Metaplanet Prefs: Pioneering Bitcoin-Backed Perpetual Preferred Stock in Japan- Part 1

Context & Strategic Significance

Metaplanet has rapidly emerged as Japan’s leading Bitcoin treasury company, vaulting from zero holdings in 2024 to over 30823 BTC by Oct 2025. This aggressive accumulation reaching 10,000 BTC by mid-2025 and surpassing even Coinbase’s corporate stash makes Metaplanet the country’s largest public Bitcoin holder. The firm’s Bitcoin-first treasury strategy is fueled by bold capital markets activity it executed Asia’s largest-ever Bitcoin equity financing (~¥770.9 billion via moving-strike warrants) and even issued zero-coupon bonds to fund BTC purchases.

This backdrop sets the stage for the Metaplanet Perpetual Preferred Shares, an innovative financing program poised to become a milestone for Japan’s financial markets. By introducing Bitcoin-backed perpetual preferred equity, Metaplanet aims to transform Japan’s conservative capital landscape much like Strategy did with its groundbreaking perpetual pref structures. In fact, Strategy’s pioneering “Bitcoin treasury playbook” establishing metrics like BTC Yield, mNAV and BTC $ Income has heavily influenced Metaplanet’s approach. Michael Saylor’s firm demonstrated that traditional markets can fund Bitcoin accumulation at scale, and Metaplanet is now adapting that blueprint to Japan. The issuance of Metaplanet Prefs is strategically significant not just for the company’s own growth, but as a first-of-its-kind in Japan, potentially unlocking a new asset class (Bitcoin-backed yield instruments) in the domestic market. It’s being likened to an “iPhone moment” for Bitcoin finance a reference to Saylor’s characterization of his own $2.5 billion pref raise as a game-changing breakthrough. In short, Metaplanet Prefs are set to marry Japan’s deep capital pools with Bitcoin’s upside, marking a seminal convergence of crypto and conventional finance in an institutional-grade structure.

Capital Structure Innovation

Preferred stock occupies a unique niche in the capital structure, a hybrid of debt and equity that offers the issuer permanent capital without the obligation of principal repayment. Metaplanet’s perpetual preferred shares are designed with this hybrid nature in mind.

Preferred equity carries equity classification but provides debt-like features such as fixed dividend payments and priority claims ahead of common stock. In practice, this means preferred shareholders receive dividends senior to common dividends and have a higher claim on assets in a liquidation, yet the capital is perpetual (no maturity date) and typically non-voting. This structure confers multiple advantages:

- Permanent Capital, No Refinancing Risk: Unlike bonds, perpetual prefs do not come due. Metaplanet avoids the refinancing and rollover risk associated with debt maturities. The preferred shares function as long-term stable capital effectively equity that behaves like fixed-income enabling the company to focus on BTC acquisition without worrying about redemption deadlines.

- Fixed Cost of Capital: The prefs will pay a predetermined dividend (expected up to ~6% annually in JPY), providing funding predictability. This fixed dividend is akin to an interest expense but is not legally a debt obligation if extreme conditions hit, Metaplanet can defer dividends (especially if structured as cumulative preferred) without triggering default, giving management flexibility in adversity.

- No Equity Dilution of Common Shareholders: Critically, preferred stock raises cash without issuing common shares. Metaplanet has been extremely aggressive in raising equity for BTC purchases, so introducing prefs helps diversify funding and relieve pressure on common equity issuance. Class A preferreds carry no conversion rights, meaning they won’t dilute the ownership of existing shareholders. This preserves upside for the common stock while still expanding the capital base.

