Metaplanet FY2025: From Small-Cap Operator to ¥500 Billion Bitcoin Financial Vehicle

In 2025, Metaplanet Inc. (TSE: 3350) executed one of the most dramatic balance sheet transformations ever seen in Japanese public markets.

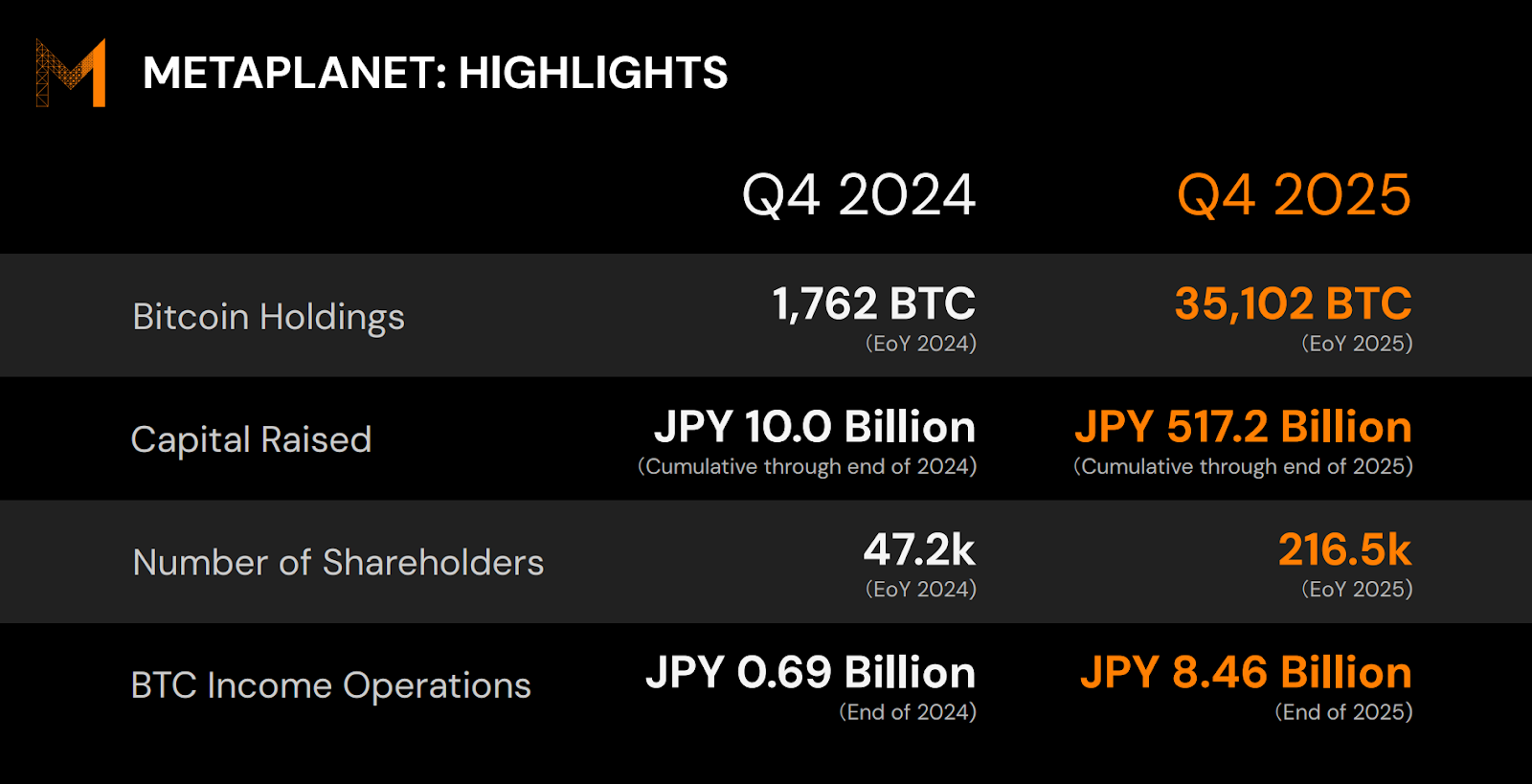

In twelve months, total assets expanded from ¥30.3 billion to ¥505.3 billion a 16-fold increase. Net assets surged to ¥458.6 billion. Bitcoin holdings rose from 1,762 BTC to 35,102 BTC.

