chairman of MicroStrategy, describes his company's latest Bitcoin-backed preferred stock as their "iPhone moment," he's making a bold claim about the future of corporate finance. This comparison to Apple's game-changing device isn't just marketing rhetoric – it represents a fundamental rethinking of how corporations can raise capital in the modern era. Under Saylor's leadership, MicroStrategy has accumulated an astounding 628,000 Bitcoin as of August 2025, and the journey of how they've financed these purchases reveals important lessons about financial innovation.

To understand why Saylor believes this new financing instrument is so pivotal, we need to examine MicroStrategy's evolution from using traditional convertible bonds to pioneering perpetual preferred stock. This shift isn't just a minor adjustment – it's a complete reimagining of corporate capital structure that could have implications far beyond a single company.

MicroStrategy's Bitcoin-Focused Financing History

The story begins in 2020 when Saylor launched MicroStrategy's bold Bitcoin strategy. The company embarked on an aggressive campaign to accumulate Bitcoin, but this required massive amounts of capital. Initially, MicroStrategy turned to two primary financing methods: convertible senior notes and common equity sales.

The convertible bond strategy was remarkably successful at first glance. During 2020 and 2021, the company issued these notes at extraordinarily low interest rates, ranging from 0% to 0.75% coupons. Think of these as loans that could transform into ownership stakes if MicroStrategy's stock price soared high enough. For instance, in early 2021, the company completed a $1.05 billion convertible note offering that carried a 0% coupon rate with a 50% conversion premium. This meant bondholders paid no interest but could convert their bonds to stock if the share price rose 50% above its level at the time of issuance.

Alongside these convertible bonds, MicroStrategy also utilized at-the-market (ATM) programs to sell common stock directly to public market investors. By mid-2025, this combined approach had generated over $8 billion in capital, all deployed to accumulate the company's massive Bitcoin treasury.

However, this heavy reliance on debt instruments introduced significant challenges that would eventually prompt Saylor to seek alternatives. The convertible bonds, despite their low headline interest rates, carried fixed maturity dates. If MicroStrategy's stock price didn't rise sufficiently for conversion to occur, the company would face the prospect of repaying principal amounts in full. This could potentially force Bitcoin sales at opportune times or require new debt issuances just to pay off old obligations.

The problems became more apparent as market conditions evolved. Interest rates rose from their pandemic-era lows, making the bond market less accommodating. By 2025, Saylor observed that MicroStrategy's own convertible bonds were trading at distressed levels in the secondary market. In his words, these instruments had become problematic largely because "nobody can buy that stuff" in the open market. The bonds had become illiquid, trapped in the hands of a small group of institutional investors. These shortcomings drove Saylor to search for a more scalable and widely accessible financing tool.

