Metrics to Understand Bitcoin Treasury Companies

An Institutional Framework for Evaluating BTC Per Share Compounding

Bitcoin Treasury Companies (BTCTCs) represent a financial architecture built on a fundamentally different mandate than traditional corporations. Conventional companies optimize for earnings per share in fiat currency. Bitcoin Treasury Companies optimize for a higher-order treasury objective:

To increase Bitcoin per share over time.

Capital raises, leverage, debt structuring, and volatility are only relevant insofar as they contribute to this objective. To evaluate these companies correctly, investors must move beyond GAAP-based metrics and adopt a Bitcoin-denominated analytical framework.

This document provides that framework, with definitions, formulas, warnings, and a complete numerical example to ensure analytical precision.

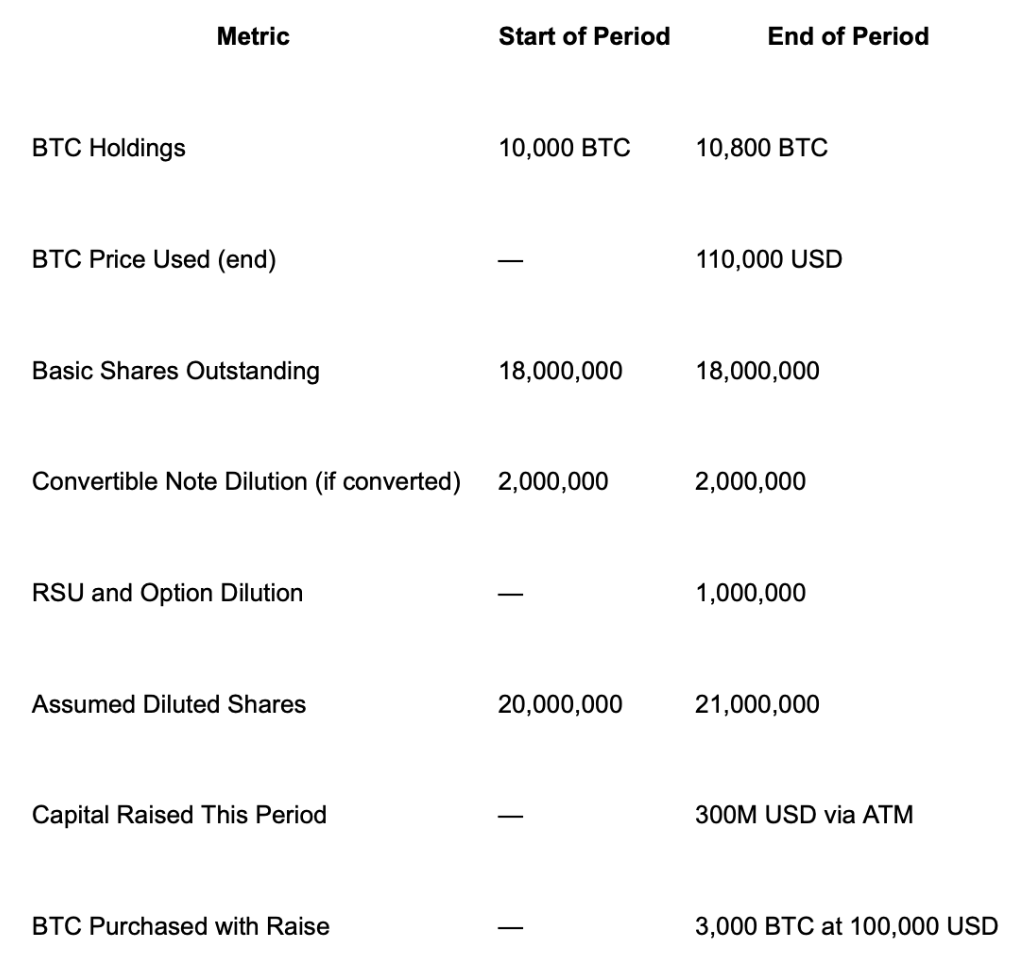

Reference Dataset for All Examples

All KPI examples reference this dataset.