This was not incremental growth. It was structural reinvention.

Metaplanet has effectively repositioned itself as Japan’s first true Bitcoin Treasury Company a publicly listed vehicle designed to accumulate Bitcoin per share through capital markets engineering.

The Scale of the Transformation

As of December 31, 2025:

- Total Assets: ¥505.3 billion

- Net Assets: ¥458.6 billion

- Equity Ratio: 90.7%

- Bitcoin Holdings: 35,102 BTC

- Bitcoin NAV: ¥481.5 billion

The company now ranks as the fourth-largest public holder of Bitcoin globally.

For perspective, most Japanese small-cap firms operate with equity ratios between 30% and 50%. Metaplanet is running a 90% equity structure while holding one of the most volatile financial assets in existence.

The expansion was funded almost entirely through capital markets activity. In FY2025:

- Financing inflows: ¥544.2 billion

- Bitcoin acquisition spend: ¥541.6 billion

Capital raised was almost entirely converted into Bitcoin.

Revenue Growth With 70% Margins

Despite the balance sheet focus, operating performance accelerated sharply.

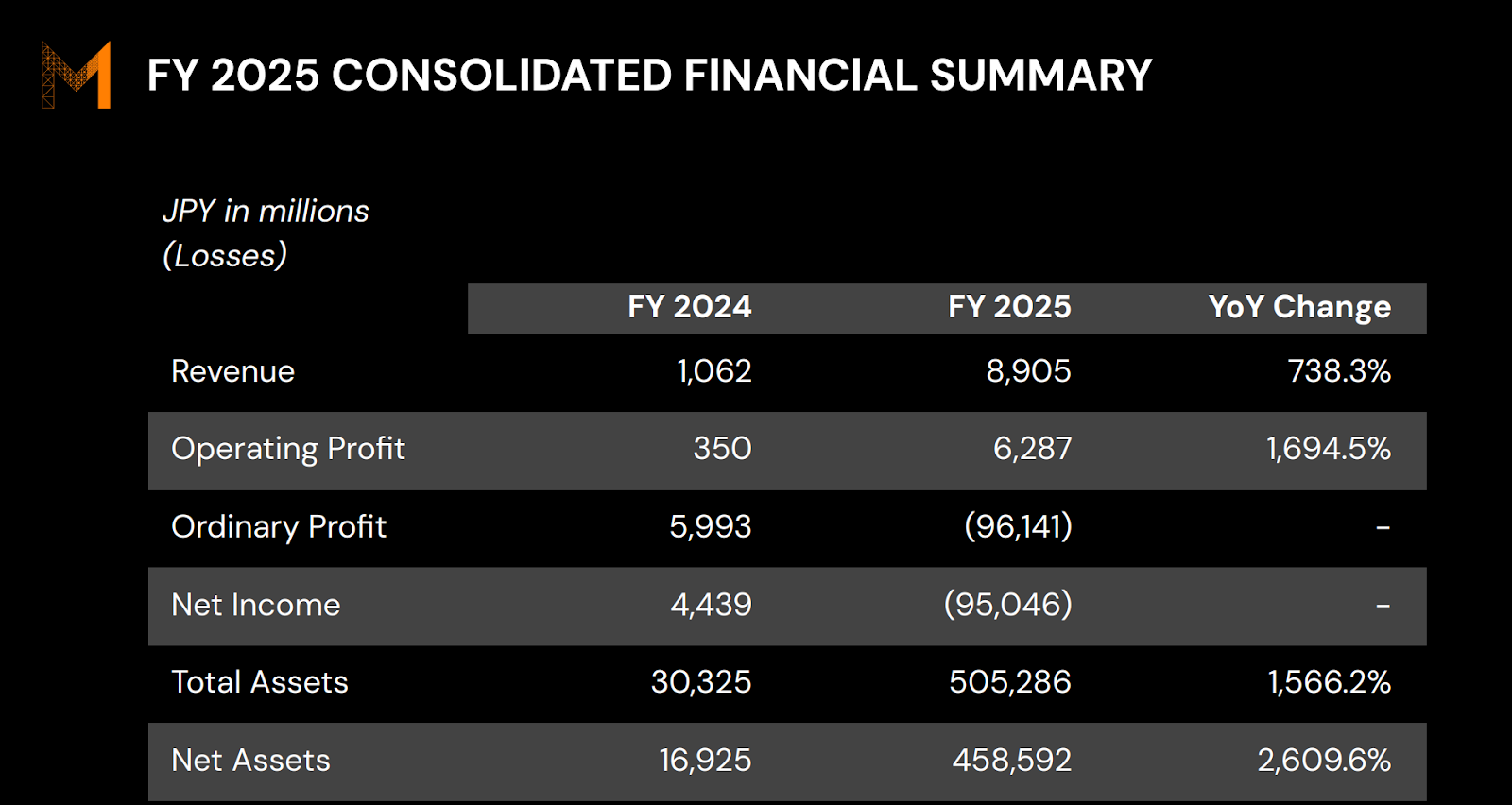

FY2025 results:

- Revenue: ¥8.9 billion (+738% YoY)

- Operating Profit: ¥6.3 billion (+1,694% YoY)

- Operating Margin: 70.6%

Roughly 95% of revenue came from Bitcoin-related income operations, primarily options-based premium generation using BTC collateral.

This distinguishes Metaplanet from passive treasury models. It is not merely accumulating Bitcoin; it is monetizing volatility on top of its holdings.

Operating cash flow was positive at ¥6.6 billion, underscoring that the core business remains cash generative.