Understanding the Current Debt & Preferred Equity Structure

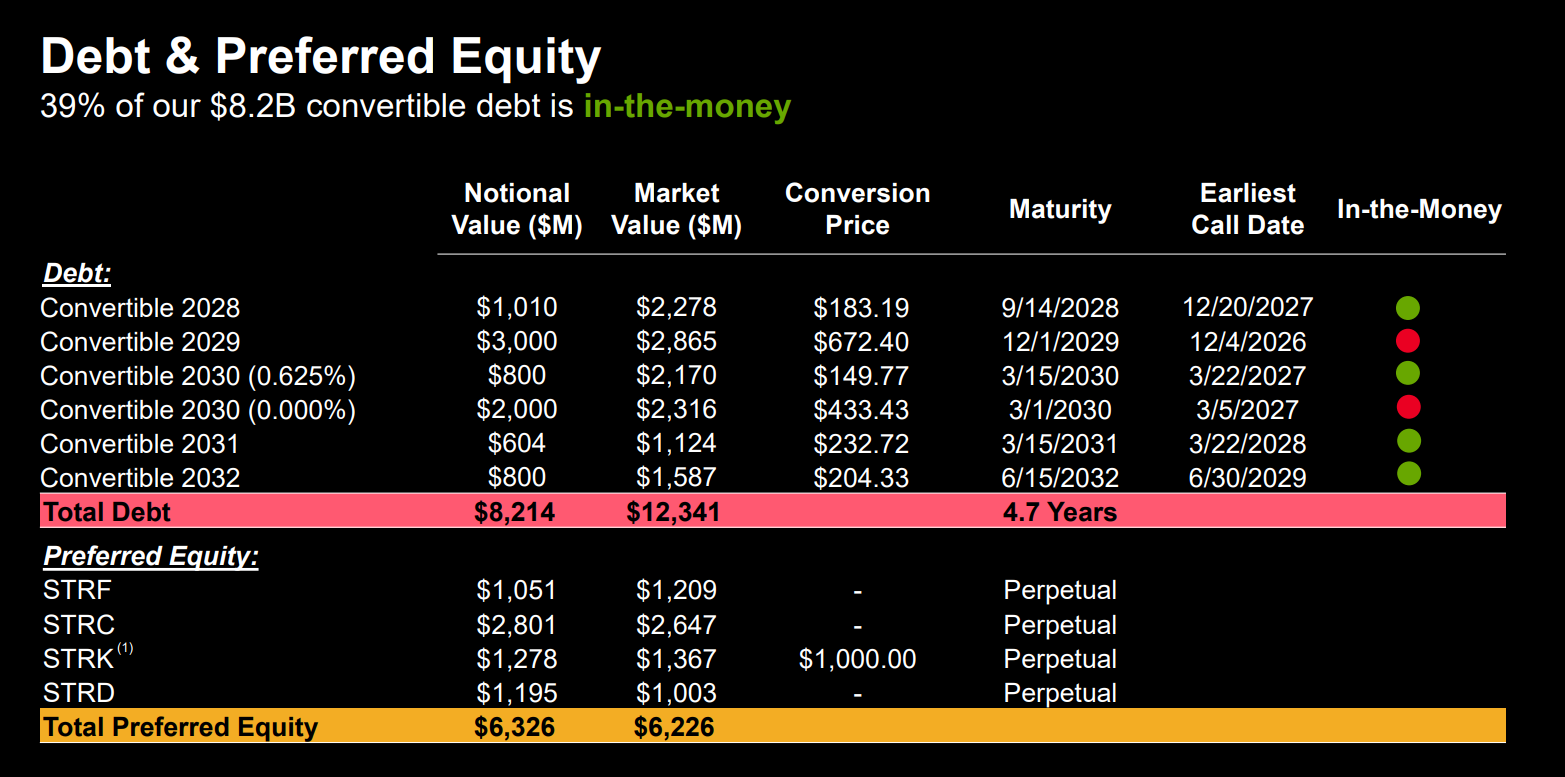

To appreciate the magnitude of MicroStrategy's transformation, let's examine the company's capital structure as of July 29, 2025. The balance sheet includes $8.2 billion in convertible debt, which carries a market value of approximately $12.3 billion. This debt portfolio has a weighted average maturity of 4.7 years, with 39% of it currently in-the-money, meaning those bonds are likely to convert to equity based on current stock prices.

The company also carries $6.3 billion in preferred equity spread across four distinct series: STRF, STRC, STRK, and STRD. Notably, the market values of these preferred tranches trade close to their par values, which reflects strong investor confidence and healthy liquidity in these instruments.

Looking at the specific convertible bonds, we can see the progression of MicroStrategy's financing journey. The 2028 convertibles carry $1.010 billion in notional value with a conversion price of $183.19. The 2029 convertibles represent $3.000 billion with a conversion price of $672.40. The 2030 bonds include two tranches: one at 0.625% coupon for $800 million and another at 0.000% for $2.000 billion, with conversion prices of $149.77 and $433.43 respectively. The 2031 convertibles carry $604 million at $232.72 conversion price, while the 2032 bonds represent $800 million at $204.33 conversion price. The total debt burden stands at $8.214 billion with a market value of $12.341 billion.

On the preferred equity side, STRF carries $1.051 billion in notional value with a 10% dividend rate, while STRC, the flagship new instrument, represents $2.801 billion with a 9% dividend rate. STRK holds $1.278 billion at 8% dividends, and STRD carries $1.195 billion at 10% dividends. The total preferred equity amounts to $6.326 billion with a market value of $6.226 billion.

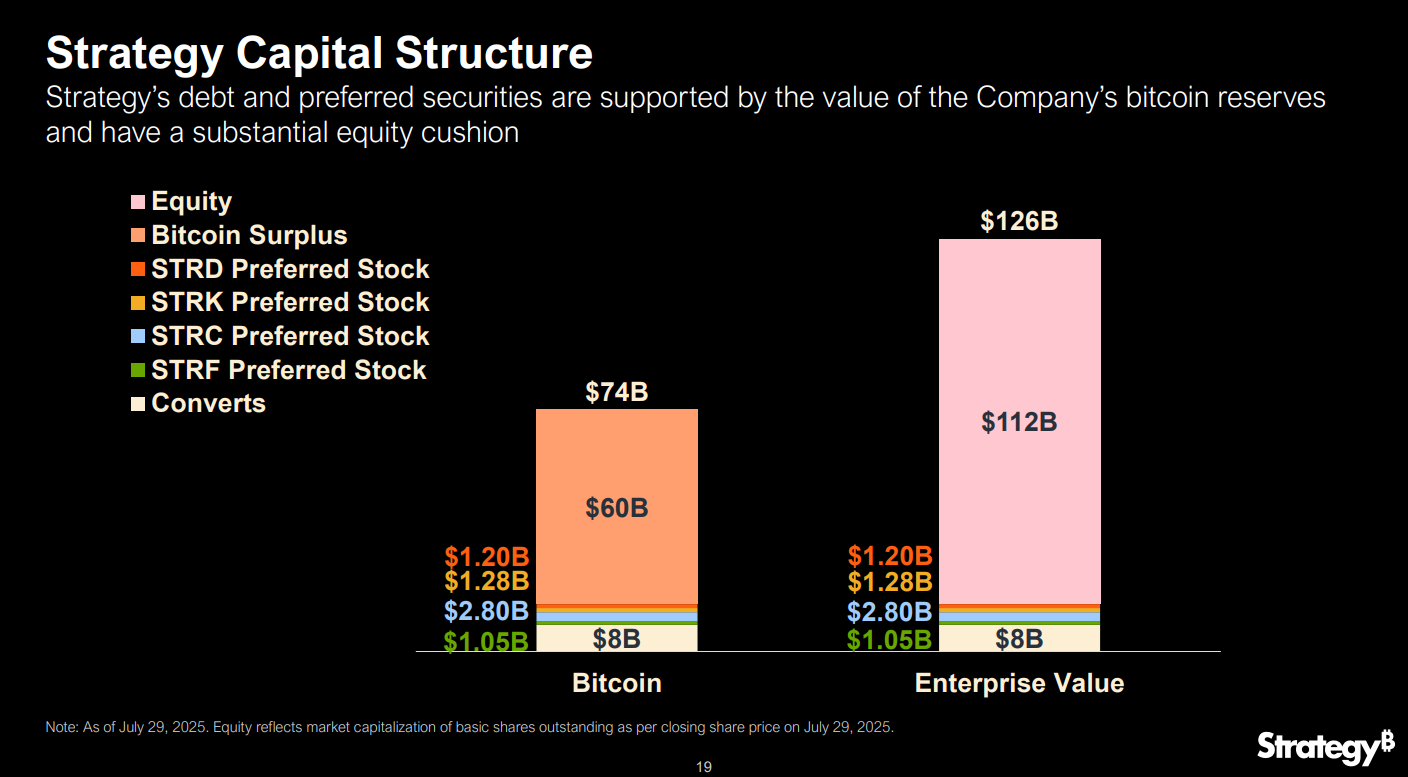

Capital Structure Positioning: The Bitcoin Backstop

What makes this entire structure viable is the enormous value of MicroStrategy's Bitcoin holdings. The company maintains a $60 billion Bitcoin surplus above its debt and preferred obligations. On a market basis, Bitcoin assets worth approximately $74 billion underpin an enterprise value of around $126 billion, leaving a substantial $112 billion equity cushion for common shareholders.