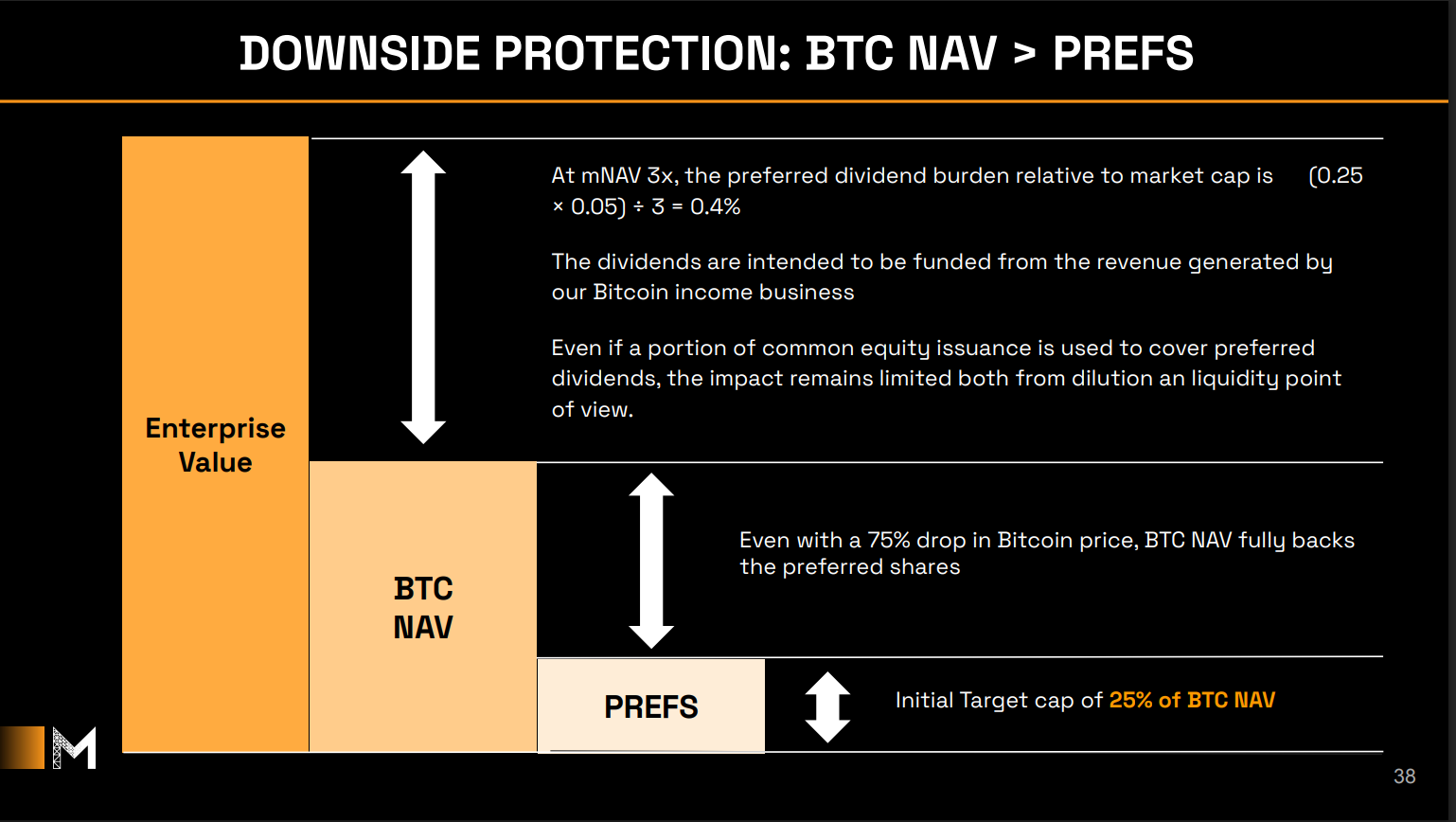

Metaplanet is instituting a strict collateralization discipline for its preferred program to safeguard credit quality. Total preferred issuance will be capped at ≤25% of Metaplanet’s BTC NAV. In other words, at any given time the outstanding preferred equity will represent no more than one-quarter of the market value of the company’s Bitcoin holdings. This conservative cap ensures the prefs are amply over-collateralized by liquid BTC assets, even under severe downside scenarios. For example, with a 25% cap, even a 75% crash in Bitcoin’s price would still leave sufficient asset coverage for the preferred shares. Management explicitly notes that capping issuance at 25% of BTC NAV keeps the dividend burden “manageable, with ample capacity” supported by the firm’s earnings and capital-raising ability. By constraining leverage in this way, Metaplanet is effectively self-imposing an investment-grade standard on its capital structure. The company will apply rigorous BTC-focused risk metrics (so-called BTC Risk and BTC Credit frameworks) to monitor coverage and ensure that the preferreds maintain high credit quality. This approach should reassure rating agencies and investors that Metaplanet Prefs represent sound, over-collateralized claims, not high-risk speculative paper.