Bitcoin Per Share (BPS)

Purpose: Measures Bitcoin ownership per share after full economic dilution. This is the Bitcoin-era equivalent of book value per share, but denominated in satoshis.

Formula: BPS = BTC Holdings ÷ Assumed Diluted Shares Outstanding

Expressed as: sats per share (1 BTC = 100,000,000 sats)

Example: Starting BPS = 10,000 ÷ 20,000,000 = 0.0005 BTC/share = 50,000 sats/share Ending BPS = 10,800 ÷ 21,000,000 = 0.0005142857 BTC/share = 51,428.57 sats/share

Interpretation: Bitcoin per share increased. The company is aligned with its treasury mandate.

Analyst Warning: Do not rely on "weighted average diluted shares" from GAAP earnings. Treasury analysis must assume full economic dilution exposure.

Assumed Diluted Shares Outstanding (ADSO)

Purpose: Defines the dilution denominator that determines BTC per share economics. Assumes all convertible notes, preferred stock, stock options, RSUs, and PSUs fully settle into common equity.

Formula: ADSO = Basic Shares + Convertible Note Shares + Preferred Share Equivalents + RSUs and Options (full conversion basis)

Example: 18M basic + 2M convertibles + 1M RSUs = 21M ADSO

Analyst Warning: Ignore vesting and strike price considerations. This is a treasury risk metric, not a GAAP presentation metric.

BTC Yield / Accretion

Purpose: Measures the rate of Bitcoin per share compounding over the period. Serves as the equivalent of same-store growth but for Bitcoin balance sheet efficiency.

Formula: BTC Yield = (Ending BPS − Starting BPS) ÷ Starting BPS

Example: BTC Yield = (51,428.57 − 50,000) ÷ 50,000 = 2.857 percent

Interpretation: The company increased Bitcoin per share by 2.857 percent this period, independent of Bitcoin price.

BTC Gain (Illustrative Bitcoin-Equivalent Increase)

Purpose: Translates BTC Yield into a Bitcoin-denominated equivalent to communicate treasury efficiency clearly.

Formula: BTC Gain = Starting BTC Holdings × BTC Yield

Example: 10,000 BTC × 2.857 percent = 285.7 BTC (illustrative equivalent)

Interpretation: This is a conceptual measure of Bitcoin-equivalent value creation, not a direct purchase amount.

BTC Dollar Gain

Purpose: Expresses BTC Gain in fiat currency terms to align with traditional equity investor communication.

Formula: BTC Dollar Gain = BTC Gain × BTC Price Used

Example: 285.7 BTC × 110,000 USD = 31.43M USD

Analyst Warning: Always confirm whether the company used period-end or current BTC price when presenting this number.

BTC Factor

Purpose: A multiplicative performance ratio useful for compounding projections over multiple periods.

Formula: BTC Factor = Ending BPS ÷ Starting BPS

Example: 51,428.57 ÷ 50,000 = 1.02857x

Interpretation: If sustained quarterly, this BTC Factor implies roughly 12 percent annual Bitcoin per share compounding.

BTC NAV (Gross Bitcoin Treasury Value)

Purpose: Represents the Bitcoin collateral base valued in fiat currency. Serves as the foundation for coverage ratios and capital stack analysis.

Formula: BTC NAV = BTC Holdings × BTC Price

Example: 10,800 BTC × 110,000 USD = 1.188B USD

Analyst Warning: BTC NAV is a gross Bitcoin value metric. It does not subtract debt or preferred capital obligations. Its purpose is collateral evaluation, not net asset calculation.

BTC Capital (Cohort-Level Capital Deployment)

Purpose: Measures actual dollars deployed into Bitcoin from a specific capital raise.

Formula: BTC Capital = Cash deployed into BTC from cohort

Example: 300M USD deployed → 3,000 BTC purchased → BTC Capital = 300M USD

Analyst Warning: Only amounts actually allocated to Bitcoin count. Excess cash or fees held in treasury should not be included.

BTC Spread (Cohort-Level BTC Accretion Rate)

Purpose: Evaluates BTC accretion from a specific cohort relative to raw BTC acquired.