This massive overcollateralization serves multiple purposes. It provides strong credit protection for both preferred equity and debt holders, while simultaneously enabling the company to raise incremental capital without jeopardizing solvency. Think of it as building a financial fortress with walls far thicker than necessary – the excess strength provides confidence to all stakeholders and flexibility for future expansion.

Preferred Stock (STRC) as the "iPhone Moment"

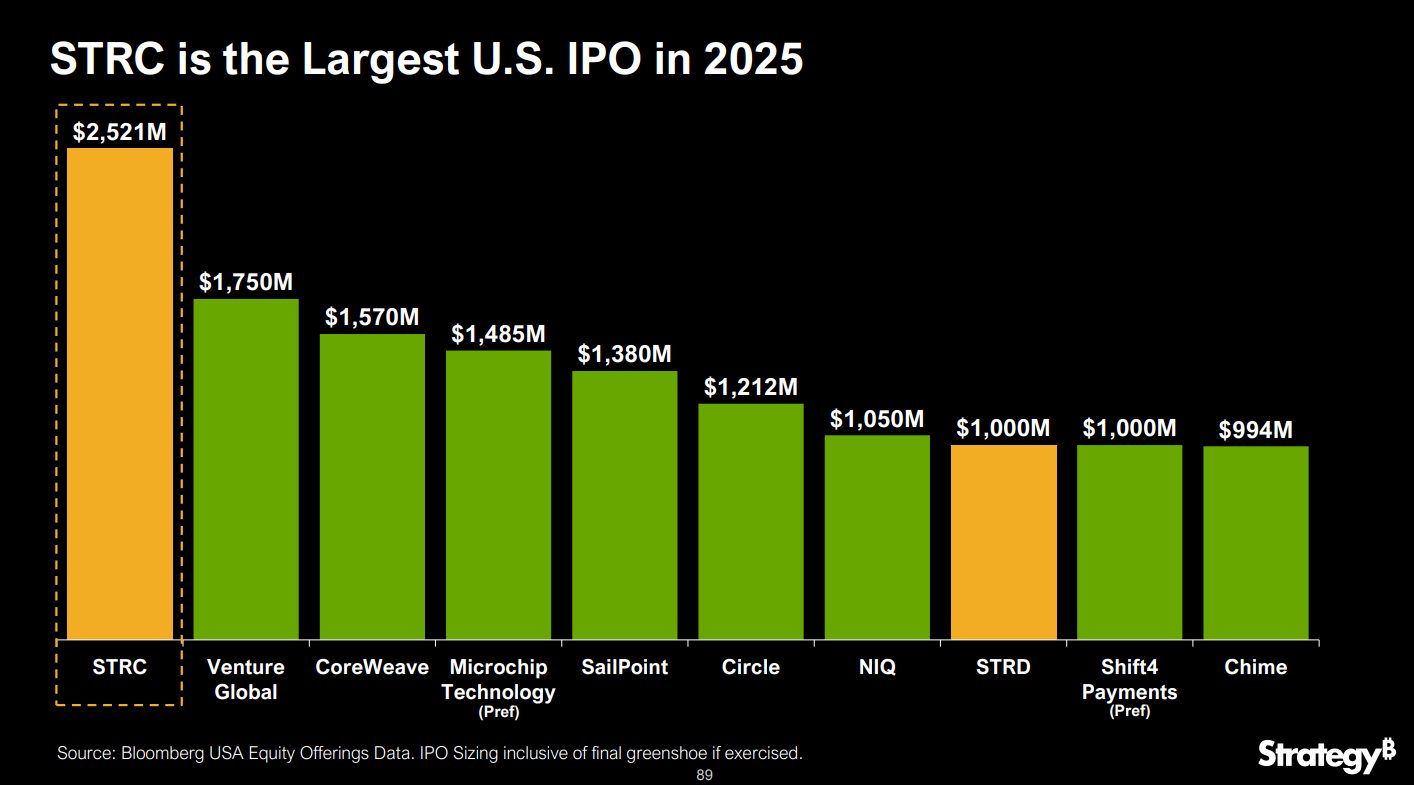

Now we arrive at Saylor's revolutionary solution: Bitcoin-backed perpetual preferred stock. In July 2025, MicroStrategy launched the "Series A Perpetual Preferred" with the ticker symbol STRC, raising $2.5 billion in its initial offering. This became the largest IPO in the United States for 2025, surpassing offerings from established companies like Venture Global, CoreWeave, and others.

But why does Saylor call this "our iPhone moment"? On the Q2 2025 earnings call, he emphasized to analysts that "Stretch is our iPhone moment," explaining that this new instrument represents a fundamental turning point for accessing capital at scale. The analogy is carefully chosen – just as the iPhone made advanced technology simple and ubiquitous for consumers, Saylor sees STRC as a simplified, mass-appealing financial product in a space previously dominated by complex or exclusive instruments.

The genius of STRC lies in how it solves multiple problems simultaneously. Unlike earlier instruments such as STRK, STRF, and STRD, which Saylor acknowledges were innovative but too complex or volatile for mass adoption, STRC is designed to function more like what he calls a "yield-enhanced savings account." As he explained, if you ask 100 people on the street if they want a high-yield bank account, "99 out of 100 say yes." This simple framing underscores the broad appeal of the new offering.