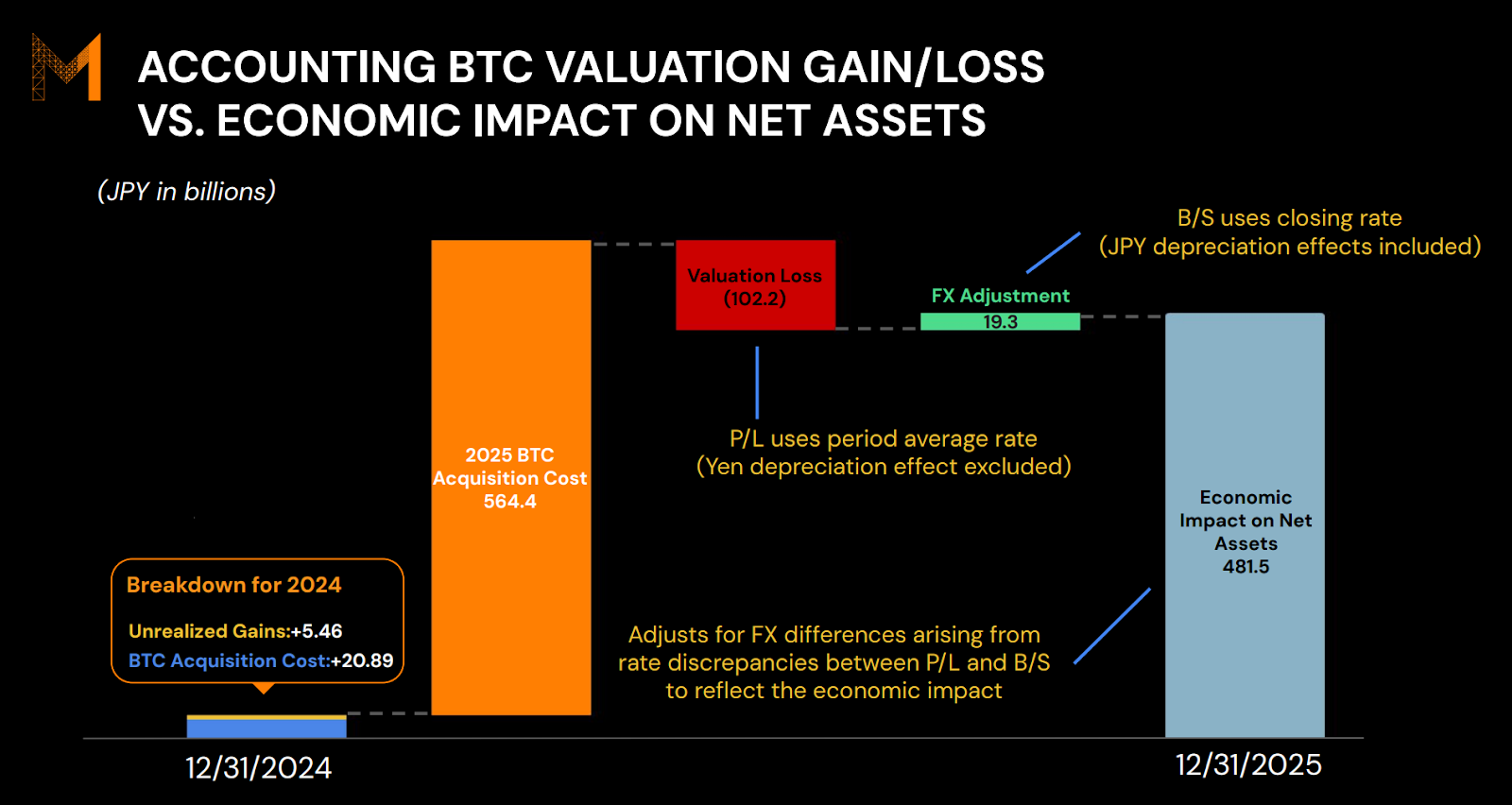

The ¥95 Billion Loss That Wasn’t

Headline numbers show a net loss of ¥95.0 billion for FY2025.

The driver was almost entirely non-operating:

- Bitcoin valuation loss: ¥102.2 billion

Under Japanese GAAP, Bitcoin is marked to market through profit and loss. When prices softened in Q4, accounting losses followed.

Economically, however, the picture is different.

Foreign currency translation gains of ¥19.3 billion partially offset the decline, leaving the effective NAV reduction closer to ¥82 billion.

There was no liquidity crisis. No forced selling. No operating breakdown.

This was accounting volatility, not operational deterioration.

Dilution But Accretive Dilution

The most controversial element of FY2025 was share issuance.

Common shares outstanding increased from 362.7 million to 1.14 billion. Fully diluted shares reached 1.46 billion.

On a traditional EPS basis, this appears destructive.

