Metaplanet Prefs: Pioneering Bitcoin-Backed Perpetual Preferred Stock in Japan- Part 2

Stakeholder Benefits

The Metaplanet Prefs are ingeniously structured to deliver benefits to all key stakeholders the issuing company, the preferred investors, and the common equity shareholders aligning their interests around Bitcoin’s growth.

Benefits for Metaplanet (Issuer)

- Diversified Funding & Lower Cost of Capital: Metaplanet gains a new fundraising avenue beyond straight equity or debt. This diversifies its capital structure and could lower its overall cost of capital. Preferred dividends (anticipated ~5–6% JPY) are tax-deductible in Japan if treated as interest (in certain cases), and even if not, they likely represent a cheaper or more flexible form of capital than the equity issuance spree Metaplanet has undertaken. By tapping yield-oriented investors, Metaplanet broadens its investor base and reduces reliance on equity markets alone. This is especially valuable as its common stock, while up 5x this year, may not sustain endless new issuance without diluting value. Prefs allow continuing BTC acquisitions without common equity dilution.

- Accelerated Bitcoin Acquisition (Leverage on NAV): Issuing preferred shares essentially leverages Metaplanet’s balance sheet for more Bitcoin buying. The company can “redeploy proceeds into BTC purchases”, creating a flywheel where new capital begets more BTC, which in turn can generate more BTC income. This accelerates Metaplanet toward its goal of 210,000 BTC by 2027. Crucially, because the prefs are capped at 25% of BTC NAV, the leverage is moderate providing a boost to BTC holdings without courting excessive risk. The impact is amplified if Metaplanet’s stock trades at a premium to its BTC NAV (i.e., mNAV > 1×). At a high mNAV multiple, raising ¥ via prefs and converting it into BTC can increase NAV per common share significantly (similar to issuing equity above book). Management cites that at an mNAV of 3×, the preferred dividend burden would be only ~0.4% of market cap a trivial cost for the added BTC “torque” this capital provides to common shareholders. In effect, Metaplanet uses the prefs to pull future BTC growth forward in time, enhancing total NAV.