The Mechanics of STRC: Engineering Stability and Yield

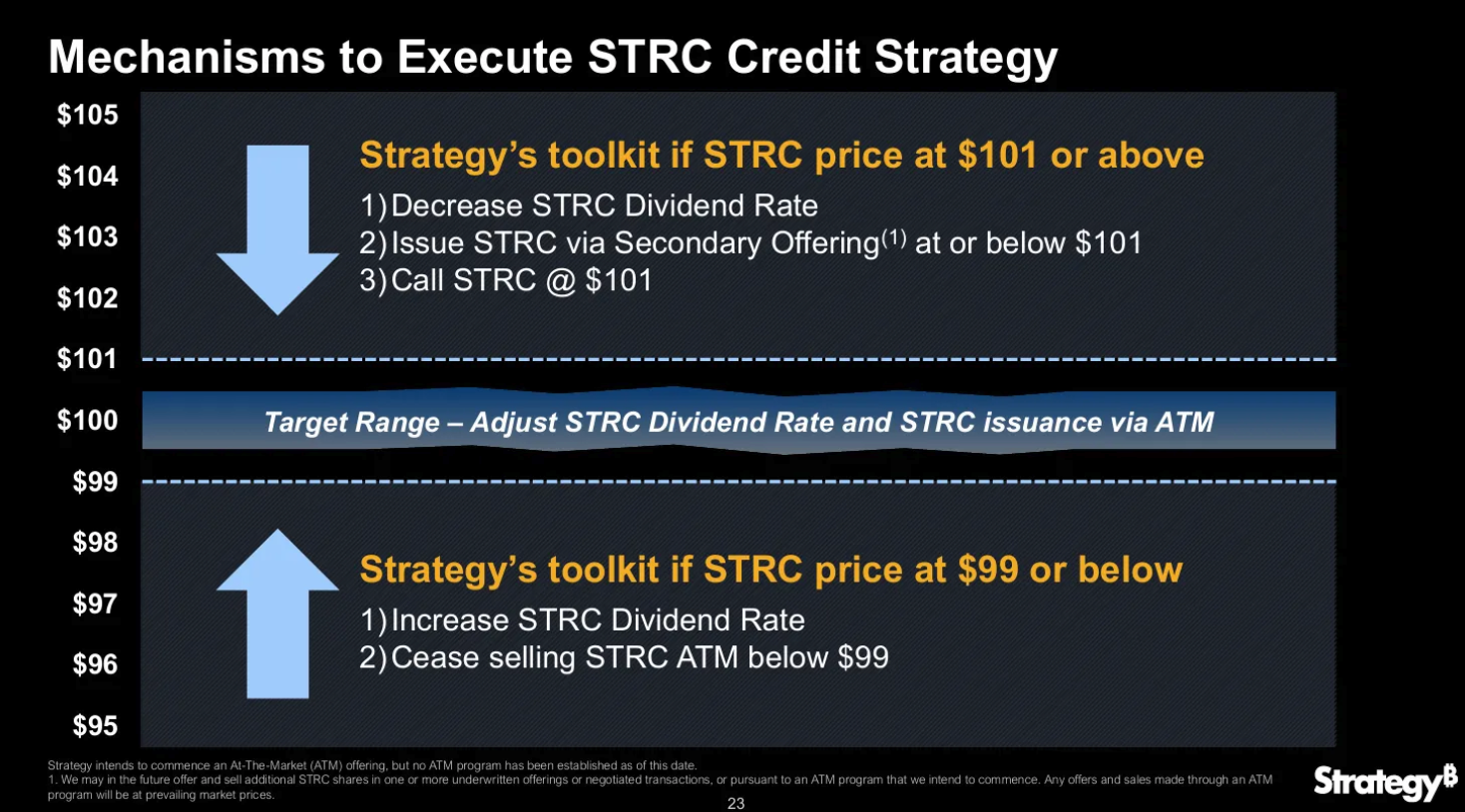

Understanding how STRC works requires examining its unique features. First and foremost, it's perpetual – there's no maturity date, no looming repayment obligation. The shares carry a sizable dividend, initially set at 9% annualized and paid monthly, providing regular income to investors. But here's where the engineering becomes clever: the dividend rate is variable, resetting monthly to target a market price near the $100 par value.

As Saylor explains, "We've stripped down to a one-month duration and it pays 500 basis points above your bank account." This means that unlike typical perpetual preferreds that can swing wildly in price with interest rate changes, STRC is designed to remain stable. If the market price drops below $100, the dividend rate increases to make the shares more attractive. If the price rises above $100, the rate decreases to bring it back down. This self-stabilizing mechanism provides the price stability that income-focused investors crave.

The overcollateralization is crucial to this stability. With approximately $5 in Bitcoin backing every $1 of STRC outstanding, investors have significant downside protection. This heavy collateralization helps keep the preferred stock's value stable even when Bitcoin prices fluctuate, giving investors peace of mind about their principal investment.

Crucially, Saylor believes that STRC and its future sister offerings can unlock an enormous new investor base and capital pool. Because STRC is a listed security trading on public exchanges with a straightforward high-yield profile, it can be purchased by a wide range of investors, from large institutions to individual retail investors. This stands in stark contrast to convertible bonds, which were effectively limited to a small group of sophisticated institutional investors.

The scalability potential is what truly excites Saylor. He told investors that if Stretch proves its design by trading at par with low volatility, "you could, in theory, sell $100 billion of it, $200 billion of it" over time. The demand could be essentially "infinite" because the product appeals to such a broad market segment. As he pointed out, "The convertible bonds clearly were not our iPhone... nobody can buy them." By contrast, STRC's accessibility could tap into vast pools of capital previously unavailable to MicroStrategy.

Understanding the Yield Sources and Sustainability

A critical question for any high-yield instrument is sustainability – where does the money come from to pay these attractive dividends? MicroStrategy's approach is sophisticated yet straightforward. The yield on the company's preferred equity is funded through a combination of capital raised via the At-The-Market (ATM) common equity program and cash flow generated from its Bitcoin strategy.