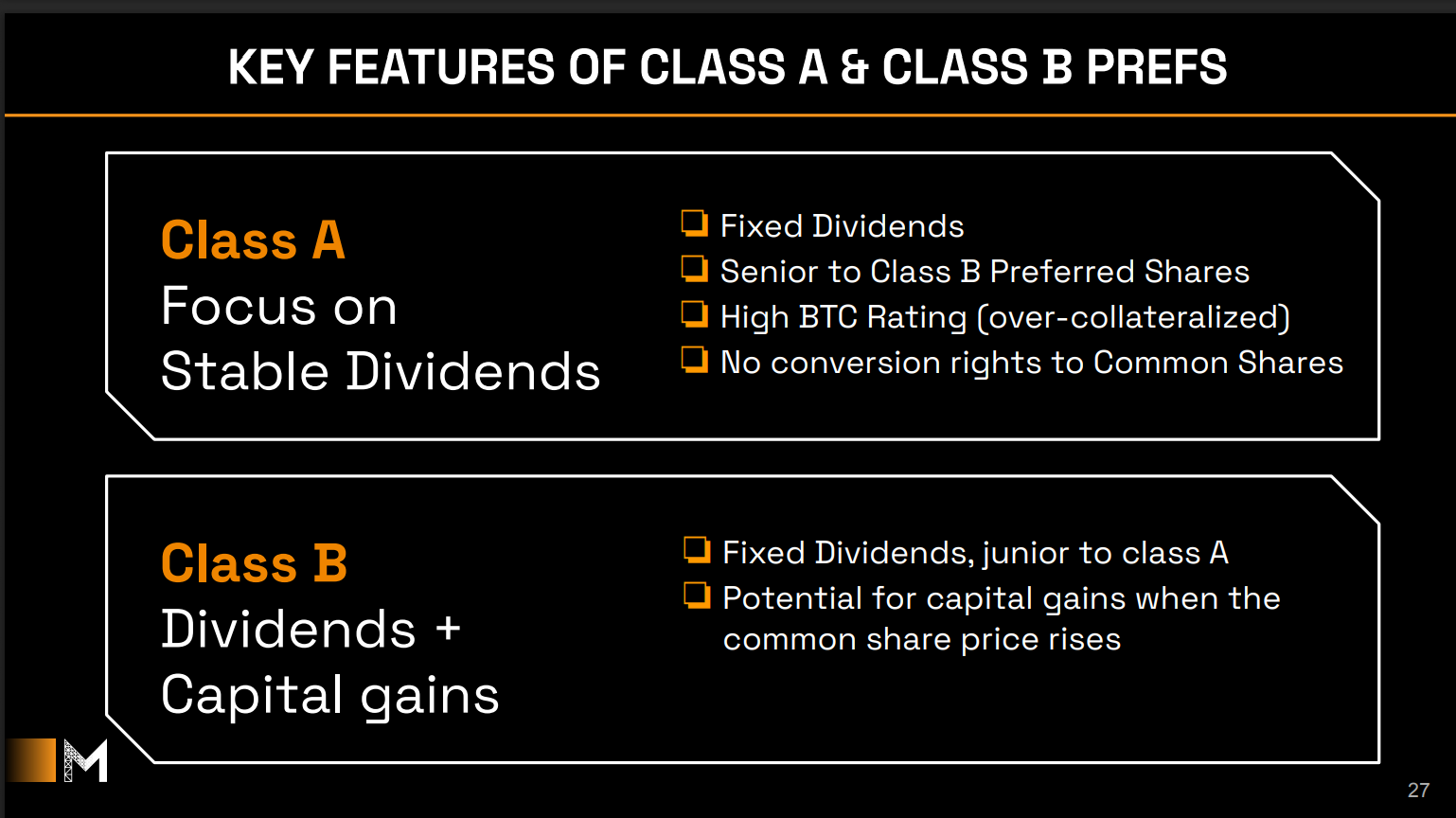

Another innovation is the introduction of multiple classes of preferreds to optimize the capital stack. Metaplanet plans an initial Class A and Class B preferred series:

- Class A Prefs: Senior, non-convertible perpetual preferred shares with a fixed dividend. These are designed to be “bond-like” providing investors stable JPY income with minimal volatility. Class A will rank ahead of Class B in dividends and liquidation, and importantly has no conversion to equity, so it truly functions as a pure fixed-income surrogate. This class targets conservative yield investors.