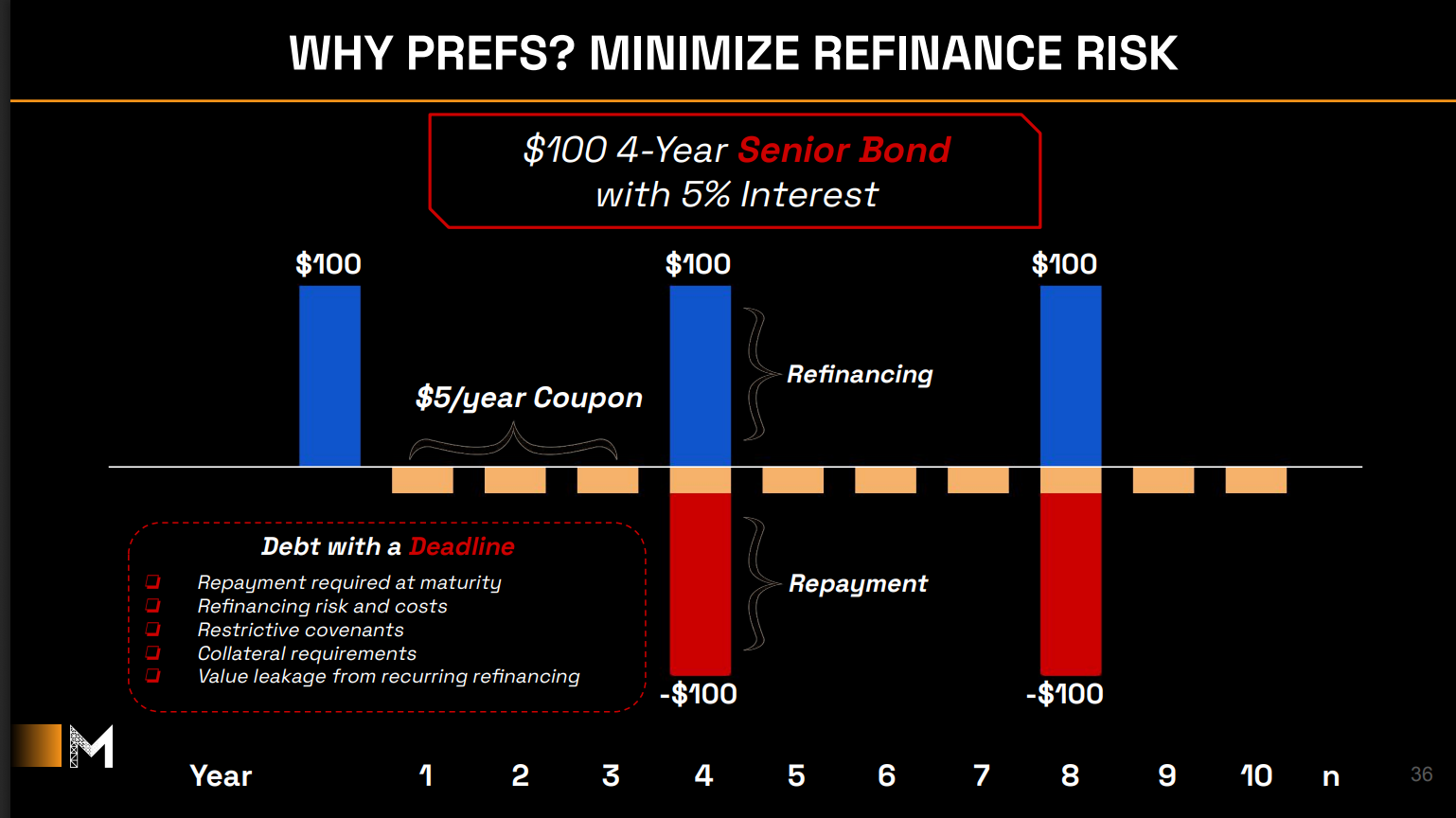

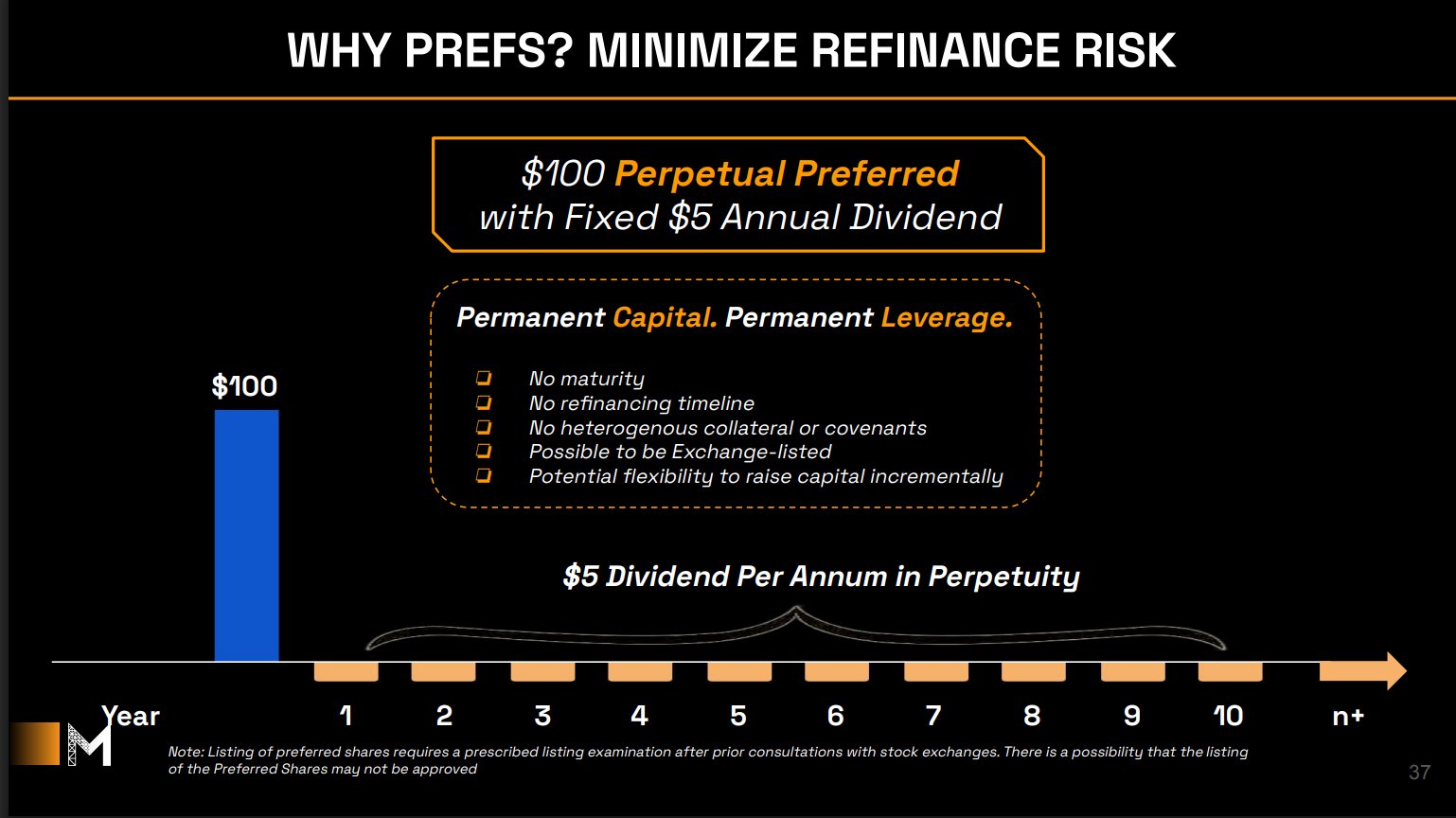

Enhanced Financial Flexibility: Preferred equity comes without the restrictive covenants of debt. There’s no repayment schedule, and dividends can potentially be deferred in a crunch (especially if cumulative). This gives management flexibility in downturns far more than if they had, say, issued ¥500B of bonds. Metaplanet can also refine terms per class (e.g. maybe a floating-rate series later, or callability features) to respond to market conditions. Such flexibility is invaluable given Bitcoin’s inherent volatility. Additionally, because preferred stock is perpetual, Metaplanet can treat it as “quasi-permanent capital” focusing on long-term BTC strategy rather than managing near-term maturities. The absence of mandatory interest expense (legally it’s a dividend) means no default risk; the company retains control over its destiny, subject only to keeping investors confident in its asset coverage.