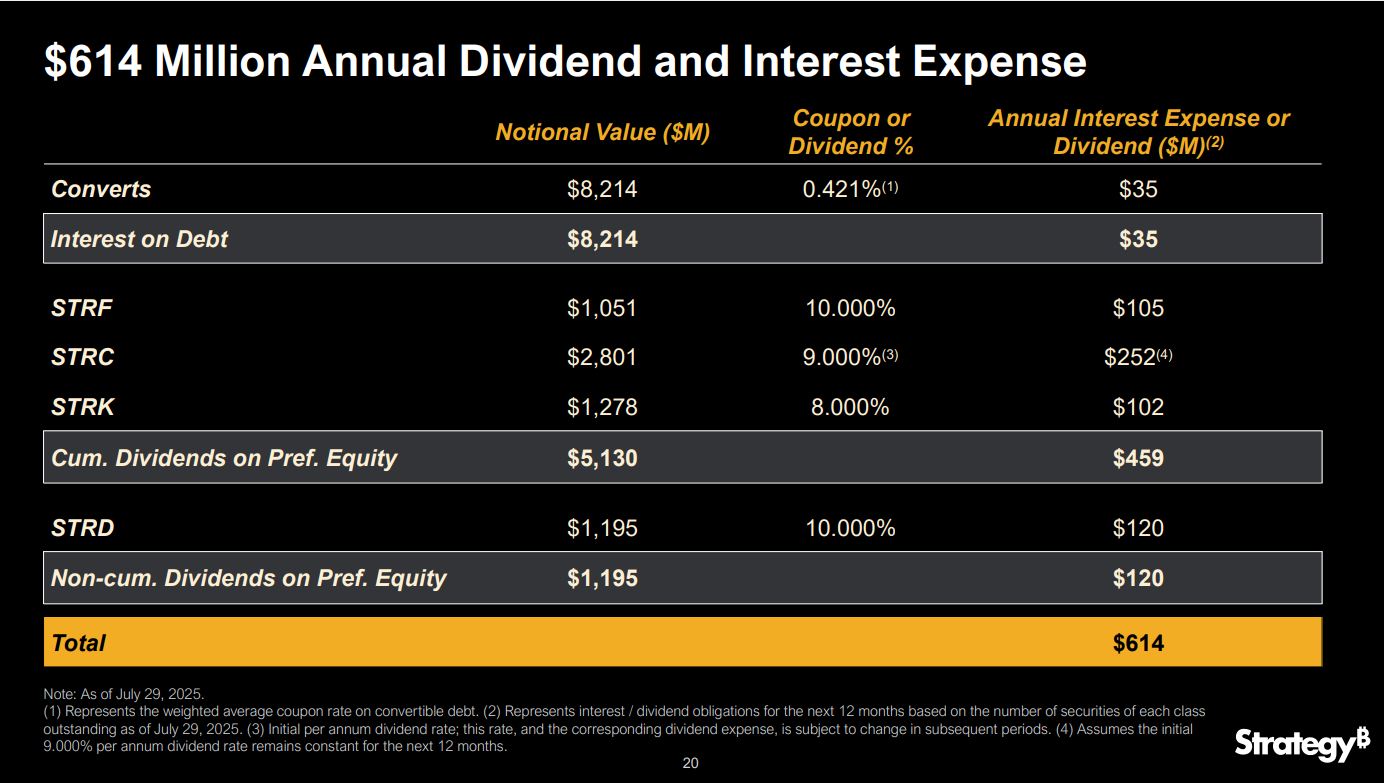

The numbers tell an important story about sustainability. The company's total annual dividend and interest expense amounts to $614 million. Breaking this down, we see $35 million in interest on convertible debt (with an average coupon of 0.421%), $105 million for STRF dividends (10% rate), $252 million for STRC dividends (9% rate), $102 million for STRK dividends (8% rate), and $120 million for STRD dividends (10% rate).