- Class B Prefs: Junior perpetual preferreds with a fixed dividend plus potential equity upside. Class B will be convertible into common stock (likely at a premium), allowing investors to participate in Bitcoin-driven equity gains if Metaplanet’s stock soars. It sits below Class A in priority. Class B gives a middle-ground option: a solid dividend but with an equity kicker, appealing to those who want yield and some Bitcoin-linked upside.

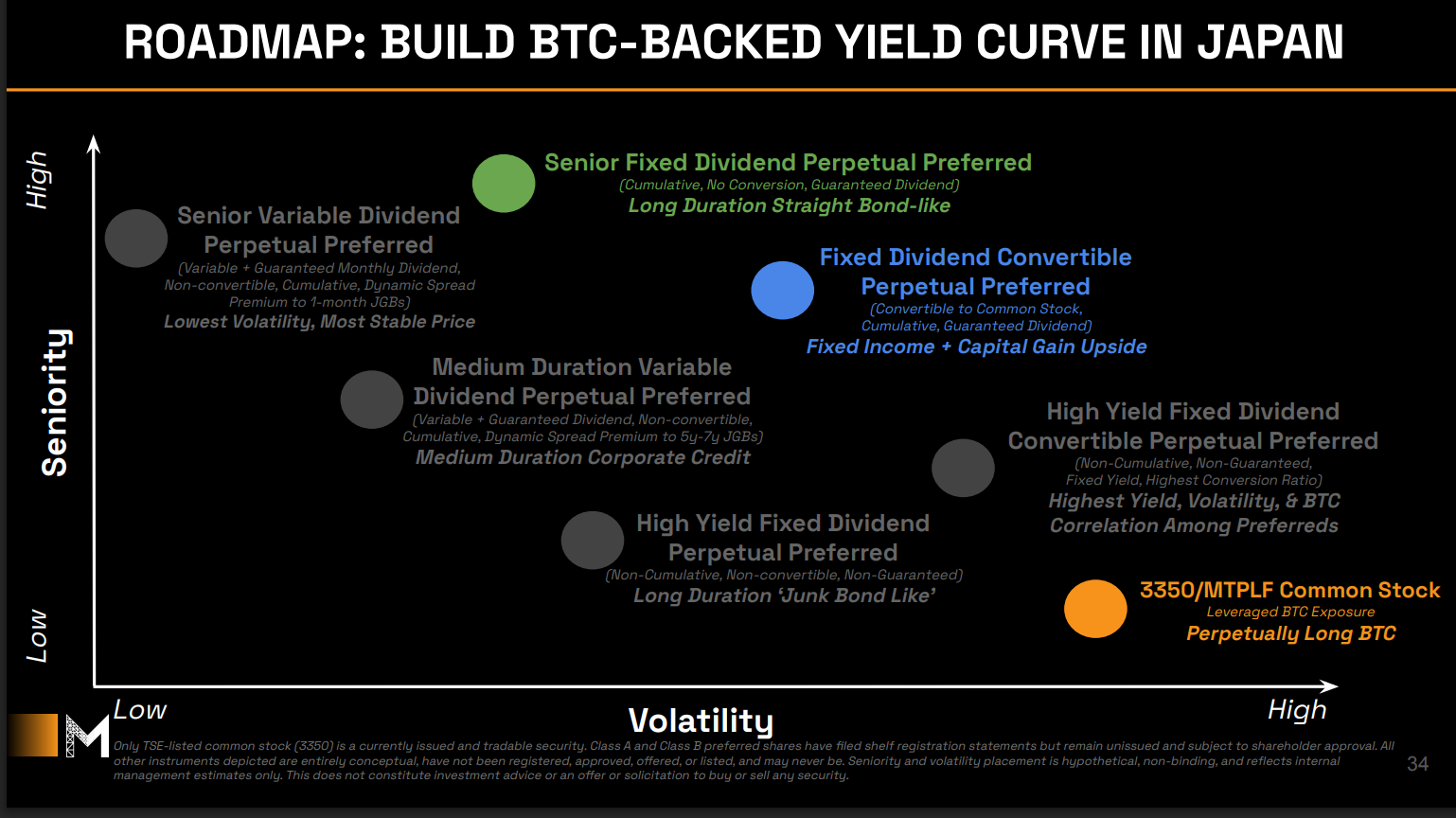

By structuring two tiers, Metaplanet can widen its investor appeal Class A for institutions seeking stability, Class B for those open to a bit more risk/return. Over time, the company even envisions a full spectrum of BTC-backed preferred instruments (fixed, floating, convertible, high-yield, etc.) to effectively build out a Bitcoin yield curve in Japan. This is analogous to Strategy’s multi-tranche approach in the U.S.