Benefits for Preferred Investors

- Attractive Yield with Asset Backing: Preferred shareholders receive a stable high-yield income stream in JPY, likely in the mid-single-digit percentages. In a country where bank deposits yield ~0% and even 30-year government bonds yield <2%, a ~5–6% yield is extraordinarily attractive. This yield is explicitly backed by Bitcoin collateral: Metaplanet’s BTC holdings (marked-to-market) provide a robust asset coverage buffer. By policy, the company will not dilute this coverage beyond the 25% NAV cap, ensuring each ¥ of preferred is over-collateralized by ¥4 of BTC assets at issuance. For investors, this means a high yield without excessive credit risk the coverage is akin to a well-collateralized bond. Furthermore, Metaplanet applies “BTC Credit Ratings” internally, effectively treating BTC as the asset underpinning the credit given Bitcoin’s absolute scarcity and liquidity, the credit profile is homogeneous and transparent (BTC price). Investors can independently verify the collateral value 24/7 via the BTC market price, a level of transparency rare in corporate debt markets.

- Lower Volatility than BTC or Equities: The preferred shares are expected to exhibit much lower price volatility than either Bitcoin or Metaplanet common stock. Because of their fixed dividend and senior claim, the prefs should trade based on yield and credit perception, not Bitcoin’s day-to-day swings. Management emphasizes that Class A in particular offers “stable dividends with lower volatility than BTC or common stock”. In essence, pref investors are insulated from a large portion of Bitcoin’s volatility they have a buffer of common equity beneath them to absorb price fluctuations. This is ideal for more conservative investors: they can indirectly participate in the Bitcoin theme (via a claim on a Bitcoin-rich company) but with a smoother ride. The prefs may trade near their ¥1000 par value if structured like typical preferreds, further anchoring volatility. In short, it’s Bitcoin-backed income with bond-like stability in price (assuming no severe distress scenario).

- Strong Protections & Potential Upside (for certain classes): Investors benefit from structural protections. Dividends on the Metaplanet prefs will likely be cumulative (at least for senior Class A) meaning if Metaplanet ever skips a dividend, it still owes it in arrears, and common dividends can’t be paid until pref arrears are cleared. This feature, common in preferreds, protects investors’ income expectations. Additionally, if Strategy’s model is followed, there may be clauses like dividend step-up in case of non-payment (e.g., compounding at higher rates) to incentivize the company to pay timely. Investors in Class B will have conversion rights that grant them upside if Metaplanet’s common stock rallies. That effectively gives them a call option on the company’s equity/Bitcoin gains, on top of the fixed dividend. For example, Class B holders might convert to common if BTC soars and Metaplanet’s share price far exceeds the conversion price, capturing capital gains. This blend of yield and upside is a unique proposition few instruments offer a high current yield and exposure to Bitcoin’s growth. Finally, by being denominated in yen and issued locally, these prefs spare Japanese investors the currency risk and complexity of investing in overseas high-yield or crypto products. They fit within traditional portfolios (e.g. trust banks or insurers could buy them under domestic allocations), potentially qualifying for inclusion in yield indices or preferred stock funds.

Benefits for Common Shareholders (Equity)

- Non-Dilutive Growth Maximizing NAV per Share: Common shareholders of Metaplanet effectively get to have their cake and eat it too. The preferred stock infusions provide capital for Bitcoin purchases without diluting common ownership. Unlike a secondary equity offering which increases shares outstanding, the prefs leave the share count unchanged (aside from any eventual Class B conversions, which are capped and likely at higher prices). This means the NAV per common share (mNAV) can grow significantly if the raised funds are invested accretively. In fact, if Metaplanet’s stock trades above its book value (mNAV >1), raising capital via preferreds and investing in BTC is highly accretive to common book value. It effectively leverages the balance sheet in favor of existing shareholders. They retain all the upside on the new BTC acquired, after paying the fixed dividend to prefs. Over time, this can compound NAV per share faster than relying only on reinvested operating profits. Management’s strategy explicitly is to use “positive operating cash flow” and equity-raised capital to compound NAV per share in the long term the prefs turbocharge this by bringing in outside capital dedicated to that objective.

- Enhanced Bitcoin Torque (Leveraged Upside): Common shareholders’ returns are now more leveraged to Bitcoin’s performance which is a double-edged sword, but attractive to those bullish on BTC. By introducing a fixed-cost layer in the capital stack, Metaplanet’s equity becomes a residual claimant with greater “torque”. If Bitcoin’s value appreciates above the dividend cost, the excess gain flows disproportionately to common equity. For example, suppose Metaplanet raises ¥80B in prefs at a 5% dividend and buys BTC. If Bitcoin’s value grows 20% annually, that’s ¥16B gain on the BTC; paying ¥4B to pref holders leaves ¥12B for equity effectively a higher return on equity capital thanks to leverage. Common shareholders effectively get leveraged BTC exposure in perpetuity: the prefs are perpetual, so the leverage doesn’t expire, and the common benefits from all future BTC price increases minus the fixed dividend “interest.” This is analogous to how homeowners benefit from house price appreciation minus their fixed mortgage interest in a rising market, leverage amplifies gains. Metaplanet’s management believes this structure will “maximize BTC exposure while minimizing dilution” for common shareholders, giving them a chance at outsized returns if Bitcoin performs well.