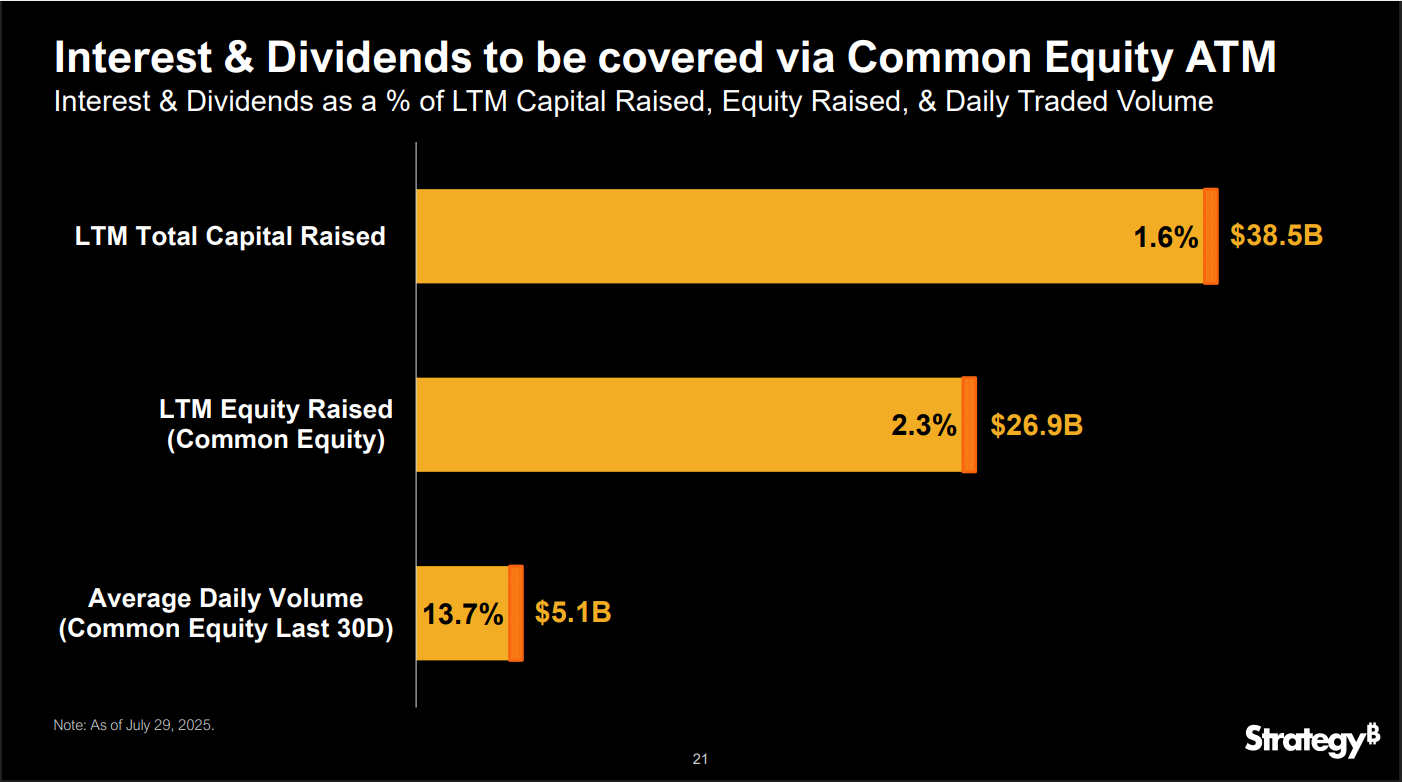

When we compare these obligations to MicroStrategy's capital-raising capacity, the sustainability becomes clear. The annual interest and dividend obligations represent only 1.6% of the company's last twelve months (LTM) total capital raised of $38.5 billion. They represent just 2.3% of LTM common equity issuance of $26.9 billion. Perhaps most impressively, these obligations amount to only 13.7% of the average daily trading volume in MicroStrategy common equity over the last 30 days, which stands at $5.1 billion.

This means the yield obligations are easily serviceable through ongoing equity issuance without materially impacting market liquidity or stability. The company can fund its preferred dividends through a small fraction of its regular capital market activities.

Yield & Liquidity Leadership in the Preferred Market

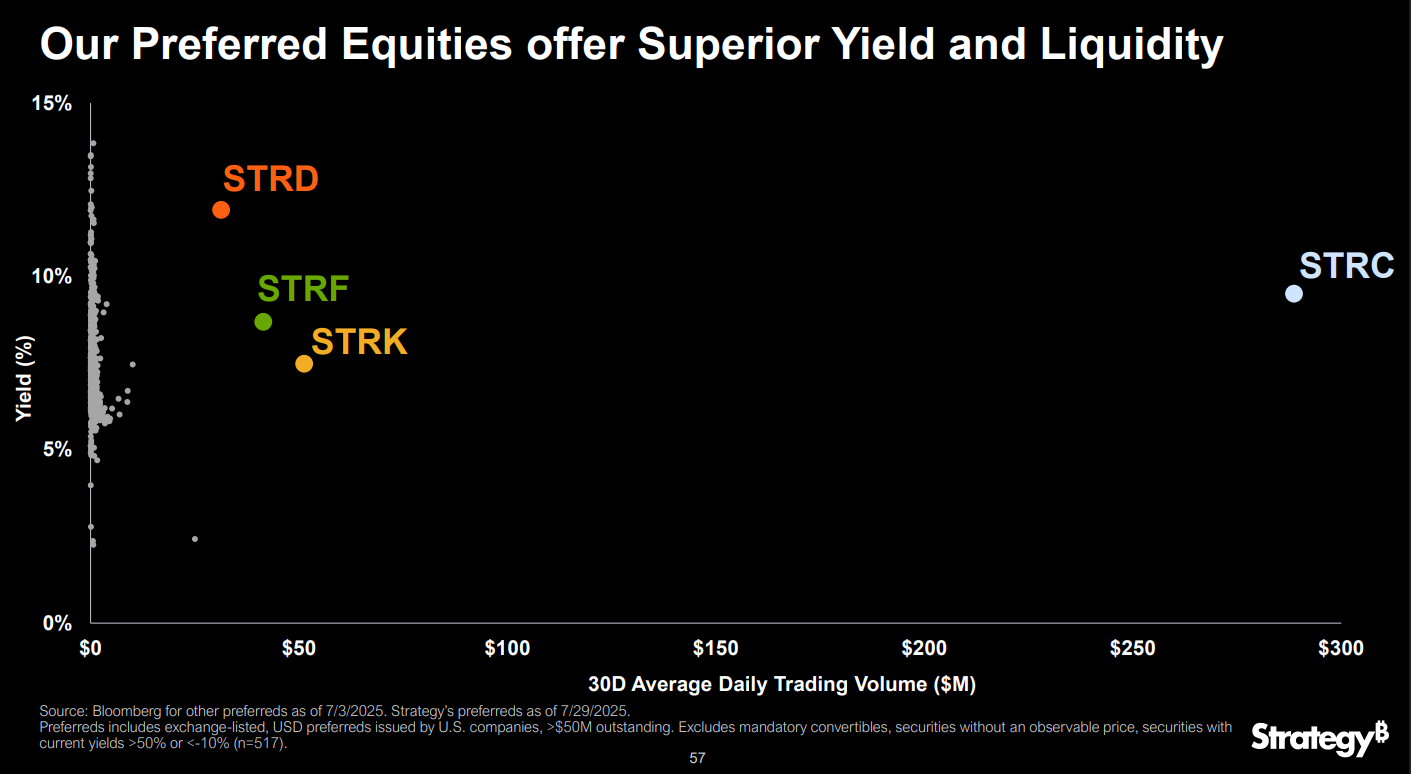

To understand STRC's competitive positioning, MicroStrategy conducted an internal Bloomberg-based analysis of all exchange-listed USD preferred stocks with more than $50 million outstanding. The results reveal why Saylor is so confident about his "iPhone moment" analogy.

- STRD delivers one of the highest yields (~13%) among large preferreds while maintaining strong daily trading volume.

- STRF and STRK cluster in the 7–9% yield range, still above most peers, with respectable liquidity.

