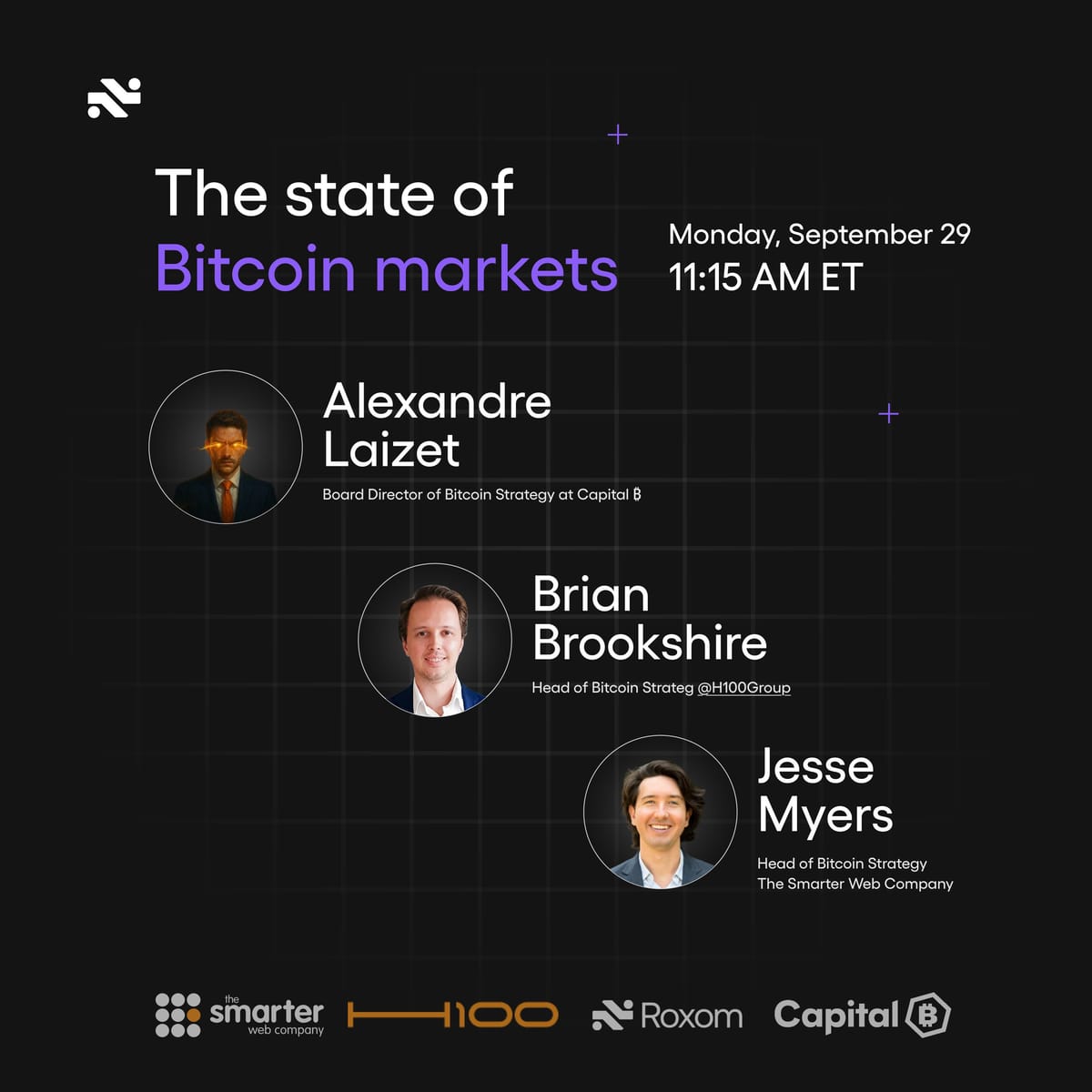

How does the future of BTCTC look like - With Brian Brookshire from H100

A UK Tech Business, a Bitcoin Treasury Vision, and the Next Phase of Institutional Legitimacy The approval and publication of the prospectus for The Smarter Web Company PLC marks a defining moment in the firm’s corporate journey. What began as a UK-born web design and digital marketing business is

A balance-sheet case study in Bitcoin-native capital structuring When Strive, Inc. released two back-to-back announcements on January 21 and January 22, 2026, many investors were left asking a simple question: Did Strive raise $150 million or $118 million? The correct answer critically is $118 million in cash, with the remainder

The shareholder approval of Strive, Inc.’s acquisition of Semler Scientific marks a watershed moment in the evolution of Bitcoin-native corporate finance. With this transaction, Strive, Inc. is not merely growing its balance sheet it is institutionalizing a new playbook for how Bitcoin treasury companies can scale, deleverage, and amplify

Introduction: Why the World Still Lacks “Good Money” For over a decade, Bitcoin has proven itself as digital capital, a scarce, global, censorship-resistant store of value. It has absorbed volatility, rewarded long-term holders, and increasingly sits on corporate and institutional balance sheets. Yet despite Bitcoin’s success, one core problem