- Preserved Voting Control and Downside Buffer: Because the preferred shares carry no voting rights in general, issuing them does not dilute the governance power of common shareholders. Founders/major holders maintain their voting stake. Additionally, in a worst-case scenario (Bitcoin downturn), the presence of preferred equity provides a cushion common equity would absorb losses first, and Metaplanet could even pause pref dividends if absolutely necessary (cumulative dividends would accumulate, but it avoids insolvency). This means the company can survive deeper troughs, potentially avoiding distress that could wipe out common shareholders in a highly leveraged debt scenario. While the prefs do introduce financial risk (fixed dividends), they do so in a way that does not threaten bankruptcy. Common shareholders thus get leverage without the same default risk as debt. As long as Metaplanet manages the coverage (which it is doing via the 25% cap rule), the common equity acts like a call option on a growing hoard of BTC financed partly by others’ money. It’s a high-risk-high-reward proposition, but one that existing shareholders likely welcome given their strong Bitcoin conviction. And importantly, by setting initial dividend rates at a manageable level (and generating significant BTC-derived income), Metaplanet is signaling that preferred dividends will be well-covered by operating income and not jeopardize common equity. Indeed, year-to-date Bitcoin income of ¥1.9 B (from option premiums) already covers a substantial portion of an expected dividend burden, and that income should rise as BTC holdings (and thus option-selling capacity) increase. Common shareholders can therefore view the prefs as a savvy way to use other investors’ capital to fuel further BTC accumulation, enhancing their long-term upside.

In sum, the Metaplanet Prefs create a win-win-win: Metaplanet gets growth capital on good terms; preferred investors get high-yield, collateral-protected income; and common shareholders get amplified Bitcoin exposure without dilution. This alignment of interests is key to the program’s strategic rationale. It harnesses Japan’s yield-seeking capital to propel Metaplanet’s Bitcoin mission, while offering each stakeholder class a tailored mix of risk and reward.

Lessons from Strategy’s Perpetual Preferred Program

Metaplanet’s initiative is heavily inspired by the playbook of Strategy. Strategy, led by Michael Saylor, was the first public company to leverage its Bitcoin treasury via perpetual preferred stock a bold financial engineering feat that demonstrated how powerful this approach can be. Examining Strategy’s case provides valuable lessons and a template that Metaplanet and others are following in Asia.