- STRC stands out as a unique outlier combining a ~9% effective yield with exceptionally high average daily trading volume (approaching $300M), signaling deep market demand and liquidity unmatched in the preferred space.

This liquidity advantage is crucial because it means MicroStrategy can tap capital markets for STRC at scale without significantly impacting price. The high trading volume supports Saylor's claim of "infinite" scaling potential – the market can absorb large issuances without disruption.

STRC's Competitive Position in the Short-Duration Yield Market

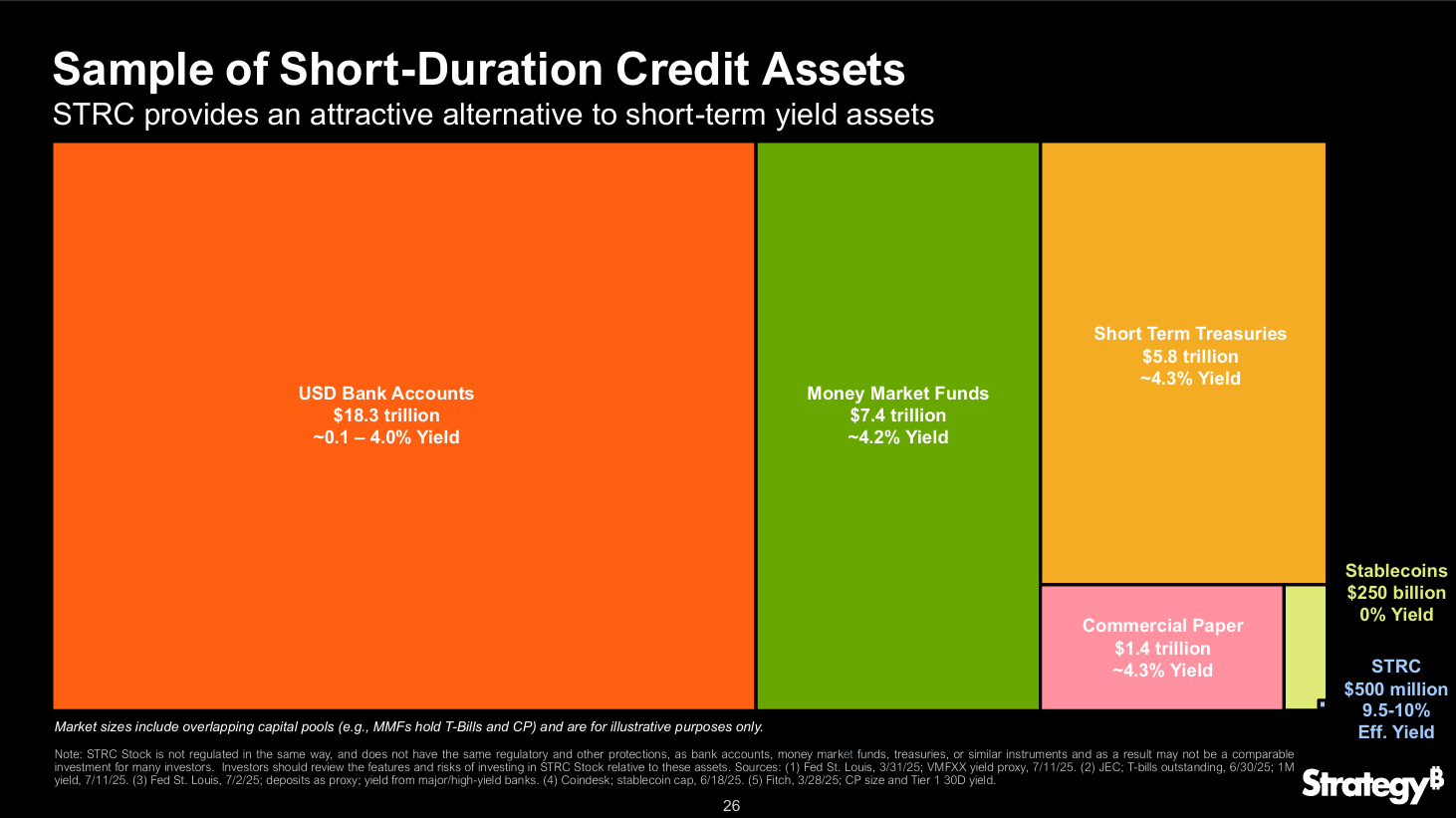

When we benchmark STRC against traditional short-term yield instruments, its revolutionary nature becomes even clearer:

- USD Bank Accounts: $18.3T market, yielding ~0.1–4.0%.

- Money Market Funds: $7.4T, yielding ~4.2%.

- Short-Term Treasuries: $5.8T, yielding ~4.3%.

- Commercial Paper: $1.4T, yielding ~4.3%.

- Stablecoins: $250B, yielding 0%.

STRC, with more than $2.5 Billion outstanding initially and an effective yield between 9% and 10%, provides more than double the yield of most short-duration instruments while maintaining overcollateralization with Bitcoin. The structure allows investors to access high-yield, short-duration characteristics without exposure to the credit or duration risks typical of corporate bonds or long-term preferreds.

This positioning places STRC in what investment professionals call a "white-space niche" – it combines the liquidity and simplicity of a money market-like instrument with yield levels typically reserved for higher-risk debt, all while being backed by Bitcoin reserves. It's a unique value proposition that didn't exist before in the market.

Why Saylor Favors Preferred Stock Over Convertible Bonds

Beyond the obvious advantages we've discussed, there's another crucial factor that makes Saylor prefer the new structure:

- The Delta-Hedging Headwind: When institutional investors purchase convertible notes, they often engage in something called dynamic delta hedging. This involves shorting MicroStrategy's common stock (MSTR) to manage their risk exposure as the bond's conversion option moves in or out of the money. This hedging activity creates persistent downward pressure on the share price, especially in volatile markets. It's like having a constant headwind against your stock price appreciation.