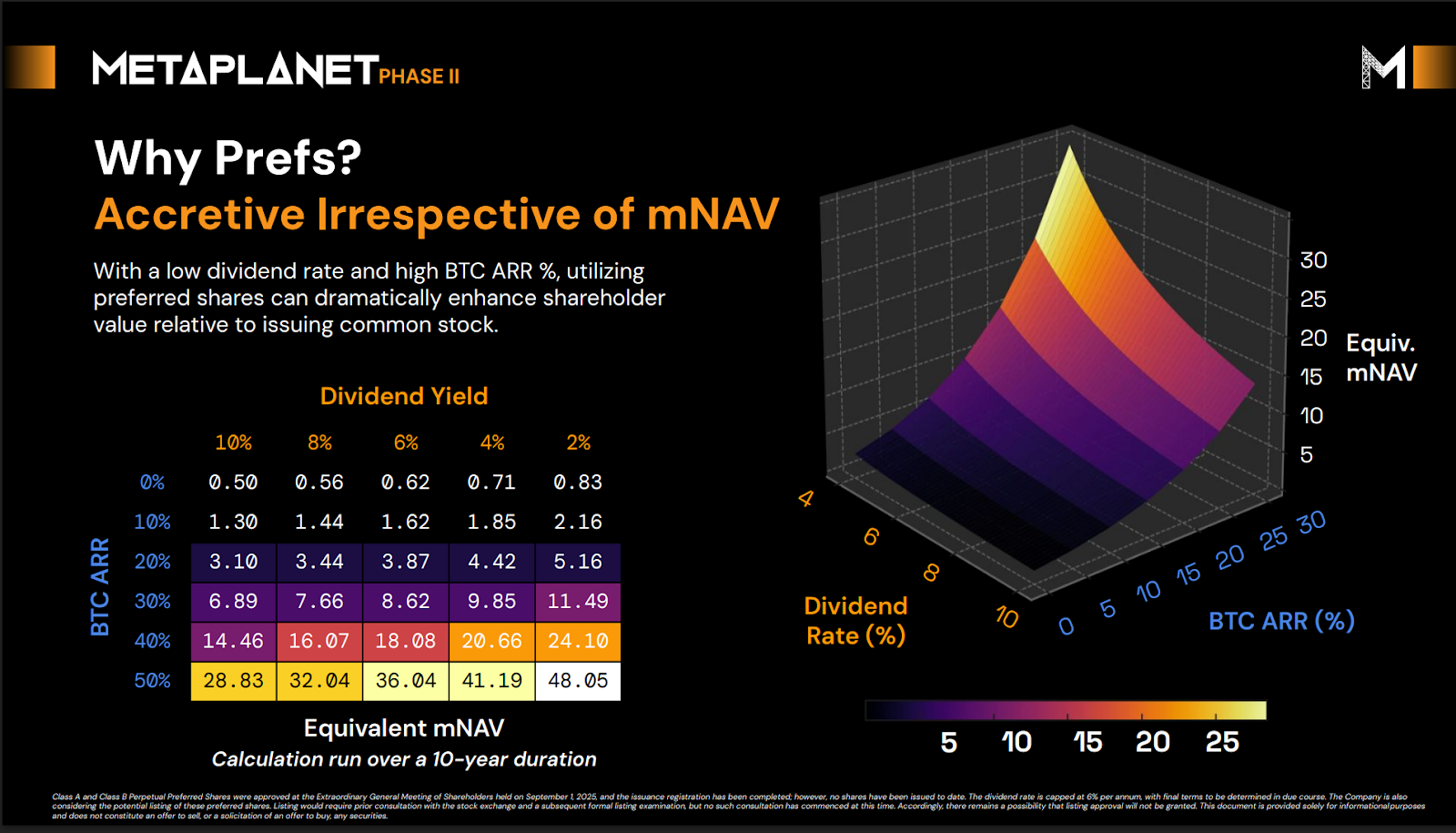

In summary, Metaplanet Prefs represent a capital structure innovation for Japan: a perpetual, over-collateralized hybrid security that provides permanent leverage on Bitcoin holdings while aligning with prudent coverage limits. It’s a creative financing tool that expands Metaplanet’s war chest for BTC accumulation without the downsides of traditional debt or common equity.Accretion Modeling: Low Coupon + High BTC Yield = NAV Expansion Metaplanet’s own modeling (see Exhibit: “Why Prefs? Accretive Irrespective of mNAV”) shows how perpetual preferreds enhance shareholder value under a wide range of Bitcoin appreciation and dividend assumptions. The 3D surface and heat map plot the equivalent market NAV (mNAV) delivered to common shareholders over a 10-year horizon. Even with a moderate BTC annual return (ARR) of 20% and a relatively rich 6% dividend, the program is projected to generate an mNAV multiple of ~3.9× versus issuing common stock at par. At higher Bitcoin appreciation (40–50% ARR) and restrained coupons (≤4–6%), the accretion becomes dramatic—mNAV expands 18–48×, far exceeding the outcome of plain equity issuance. This illustrates the “fixed-cost leverage” dynamic: a capped yen dividend burden paired with high BTC price appreciation compounds value for common equity. In other words, once the cost of preferred capital (dividend) is locked, any BTC price appreciation above that hurdle accrues almost entirely to the residual common holders, even if mNAV is modest at issuance.