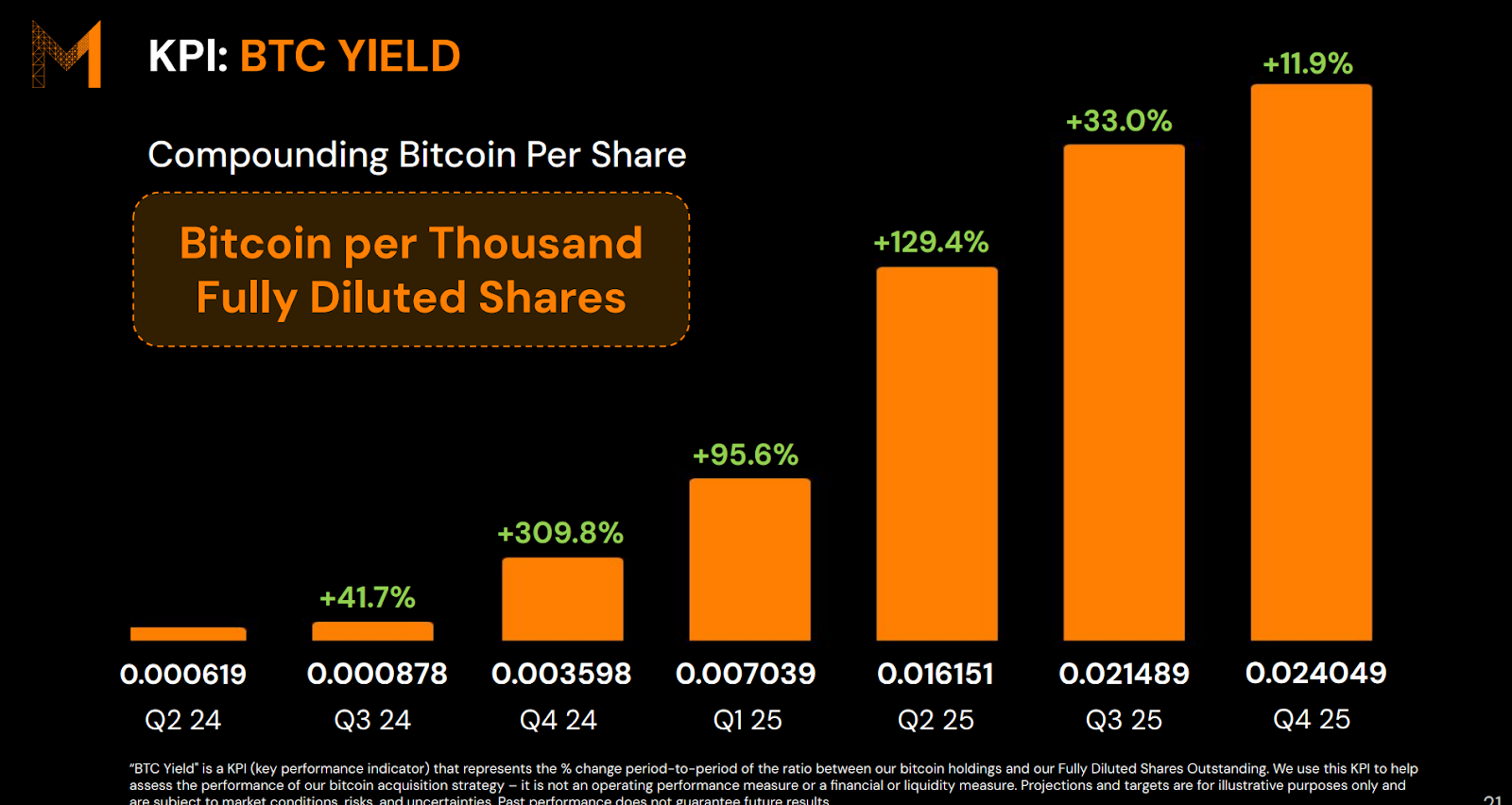

But Bitcoin Treasury Companies are not evaluated on EPS.

They are evaluated on Bitcoin per share.

At the end of 2024, Bitcoin per 1,000 fully diluted shares stood at 0.0036 BTC.

By the end of 2025, that figure had risen to 0.0240 BTC a 6.7x increase.

BTC Yield (the annual growth rate of Bitcoin per share) reached 568%.

Dilution occurred. But Bitcoin ownership per share expanded dramatically.

In treasury strategy terms, that is successful capital allocation.

Risk and Leverage

Total liabilities at year-end were ¥46.7 billion modest relative to a ¥481.5 billion Bitcoin NAV.

The company also secured a USD 500 million Bitcoin-collateralized credit facility and issued preferred shares to diversify funding.

Even under stress testing scenarios assuming an 86% Bitcoin price decline, management indicates liabilities and preferred capital remain covered.

This is not a maximal leverage strategy. It is measured expansion.

The primary risks lie elsewhere:

- Sustained Bitcoin price drawdowns

- Volatility compression impacting options income

- Capital market access tightening

The model is sensitive to market conditions but currently conservatively capitalized.

FY2026: Scaling the Engine

Management forecasts:

- Revenue: ¥16.0 billion (+79.7%)

- Operating Profit: ¥11.4 billion (+81.3%)

The thesis is straightforward: a larger Bitcoin base enables larger collateral pools, which enable larger premium income generation.

Execution will depend on maintaining volatility harvesting discipline while expanding treasury holdings.

A New Type of Japanese Equity

Metaplanet no longer resembles a traditional Japanese operating company.

It now operates as:

- A ¥500+ billion Bitcoin-backed balance sheet

- A capital markets-driven accumulation vehicle

- A volatility monetization platform

- A public equity proxy for Bitcoin exposure

This is not a cyclical stock. It is not a value stock. It is not a growth stock in the conventional sense.

It is a Bitcoin-denominated capital structure experiment unfolding in real time on the Tokyo Stock Exchange.

The central investment question is not whether GAAP earnings are volatile.

It is whether Bitcoin per share continues to compound faster than dilution.

If it does, Metaplanet may become the defining Digital Credit equity in Asia.

If it does not, accounting volatility will dominate narrative and valuation.

For now, the numbers suggest the engine is working.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.