- The 12% Hidden Cost: While the headline coupon rate on convertible bonds may be near 0%, the true cost of capital is far from free. When you factor in the value of the conversion option granted to investors, the hedging-driven market impact, and the dilution potential, Saylor calculates that the effective cost can approach 12%. This makes convertible bonds much less attractive than their surface-level terms suggest.

- Limited Access of Capital: Convertible bonds trade in a closed ecosystem of institutional investors. As Saylor noted, "nobody can buy that stuff" in the open market. This illiquidity limits MicroStrategy's ability to raise capital at scale and traps the bonds at inefficient prices.

- The Preferred Stock Advantage: Preferred shares solve every one of these problems: no hedging pressure (no conversion feature to hedge), transparent costs (explicit 8-10% dividends), broad market access (trades like regular stock), perpetual structure (never matures), and strategic alignment (permanent capital for permanent holdings). What you see is what you get – no hidden complexities, just straightforward equity financing that matches MicroStrategy's long-term Bitcoin vision.

The Comprehensive Comparison: Convertible Bonds vs. Preferred Stock

Let's systematically compare these two financing approaches to understand why Saylor views preferred stock as superior:

Convertible Bonds vs Preferred Stock

Roxom Research – Capital Structure| Feature | Convertible Bonds | Preferred Stock |

|---|---|---|

| Structure | Debt with fixed term, convertible into equity. | Perpetual equity; may or may not be convertible. |

| Access | Limited to institutions; typically low secondary liquidity. | Publicly traded and retail accessible on major venues. |

| Maturity | Fixed maturity; principal repayment required at term. | No maturity; no repayment obligation. |

| Payments | Mandatory coupon/interest per indenture. | Dividends may be skipped if non-cumulative; board-discretionary. |

| Dilution | Potential equity dilution upon conversion. | Typically no voting dilution; economic dilution only via issuance. |

| Collateral | Generally unsecured (seniority defined by indenture). | Often over-collateralized or asset-linked (e.g., Bitcoin-backed). |

| Cost of Capital | Headline coupons can be near 0%, but effective cost can approach ~12% once conversion premium, dilution risk, and market dynamics are priced in. | Dividend rate is explicit and adjustable; total cost is fully visible (e.g., 8–10% depending on terms). |

Strategic Advantages for MicroStrategy's Bitcoin Strategy

From Saylor's perspective, the shift to preferred stock maximizes strategic agility and minimizes constraints for MicroStrategy's Bitcoin accumulation strategy:

- No Maturity or Repayment Pressure: Perpetual preferred shares have no fixed maturity date. This means there is no looming repayment schedule – the capital raised never has to be paid back in principal. In contrast, convertible bonds carry a due date, creating refinancing risks if they don’t convert.

- Flexible Dividend Obligations: Preferred dividends can be deferred or skipped in certain circumstances. Non-cumulative dividends mean missed payments do not accumulate. Missing an interest payment on a bond would constitute a default.

- No Dilution of Common Equity Control: Issuing preferred stock allows capital raising without diluting common shareholders’ voting control. Convertible bonds, if converted, would dilute existing owners.

- Broader Investor Base: Preferreds are publicly traded and accessible to a wide range of investors, unlike convertibles which are often private and illiquid.

- High Yield with Manageable Cost: Preferreds pay higher ongoing yields but avoid large one-time repayments or equity give-up. Dividends can be adjusted or paused if needed.

- Leverage and Upside Engineering: Convertible preferreds can offer a mix of yield and upside non-convertible preferreds simplify the proposition for broader appeal.

Improved Capital Structure: Preferred equity strengthens the balance sheet, reduces leverage ratios, and removes refinancing risk.

Conclusion: The Revolutionary Implications

Saylor evaluates preferred stock as superior to convertible bonds because it offers permanence, scalability, and simplicity versus the temporary, limited, and complex nature of past financing methods. He has effectively reinvented MicroStrategy's capital stack to better fit a world where Bitcoin is the core asset. In doing so, he likens this innovation to unveiling a revolutionary product that could transform an entire industry.

Whether STRC truly becomes the "iPhone" of corporate finance remains to be seen, but it has undeniably enabled MicroStrategy to continue its bold experiment of marrying corporate finance with cryptocurrency in an unprecedented way. The shift represents more than just a financing decision – it's a fundamental rethinking of how corporations can structure themselves around non-traditional assets. By creating instruments that are simple enough for mass adoption yet sophisticated enough to handle complex capital needs, MicroStrategy may have indeed found its "iPhone moment" in the world of corporate finance.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Read more

The Smarter Web Company’s Move to the London Stock Exchange Main Market:

A UK Tech Business, a Bitcoin Treasury Vision, and the Next Phase of Institutional Legitimacy The approval and publication of the prospectus for The Smarter Web Company PLC marks a defining moment in the firm’s corporate journey. What began as a UK-born web design and digital marketing business is

Strive’s SATA Follow-On: From a Proposed $150M Offering to a $118M Capital Raise

A balance-sheet case study in Bitcoin-native capital structuring When Strive, Inc. released two back-to-back announcements on January 21 and January 22, 2026, many investors were left asking a simple question: Did Strive raise $150 million or $118 million? The correct answer critically is $118 million in cash, with the remainder

Strive–Semler Merger Approved: A Defining Moment for Bitcoin-Native Corporate Finance

The shareholder approval of Strive, Inc.’s acquisition of Semler Scientific marks a watershed moment in the evolution of Bitcoin-native corporate finance. With this transaction, Strive, Inc. is not merely growing its balance sheet it is institutionalizing a new playbook for how Bitcoin treasury companies can scale, deleverage, and amplify

Digital Money: The Final Layer of the Bitcoin Financial Stack

Introduction: Why the World Still Lacks “Good Money” For over a decade, Bitcoin has proven itself as digital capital, a scarce, global, censorship-resistant store of value. It has absorbed volatility, rewarded long-term holders, and increasingly sits on corporate and institutional balance sheets. Yet despite Bitcoin’s success, one core problem