Market Opportunity

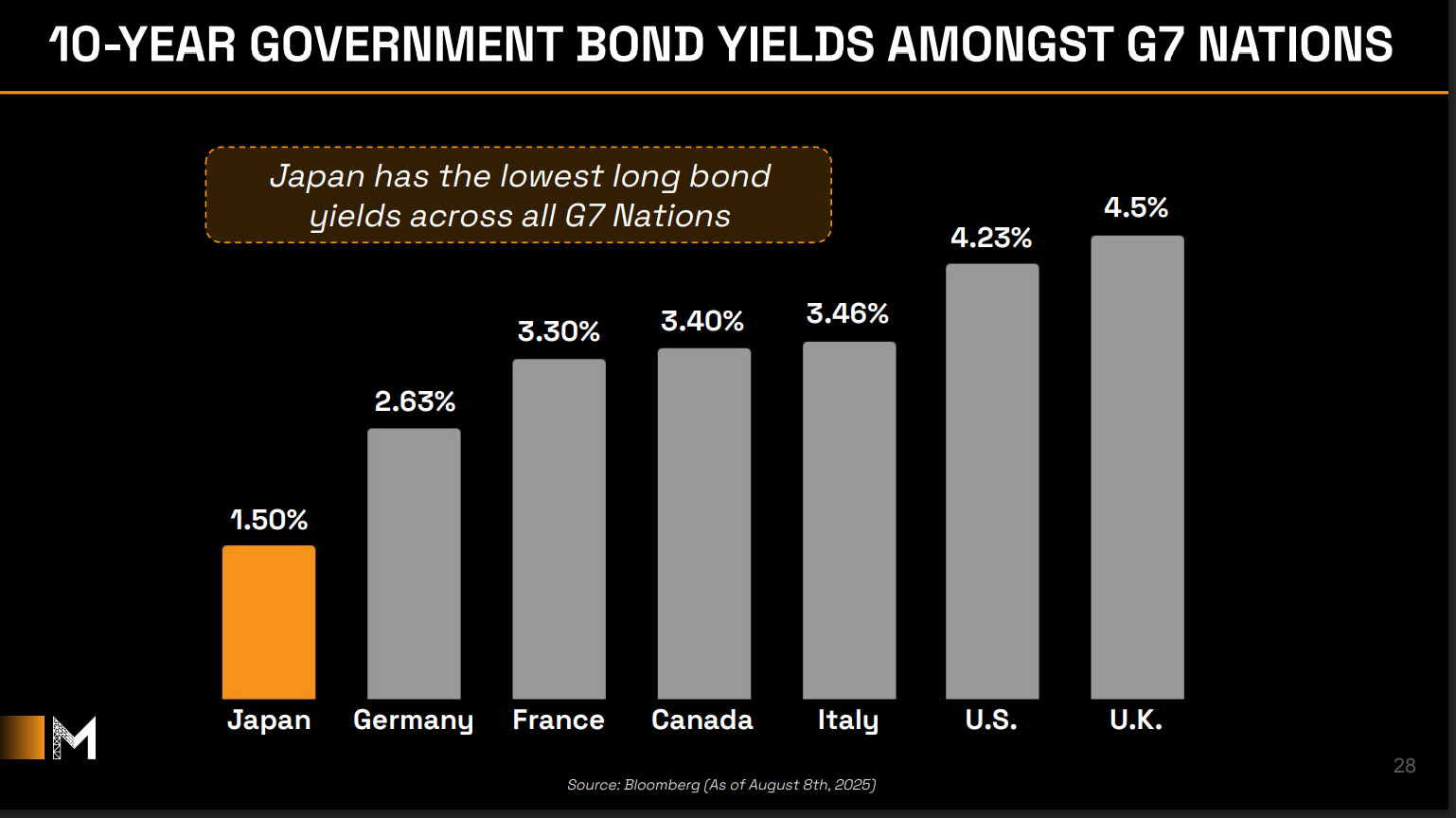

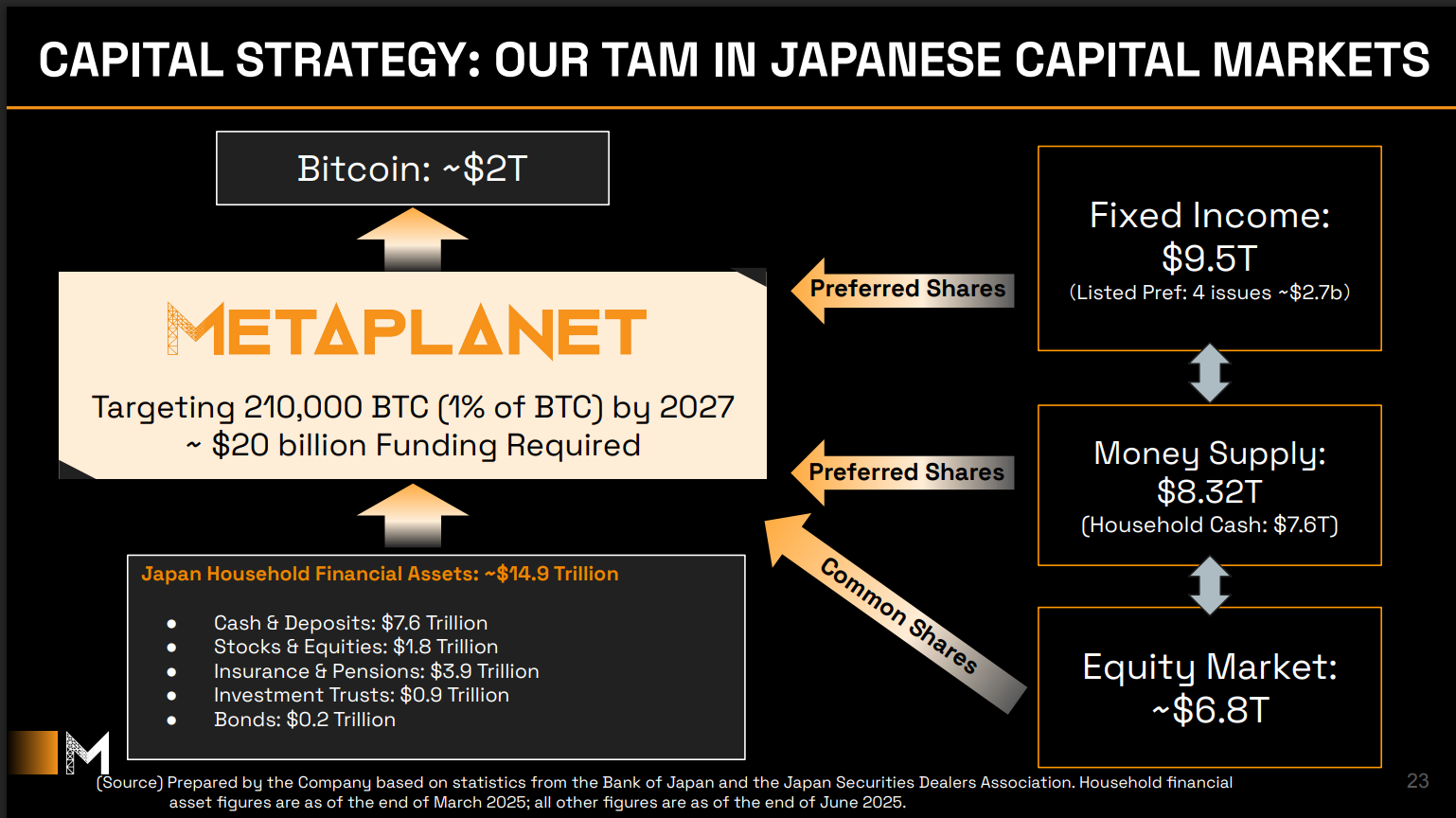

Japan’s financial landscape is defined by enormous savings pools and chronically low yields, a combination that creates fertile ground for Metaplanet’s Bitcoin-backed preferreds. Japanese investors hold trillions of dollars in cash and bonds, yet earn negligible returns by global standards. Household financial assets exceed $14.9 trillion (approx ¥2,000 trillion), with over half of that sitting in bank deposits and cash earning near 0% interest. Likewise, Japan’s domestic fixed-income market (≈$9.5 trillion) offers scant yield; the 10-year Japanese government bond yields only around 1.5%, the lowest among G7 nations. By contrast, U.S., U.K., and European bonds yield 3-4.5%, highlighting how yield-starved Japanese capital is.

Figure: 10-Year Government Bond Yields in G7 (Aug 2025). Japan’s 10-year yield (~1.5%) is by far the lowest, reflecting a domestic investment climate hungry for yield.

With an aging population and limited domestic growth, Japanese insurers, pensions, and savers are desperate for higher income streams. The Metaplanet Prefs directly address this need by offering a new source of yield backed by Bitcoin, an asset with distinct return drivers. In effect, Metaplanet is attempting to channel Japan’s vast idle savings into productive financing for Bitcoin or as the company puts it, to “transform Japan’s