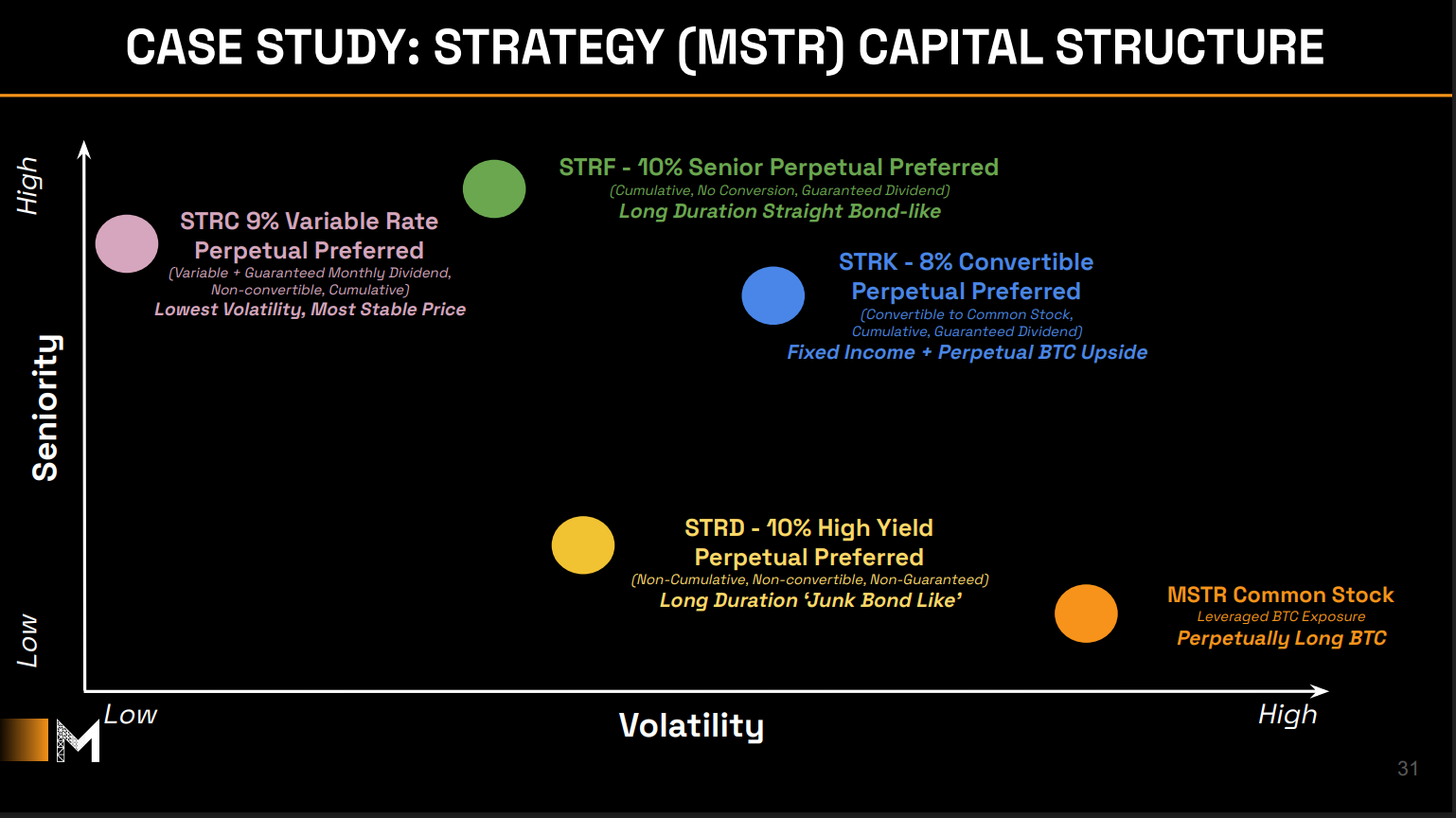

Multi-Class Perpetual Preferred Structures: In early-to-mid 2025, Strategy issued several series of perpetual preferred stocks, each with distinct features targeting different investor segments. These were nicknamed STRF, STRC, STRK, and STRD (collectively termed “Strategy’s preferreds”), and they essentially tiered the capital structure above common equity:

- STRF (“Strife”) – 10% Fixed-Rate Senior Preferred: A cumulative, non-convertible perpetual preferred stock with a 10.00% fixed annual dividend (paid quarterly in cash). This was senior in preference and had features like guaranteed dividends and even a penalty rate if dividends were missed (accruing at +1% per quarter missed, up to 18%). Strategy sold 8.5 million shares of STRF in March 2025 at $85 each, raising roughly $711 million net. This class is analogous to a high-coupon bond appealing to yield-focused investors wanting maximum income and priority (low volatility, “bond-like” stability).

- STRC (“Stretch”) – 10.25% Variable-Rate Preferred: A perpetual preferred with a floating dividend rate, initially 9.0% annually, adjustable monthly at management’s discretion within limits (tied partly to SOFR). It paid dividends monthly and was structured to trade near $100 par by adjusting the rate. In July 2025, Strategy issued ~28 million shares of STRC at $90 each, raising a huge $2.47 billion net. STRC gave the company flexibility to lower the rate if market conditions allowed, and investors got a slightly lower starting yield but with some rate reset mechanism. This series was intended to maintain stable pricing and act like a long-duration variable-rate bond again non-convertible and cumulative.

- STRK – 8% Convertible Preferred: A perpetual preferred with a fixed ~8% dividend that is convertible into common stock. This class offers investors a lower coupon but the potential to convert into Strategy’s common shares (thus capturing Bitcoin upside if the stock price rises above the conversion price). It’s cumulative and carries guaranteed dividends until conversion. STRK caters to investors who are willing to accept less current yield in exchange for equity upside participation essentially a hybrid of fixed-income and equity. (Strategy’s filings indicated a Series B convertible pref around 8% with such terms).

- STRD – 10% High-Yield Subordinated Preferred: A perpetual preferred with a high 10% coupon but non-cumulative and non-guaranteed. This is akin to a “junk bond”-like tranche the highest yield but also higher risk (if the company skips dividends here, investors have no recourse to claim missed payments). It’s likely junior-most in preference, meant for yield chasers who are effectively taking on more risk for a 10% return.

These multiple classes allowed Strategy to tap different pockets of capital from conservative fixed-income funds (who bought STRF for steady 10%), to more opportunistic investors (who took STRK for upside), to those okay with risk (STRD). The key lesson is that by slicing the risk/return, Strategy dramatically expanded the investor audience for its financing. The result: it raised over $3.2 billion in 2025 through these perpetual preferreds, an astonishing sum that fueled its Bitcoin holdings to hundreds of thousands of BTC. (Saylor’s Strategy is reported to hold well over 600,000 BTC after these moves, although that figure likely includes leveraged affiliates; either way, it’s by far the largest corporate BTC stash).

Critically, Saylor described the launch of STRC (the variable preferred) as Strategy’s “iPhone moment” , a watershed innovation that unlocked massive capital from traditional markets into Bitcoin. The analogy underscores how transformative this financing was: much like the iPhone revolutionized mobile computing, the successful issuance of a Bitcoin-backed preferred at scale proved that Bitcoin can directly interface with mainstream capital markets. It validated the concept that yield-hungry investors would bankroll a Bitcoin accumulation strategy, if packaged in the right security. This stamp of market approval is precisely what Metaplanet is leveraging.

Adaptation to Japan: Metaplanet’s preferred program is essentially a localized adaptation of Strategy’s strategy. The Japanese firm has studied Saylor’s approach and is adopting similar structures (a senior fixed class and a convertible class to start, analogous to STRF and STRK). The expected dividend rates in Japan are a bit lower up to ~6% in JPY, reflecting Japan’s lower interest baseline (vs. 8–10% in USD that Strategy had to pay). But the concept is the same: multiple tranches, perpetual duration, Bitcoin-collateralized, no dilution to common. Metaplanet’s management openly credits “Strategy’s breakthrough innovations in perpetual preferred share structures” for establishing the blueprint they are following. The lessons learned include how to communicate these complex structures to investors, how to structure terms (e.g. ensuring a cleanup redemption clause if issuance falls below 25% of original Strategy did that to maintain liquidity), and how to balance the coupon to make it attractive yet sustainable.

