Metaplanet’s Class B Preferred Shares: Japan’s First Institutional Bitcoin Preferred Equity

Metaplanet Inc. has entered a new chapter of corporate finance in Japan. With the launch of its Class B Preferred Share issuance raising ¥21.249 billion in long-dated, equity-classified capital the company has constructed one of the most sophisticated Bitcoin-backed funding instruments ever seen in Asia.

Metaplanet’s Class B Preferred Share issuance placed via third party allotment with global institutional investors marks the first major step toward institutional Bitcoin capital formation in Japan. While the securities are unlisted today, the structure lays the groundwork for a future listed market for Bitcoin-backed preferred shares.

This article breaks down how Metaplanet engineered this transaction, why it matters, and what it signals for the global evolution of Bitcoin treasury finance.

1. Executive Summary A Japanese BTCTC Goes Institutional

On November 20, 2025, Metaplanet approved the issuance of 23.61 million Class B Preferred Shares at ¥900 per share, with the following characteristics:

- Yield: 4.9% annual dividend on ¥1,000 liquidation preference

- Structure: Perpetual, non-voting, convertible into common at ¥1,000

- Listing Intent: Targeting future IPO of Class B on the TSE

- Investor Base: Global institutions (Nautical, Smallcap World Fund, Anson, Ghisallo)

- Underwriters: Goldman Sachs Japan, Cantor Fitzgerald

Net proceeds: ¥20.414B will be used as follows:

- ¥14.998B – New Bitcoin purchases

- ¥1.666B – Bitcoin Income Generation (options strategy)

- ¥3.75B – Redemption of 19th series 0% bonds

This positions the Class B issuance as a pure Bitcoin capital-raising instrument, structurally similar to Strategy’s STRE preferreds, but built within the Japanese regulatory and market framework.

2. Strategic Rationale Why Preferred Equity Is the Perfect BTCTC Instrument

Metaplanet’s management recognizes that the Japanese equity market is undergoing a shift. With Metaplanet’s mNAV temporarily below 1.0x, issuing common shares would dilute BTC/share and suppress long-term value creation.

Preferred equity solves that problem elegantly.

2.1 Preferred Equity Is Equity in Form, Debt in Behavior

Class B preferred shares allow Metaplanet to:

- Raise non-dilutive capital upfront

- Avoid issuing cheap common shares at suppressed valuations

- Maintain voting control

- Improve capital ratios (equity classification)

- Secure long-duration funding without refinancing risk

- Defer common dilution until ¥1,000 conversion price is exceeded

This is textbook Bitcoin treasury engineering: raise low-cost fiat capital → convert into a superior monetary asset (BTC).

3. Detailed Breakdown of Terms A True Institutional Preferred

The Class B instrument is a hybrid security meticulously designed for global professional investors.

3.1 Dividend Economics

- 4.9% annual yield, paid quarterly

- Based on ¥1,000 liquidation preference

- Stub period: ¥0.40

Annual dividend burden:

¥1.157B per year – A manageable payout given BTC derivatives revenue

3.2 Conversion Optionality

Holders can request the company to acquire their Class B shares and deliver common shares calculated as:

¥1,000 liquidation pref ÷ ¥1,000 conversion price

This is effectively a perpetual call option on the common stock, but exercised only if Metaplanet’s equity dramatically re-rates.

3.3 Downside Protection: Redemption Rights

Holders may redeem for cash at:

¥1,000 liquidation preference + unpaid dividends

Triggered if:

- Class B is not listed by Dec 2026

- Corporate reorganization

- Squeeze-out

- Delisting

This provides institutional investors with hard downside protection, ensuring the security functions like a long-dated credit instrument if listing fails.

3.4 Issuer Call Options

Two critical call features:

- Market-price call: After 10 years, if Class B trades >130% of ¥1,000.

- Capital-threshold call: If outstanding liquidation preference falls below ¥6B.

These prevent the preferred from trading out of control in a future Bitcoin bull market.

4. Funding Allocation A Bitcoin Treasury Masterclass

Metaplanet’s capital allocation mirrors Strategy’s three-flywheel model: (1) raise capital → (2) buy BTC → (3) use BTC to generate cashflows → (4) raise more capital → repeat.

Breakdown:

- ~74% to purchase new Bitcoin (¥14.998B)

- ~8% to Bitcoin Income Generation (¥1.666B)

- ~18% to redeem straight bonds (¥3.75B)

This smartly shifts the balance sheet from short-maturity 0% bonds into long-duration preferred equity while increasing BTC per share.

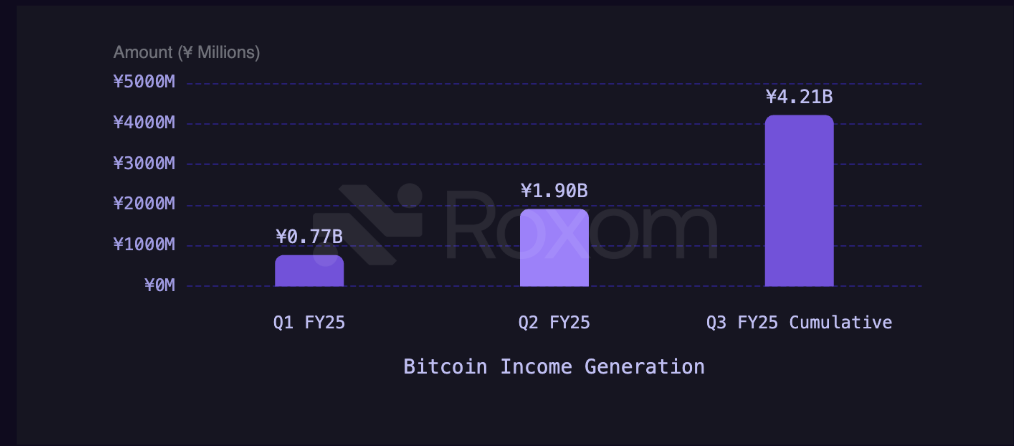

Bitcoin Income Generation

The company has already generated:

- ¥772M in Q1 FY25

- ¥1.904B in Q2 FY25

- ¥4.214B cumulatively by Q3 FY25

This is a crucial structural pillar:

The BTC income business is designed to fund preferred dividends, ensuring the security becomes BTC-self-funding.