Formula: BTC Spread = Cohort-attributed BTC Gain ÷ BTC purchased in cohort

Example: 150 BTC attributed gain ÷ 3,000 BTC purchased = 5 percent BTC Spread

BTC Dollar Income (After Financing Cost)

Purpose: Captures net BTC price effect after interest or dividend costs and scales appropriately.

Steps: Unrealized P&L = (BTC Price End − BTC Entry Price) × BTC purchased Net P&L after cost = Unrealized P&L − financing expense If net gain: BTC Dollar Income = Net P&L × BTC Spread If net loss: BTC Dollar Income = Full Net P&L

Example: BTC moved 100k to 110k → 3,000 BTC → 30M USD unrealized gain Financing cost: 6M USD → 24M USD net Spread: 5 percent → BTC Dollar Income = 24M × 5 percent = 1.20M USD

BTC Dollar Value (Total Period Accretion Output)

Purpose: Aggregates company-wide BTC Dollar Gain and cohort BTC Dollar Income into a single accretion output signal.

Formula: BTC Dollar Value = BTC Dollar Gain (company) + BTC Dollar Income (cohort)

Example: 31.43M USD + 1.20M USD = 32.63M USD

BTC Dollar Equity (Residual BTC Treasury Value)

Purpose: Illustrative residual BTC value after recognizing accretion signals above.

Formula: BTC Dollar Equity = BTC NAV − BTC Dollar Value

Example: 1.188B USD − 32.63M USD = 1.155B USD

BTC Torque (Capital Efficiency Yield)

Purpose: Shows BTC Dollar Value created per dollar of BTC Capital deployed.

Formula: BTC Torque = BTC Dollar Value ÷ BTC Capital

Example: 32.63M USD ÷ 300M USD = 10.88 percent BTC Torque

BTC Multiple (Value Retention Ratio)

Purpose: Compares BTC NAV to BTC Dollar Equity. Indicates how much NAV expansion is attributed to execution versus passive exposure.

Formula: BTC Multiple = BTC NAV ÷ BTC Dollar Equity

Example: 1.188B ÷ 1.155B = 1.0286x

BTC Rating (Capital Stack Coverage Ratio)

Purpose: Measures Bitcoin collateral coverage relative to senior and pari obligations due before or equal to the instrument reviewed.

Formula: BTC Rating = BTC NAV ÷ liabilities due at or before that instrument's maturity or trigger

Example: 1.188B USD ÷ 450M USD = 2.64x BTC Rating

BTC Risk (Coverage Failure Probability)

Purpose: Estimates probability that BTC Rating falls below 1 before instrument Duration, using assumed BTC ARR and volatility.

Example: Assumptions: BTC ARR 20 percent, BTC volatility 60 percent, Duration 3 years Illustrative BTC Risk: approximately 22 percent probability BTC Rating drops below 1

BTC Credit (Implied Spread)

Purpose: Converts BTC Risk into implied credit spread necessary to offset coverage failure risk.

Example: 22 percent risk over three years implies approximately 8 to 9 percent annual hazard If a preferred yields 6 percent, risk is mispriced relative to BTC treasury coverage

Duration Interpretation

Convertible Notes: Duration equals the earlier of stated maturity or investor put/repurchase date Example: 5-year note with 3-year put → Duration = 3 years

Preferred Stock: Use Macaulay Duration Formula: Macaulay Duration = (1 + Effective Yield) ÷ Effective Yield Example: 12 percent effective yield → 1.12 ÷ 0.12 = 9.33 years

Conclusion

A Bitcoin Treasury Company should not be evaluated using legacy corporate KPIs alone. BTC per share, dilution-adjusted treasury metrics, and BTC collateral coverage are the correct analytical tools for this new corporate form.

If Bitcoin per share is compounding, the company is executing. If Bitcoin per share is flat or declining, no amount of Bitcoin on the balance sheet justifies the structure.

This framework separates disciplined Bitcoin Treasury management from narrative-driven dilution. It establishes a complete professional lens for underwriting, comparing, and allocating to Bitcoin Treasury Companies as a legitimate emerging asset class.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.