Market Impact and Regional Replication: The success of Strategy’s pref issuance has not only inspired Metaplanet but could spur regional replications across Asia. Metaplanet is the first in Japan, but if it proves viable, other Bitcoin-heavy companies or even traditional firms could consider similar perpetual prefs to fund Bitcoin or other investments. We may see a wave of “Bitcoin yield” instruments across Asian markets for example, firms in South Korea or Singapore might attempt Bitcoin-backed bonds or prefs, or financial institutions might structure funds around this concept. Metaplanet’s Japanese adaptation is particularly significant because Japan’s markets are large and conservative; success here would signal that even the most traditional investors (e.g. Japanese life insurers or trust banks) are willing to participate in crypto-linked financing given the right structure. That could encourage companies region-wide. In fact, the number of public companies holding BTC is rising fast (162 and counting, from 112 a few months prior), and these firms will look for efficient ways to raise capital for more BTC or to monetize their holdings. Perpetual preferreds might become a standard arrow in the corporate treasury quiver.

It’s worth noting that Metaplanet itself frames this move as “standing on the shoulders of giants”, explicitly acknowledging Strategy’s role in pioneering the Bitcoin treasury model and preferred financings. By localizing that model, Metaplanet could trigger an Asia-wide evolution in Bitcoin corporate finance much like how U.S. junk bond innovations in the ‘80s eventually spread globally. If Metaplanet Prefs succeed, expect other Bitcoin-rich Asian companies (or new “Bitcoin SPVs”) to issue similar instruments, potentially leading to a vibrant regional market for crypto-collateralized credit. Metaplanet’s approach might also influence regulatory attitudes success would demonstrate that robust investor protections (collateral caps, transparent metrics) make such instruments acceptable and even welcome in mainstream exchanges.

Risks & Considerations

While the Metaplanet Prefs promise many benefits, they also introduce new risks that investors and the company must carefully consider. The interplay of Bitcoin volatility and fixed-income obligations creates unique challenges that need to be managed.

Bitcoin Price Volatility & Collateral Risk: The elephant in the room is Bitcoin’s notorious price volatility. A sharp or prolonged decline in BTC price could erode the asset coverage of the preferred shares. Metaplanet’s 25% NAV cap is designed to withstand large drawdowns (up to 75% price crashes) while keeping prefs fully covered. However, if BTC fell more than 75% (which has happened in past bear markets), the coverage ratio could slip, potentially spooking investors or credit rating agencies. In extreme scenarios, a crash of Bitcoin’s value would not only balloon Metaplanet’s leverage ratio but also jeopardize its ability to raise new capital (just when it might need it most). Preferred holders might see the market price of their shares drop if confidence in collateral falters, even if no default occurs (preferreds can trade at a discount if investors fear dividends might be halted). This risk is somewhat mitigated by the fact that Metaplanet holds the BTC itself (no rehypothecation etc.), and any price decline doesn’t force a liquidation (unlike a margin loan scenario). The prefs don’t accelerate or default they’re perpetual so time is on Metaplanet’s side to wait out a recovery. Still, sustained low BTC prices would make it hard to issue more prefs or even to maintain dividends if the company’s BTC income (from option premiums) dries up in a bear market (low volatility could mean lower option premiums). Investors must accept that their credit exposure ultimately hinges on Bitcoin’s long-term value; this is an investment with crypto-linked credit risk. That said, the initial low leverage provides a significant buffer, and Metaplanet can also reduce dividend payouts on a new variable-rate series if needed (taking a page from Strategy’s STRC which allowed rate cuts to keep price at par).

Dividend Coverage & Sustainability: The ability to pay preferred dividends consistently is paramount. Metaplanet has been generating robust cash flows from its Bitcoin Income Generation segment (¥1.13 B in Q2 from selling BTC put options). Full-year 2025 operating profit is forecast at ¥2.5 B. However, if the full ¥555 B capacity of prefs were issued at ~6%, annual dividends would be ~¥33 B far above current earnings. In practice, Metaplanet is unlikely to utilize the entire shelf at once; the issuance will probably be gradual and sized such that initial dividend obligations are covered by a combination of operating income and a portion of new BTC yield. The company explicitly notes that given its revenue model, the impact of dividend payments is expected to be minimal presumably because they will manage issuance volume relative to income. Still, there’s a risk that BTC income could fluctuate. The option premium strategy has been lucrative in a rising or range-bound BTC market, but it entails risk a sudden BTC plunge could force Metaplanet to buy BTC at strike (which they don’t mind as a strategy, but it uses cash), or low volatility could shrink premiums. If those cash flows fall short, Metaplanet might have to dip into BTC holdings or raise funds to pay pref dividends. Non-cumulative preferreds (if any) could simply skip dividends in hardship (which would hurt market price but avoid obligation), whereas cumulative prefs would accrue a growing liability if not paid, potentially restricting common dividends and new financing. To mitigate this, Metaplanet might keep some cash reserve or limit pref issuance until income ramps up. It’s worth noting that post-quarter BTC price gains can bolster the balance sheet e.g., as of Aug 2025, Metaplanet had an unrealized gain of ¥31.3 B from BTC price appreciation after Q2, indirectly strengthening its ability to cover obligations. Ultimately, the sustainability of dividends will rely on Bitcoin’s performance and Metaplanet’s treasury operations (like option writing or any BTC lending they do). Investors will need to monitor a new set of metrics: coverage ratio (BTC NAV ÷ Pref liquidation pref), BTC income vs dividend, etc. Metaplanet is likely to provide transparent reporting on these (similar to how it introduced BTC Yield and mNAV metrics) to assure investors.