multi-trillion-dollar fixed income market into a Bitcoin accumulation engine.” It’s a bold vision: turning a portion of Japan’s low-yield capital base into Bitcoin-backed credit that pays out attractive yields to investors and funnels fresh capital into BTC purchases.

Importantly, Metaplanet Prefs would be Japan’s first-ever Bitcoin-backed fixed-income instrument, creating what is essentially the first Bitcoin yield curve in the country. This means Japanese investors could obtain exposure to Bitcoin’s economics (as collateral) without buying Bitcoin directly, and in a format (preferred shares) that is familiar and tradable on traditional stock exchanges. The significance cannot be overstated: it bridges the crypto and traditional worlds. Investors who would never hold Bitcoin due to its volatility or regulatory constraints can now buy a yen-denominated preferred stock that yields perhaps 5–6% and is over-collateralized by Bitcoin. For yield-hungry institutions, this is a novel “BTC-backed bond proxy” essentially creating yield where none existed. If Metaplanet issues multiple series (e.g. fixed vs floating, different tenors via callable structures), over time a full term structure a BTC yield curve could develop, linking Bitcoin’s economics to Japan’s capital markets in a stable, yield-paying form.

Market demand for such an instrument is expected to be strong. Japan’s household cash holdings (~$7.6T) and bank savings could be mobilized if a compelling product emerges. Few domestic products offer both high yield and liquidity currently, to get >5% yield Japanese investors often have to either take forex risk (foreign bonds) or credit risk (junk bonds) or venture into complex alternatives. Metaplanet Prefs offer a high-yield option right at home, with a unique collateral (BTC) that is uncorrelated to yen interest rates. Moreover, the supply of preferred equity in Japan is minuscule today (only 4 listed issues totaling ~$2.7B exist). Metaplanet’s ~$3.7B (¥555B) shelf registration for preferreds nearly doubles the entire domestic preferred market, underscoring the pent-up demand for yield instruments.

In essence, Metaplanet is seizing a market opportunity at the intersection of two extremes: Japan’s excess capital with no yield, and Bitcoin’s high-growth, high-yield potential but lacking traditional yield instruments. By wrapping Bitcoin exposure into a yield-bearing security, Metaplanet Prefs could unlock a flood of capital from conservative coffers into the Bitcoin ecosystem. It’s a mutually beneficial innovation: Japanese savers get Bitcoin-backed yield (something previously unattainable), and Metaplanet gets low-cost, long-term financing for its Bitcoin acquisitions. If successful, it will effectively establish Japan’s first BTC yield curve, denominated in JPY, setting benchmarks for Bitcoin-linked cost of capital across durations and risk tiers.