This is what separates BTCTCs from miners and traditional corporates they can monetize volatility to cover fiat obligations while compounding BTC NAV.

5. Dilution Mechanics Intelligent and Delayed

Base Dilution from Class B

- 23.61M shares convertible

- Dilution: 2.07%

The Key Insight:

Conversion dilution only occurs once common stock > ¥1,000. At ¥1,000, the implied enterprise value and mNAV would be radically higher, meaning BTC/share is likely materially higher even with dilution.

This is structurally identical to the Strategy playbook: dilute only in bull markets where BTC appreciation dwarfs dilution.

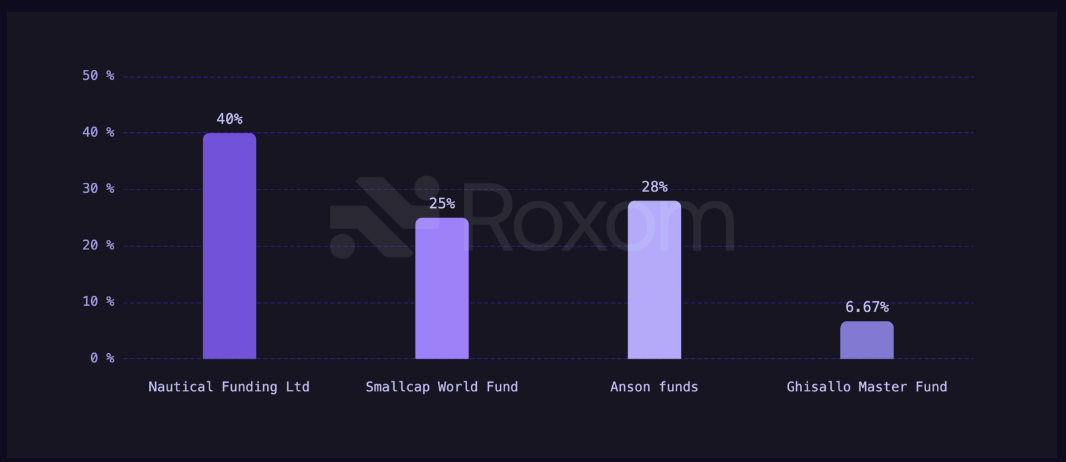

6. Institutional Investor Base The Beginning of a Global Market

Class B holders include:

- Nautical Funding Ltd – 40%

- Smallcap World Fund – 25%

- Anson funds – ~28% combined

- Ghisallo Master Fund – 6.67%

This is a credible, global institutional base with deep experience in convertible arbitrage, preferred equity, and special situation credit.

Goldman Sachs and Cantor Fitzgerald’s involvement signals:

- Professional structuring

- International investor interest in BTC-linked yield instruments

- A potential future secondary market for BTC-backed preferreds

Metaplanet is effectively creating Japan’s first institutional BTCTC investor ecosystem.

7. Core Risks What Professionals Will Watch

1. Listing Risk (The Big One)

If Class B is not listed by December 2026, holders can demand ~¥23.6B in cash. Metaplanet plans to cover this via:

- USD 500M credit facility

- Issuing new preferreds

- Continued BTC business revenue

But this remains a real liquidity cliff.

2. BTC Income Strategy Discipline

Option-premium strategies must be run conservatively.Over-leveraging or chasing high IV could backfire.

3. Heavy Bitcoin Dependence

The entire thesis rests on:

- Long-term BTC appreciation

- Continued institutional appetite for BTC-linked instruments

8. Strategic Impact The First True Bitcoin Preferred in Japan

Metaplanet’s Class B offering is not just a fundraising exercise it’s the construction of a new asset class.

This issuance accomplishes five breakthrough outcomes:

- Japan’s first institutional Bitcoin preferred share

- A scalable capital engine for BTC accumulation

- Transition from EVO-dominated financing to global capital

- A path to listing BTC-backed preferreds on the TSE

- A full Bitcoin capital stack preferreds + warrants + bonds + common equity

This is exactly how Strategy transformed itself into a monetary-energy accumulator. Now Japan has its first real player.

9. Conclusion A Milestone in Bitcoin Corporate Finance

Metaplanet’s Class B Preferred Shares represent a pivotal moment in the evolution of Bitcoin treasury companies.

This issuance:

- Embeds Bitcoin into Japan’s corporate finance infrastructure

- Demonstrates how to engineer low-dilution, high-duration fiat capital

- Brings global institutional investors into the Japanese BTCTC ecosystem

- Creates a template for future Bitcoin preferreds across Asia

- Expands Metaplanet’s ability to compound BTC/share over multiple cycles

As Bitcoin continues its global monetization, instruments like Class B will become the backbone of corporate Bitcoin accumulation strategies.

Metaplanet is now firmly positioned as Japan’s Strategy Inc. a pioneer in Bitcoin-denominated corporate finance.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.