Regulatory and Execution Risks: Launching the first Bitcoin-backed preferred in Japan requires navigating uncharted regulatory terrain. Metaplanet has to secure shareholder approval (hence the EGM to amend the Articles and authorize 555 M preferred shares) and then work with the Japan FSA, stock exchange, and underwriters to structure the offering. There is a risk that regulators impose constraints for instance, they might require enhanced risk disclosures, limit marketing to institutional investors, or even question the classification of the instrument (debt vs equity treatment). Metaplanet has cautioned that further discussions with exchanges, authorities, and investors are needed and that the terms may be adjusted or the issuance might not occur at all depending on feedback. In Japan’s relatively conservative financial system, a Bitcoin-collateralized security will be viewed with caution. The success of Strategy’s issuance (done under U.S. SEC regulations) provides a precedent, but Japan may have its own stipulations. For example, Japanese banks or insurers might have regulatory caps on investing in such instruments unless ratings are high. Metaplanet will likely seek a credit rating for the prefs; if Bitcoin’s volatility leads rating agencies to assign a sub-investment grade, some potential buyers (like pension funds) could be restricted. Execution risk also extends to market reception: this is a novel product, so investor education is crucial. Metaplanet’s investor relations will need to clearly articulate the risk/reward, perhaps by sharing how Strategy’s prefs trade (for reference, Strategy’s 10% STRF has traded around par after issuance, indicating market acceptance). Any misstep in messaging could affect demand. Additionally, liquidity of the preferred after issuance is a consideration if few market-makers support it, investors may demand a liquidity premium (higher yield). The timeline risk is also present: the shelf registration is for 2 years; if market conditions deteriorate (e.g., a Bitcoin bear or yen interest rate spike) during that period, Metaplanet might not issue the full amount.

Interest Rate and FX Risk: While Bitcoin drives the asset side, the liability (pref dividend) is effectively a yen interest rate from Metaplanet’s perspective. If inflation or other forces push up JPY interest rates, future series of prefs might require higher coupons to attract buyers, or the market price of existing prefs could fall to yield-align with new rates. Japan is infamous for long-term low rates, but the environment is shifting (the BOJ has inched up yield curve control limits). A rise in Japan’s risk-free rates would make a 5% yield less enticing, possibly forcing Metaplanet to offer more or find a different investor set. However, rising rates usually coincide with inflation or currency issues, in which case Bitcoin’s price might also rise (as a hedge), boosting Metaplanet’s NAV so there could be an offset. On FX, Metaplanet earns in JPY (from option premiums on BTC, presumably settled in yen) and its dividends are in JPY, so FX mismatch isn’t a direct issue. But indirectly, Bitcoin’s price in JPY = BTC in USD × USD/JPY rate. Yen depreciation could increase BTC’s yen price and thus NAV (helpful for collateral) but wouldn’t affect the USD value of BTC. Since expenses (dividends) are in JPY, a weak yen actually makes BTC sales (if needed to pay dividends) more fruitful in yen terms. Conversely, yen strengthening could compress BTC’s yen value. This dynamic is worth noting: part of the pref investor’s bet is on yen vs. Bitcoin but given Bitcoin is a global asset, this is more of a byproduct risk than a central one.

Common Equity Considerations: Common shareholders face dilution risk from Class B conversions (if Class B pref converts to common, it will increase share count). However, this is likely a trade-off they accept because conversion would only occur if the stock is doing well (the upside scenario). Also, conversions would likely happen at a price above current market (otherwise pref holders wouldn’t convert), meaning the equity capital comes in at a higher NAV often not harmful to existing holders. Still, it caps some upside for common (sharing it with Class B investors). Another subtle risk: the presence of a large preferred layer could make the common stock more volatile. In distress, all losses funnel to common (pref is senior), so common becomes akin to a leveraged residual claim. Equity investors will have to get comfortable with a more complex capital stack and monitor metrics like mNAV and coverage. If for some reason Metaplanet stretched the 25% cap (say Bitcoin falls and they don’t reduce pref accordingly), the market might penalize the common severely. Yet, given management’s large personal stakes and their emphasis on being conservative, this seems unlikely.

Summing up Risks: In aggregate, the core risk is that Metaplanet is adding fixed financial obligations on top of a volatile asset base. This is a form of financial leverage, and leverage cuts both ways. The company is confident this is a winning formula (and so far, Strategy’s success supports that), but it demands disciplined risk management. Metaplanet must actively manage its BTC income and capital raises to ensure pref dividends are always covered comfortably. It must also maintain market confidence in the collateral by upholding the ≤25% NAV promise (any hint of going beyond would undermine credibility). There’s also a governance aspect: will Metaplanet’s management use the funds judiciously? Thus far they have (every yen raised went into BTC, as promised), and the pref prospectus will likely commit to using proceeds for Bitcoin purchases. Any deviation (like using funds for risky ventures or non-BTC acquisitions) could raise risk. Lastly, liquidity risk for investors: if one wants to exit the pref, will there be buyers? Likely yes if yield is attractive, but in a market panic, even preferreds can become illiquid.

Ultimately, these risks are manageable with prudent policies, and Metaplanet has signaled strong risk management intent (transparent metrics, conservative caps, etc.). It’s creating a novel symbiosis of volatile crypto assets with stable funding structures ensuring that the “Bitcoin engine” has a robust chassis around it.

Conclusion

Metaplanet’s proposed perpetual preferred stock program represents a financial engineering breakthrough in Japan’s capital markets. It is a bold synthesis of traditional finance and cutting-edge crypto treasury strategy potentially a transformative moment for how companies finance Bitcoin accumulation. By launching Metaplanet Prefs, the company is not only furthering its own strategic goal (to secure an “unassailable” 1% of the world’s BTC supply by 2027), but also pioneering a new asset class that could reverberate across the industry.

This initiative can be seen as Japan’s “iPhone moment” for Bitcoin finance a reference to Michael Saylor’s characterization of Strategy’s successful $2.5 billion pref issuance. Just as the iPhone’s debut catalyzed a new era in technology, Metaplanet Prefs could catalyze a new era in corporate finance: one where Bitcoin-backed credit instruments become mainstream. If successful, Metaplanet will have proven that even Japan’s conservative investors and regulators are ready to embrace innovative vehicles marrying the stability of fixed income with the dynamism of digital assets.

For Japanese institutional investors, Metaplanet Prefs offer a timely solution to a structural problem the lack of yield. They provide a high-yield, yen-denominated security with robust collateral in an economy starved for exactly that. We may soon see yield-starved regional banks, insurance companies, and asset managers allocating to Metaplanet Prefs as a portfolio enhancer, effectively creating Japan’s first Bitcoin-yield investor base. This could gradually normalize Bitcoin as an underlying asset for credit products, paving the way for others to issue similar instruments (e.g., other Japanese corporates could issue BTC-backed debt/preferred, or financial intermediaries could structure products around Metaplanet’s securities).

For global investors (particularly those bullish on Bitcoin), Metaplanet’s common equity becomes even more intriguing. It offers a leveraged play on BTC via a publicly traded Japanese company in a way that’s arguably safer than outright leverage because the leverage is locked in a perpetual junior layer (the prefs) without threatening solvency. If Metaplanet Prefs take off, the company can accelerate its BTC accumulation dramatically, meaning its common shareholders get increasing “Bitcoin per share” exposure over time. The upside torque could be significant, effectively making Metaplanet’s equity a proxy for a leveraged Bitcoin holding company with strong risk management. Global investors looking at Strategy’s success (whose stock also benefited from its innovative financing and now enormous BTC holdings) will likely evaluate Metaplanet on a similar basis comparing “BTC per share” and strategies to maximize it. In a sense, Metaplanet could become Asia’s Strategy, and its stock a vehicle for those seeking high-beta Bitcoin exposure through an equity.

Strategically, Metaplanet Prefs solidify the company’s position at the vanguard of Bitcoin corporate adoption. Management has articulated a mission to “digitally transform Japan’s capital markets” and use the fixed-income market as “rocket fuel” for Bitcoin accumulation. By executing on this plan, Metaplanet is not just advancing its own interests but also validating a new theory of corporate finance one where “absolutely scarce digital capital” (Bitcoin) underpins a homogenous credit that transcends borders. The frameworks developed (BTC yield, mNAV, etc.) and the success of these instruments could serve as a universal language for Bitcoin Treasury Companies globally. We could envision a future where companies from New York to Tokyo all issue Bitcoin-collateralized preferreds, speaking in terms of BTC coverage ratios and yield spreads over Bitcoin’s “risk-free” rate (if such a notion emerges). Metaplanet is helping pave that road.

In conclusion, the launch of Metaplanet Prefs is a landmark in bridging traditional finance with the Bitcoin standard. It demonstrates creative capital structure engineering aimed at unlocking the immense capital in low-yield markets and redirecting it into the Bitcoin ecosystem. While challenges and risks exist, Metaplanet’s careful planning capping leverage, ensuring transparency, and learning from Strategy puts it in a strong position to succeed. Should it do so, it will not only accelerate Metaplanet’s own Bitcoin accumulation and shareholder returns, but also establish a model that others are sure to follow. The first BTC-backed perpetual preferred in Japan could indeed be the “hyperbitcoinization” moment for Japanese finance, converting conservative capital into Bitcoin-fueled growth. As Strategy proved in the U.S., such structures can be a win-win for issuers and investors. Now Metaplanet is set to prove it in Japan, potentially igniting a paradigm shift across Asia’s financial markets one where Bitcoin finds a home in yield portfolios, and visionary firms like Metaplanet lead the way in architecting that future.