H100 Group AB – Pioneering Sweden’s Bitcoin Treasury Strategy- Part 2

Valuation & mNAV Analytics

At its core, valuing H100 Group comes down to valuing its Bitcoin holdings – and then assessing the premium/discount the market assigns relative to those holdings (the market-to-NAV multiple, mNAV). Traditional metrics like P/E are not meaningful yet (H100 has negative earnings due to startup costs). Instead, we focus on BTC NAV and related analytics:

Bitcoin NAV: We define NAV as the market value of H100’s Bitcoin holdings (plus any other liquid assets) minus debt. As of Sept 10, 2025:

- BTC holdings: 1,005 BTC.

- BTC price: ≈$28,000 (assuming a post-halve dip from $112k highs – hypothetical for illustration).

- Gross BTC value: ~$28k * 1,005 = $28.14 M (≈SEK 310 M at 11 SEK/USD).

- Cash: H100 likely had minimal cash (having deployed most); assume SEK 20 M remaining.

- Debt: ~SEK 342 M convertible (Tranche 7) – but since it’s convertible, one might treat it as equity in NAV calc. We include it in diluted share count rather than as debt for NAV.

- Thus, BTC NAV ≈ SEK 330 M (if BTC at $28k; it was much higher at $110k – in that scenario NAV was ~SEK 1.2 B).

Market Cap: at SEK 5.12/share * ~330 M shares = ~SEK 1.69 B. If BTC were 28k, that’s ~5.1× NAV (if BTC were still $110k, mcap ~1.69 B vs NAV ~1.23 B = ~1.4×).

This highlights that mNAV is fluid, driven by both BTC price and stock price. Investors effectively arbitrage between the two:

- If mNAV >> 1, the market is valuing H100’s growth potential (or perhaps overvaluing). H100 can capitalize by issuing shares (as it did at 3–5× mNAV in mid-2025).

- If mNAV ~1, the market is saying H100 = value of its BTC (no premium for strategy). If <1, market is skeptical (discount, as often seen in closed-end funds).

Historical mNAV: Exhibit 3 (above) charts mNAV at key points in 2025:

- July 2025: mNAV ~3.1× after initial buys (market cap ~SEK 918 M vs BTC NAV ~300 M) – optimism high.

- Aug 2025: mNAV peaked ~4.8–5× (stock blow-off to SEK 16+, while BTC holdings still catching up) – exuberant phase.

- Sept 2025: mNAV fell to ~1.5× after dilution and a crypto pullback – more grounded.

We present a longer view of mNAV in Exhibit 4 (bands indicate hypothetical ranges). Historically, analogous companies trade in cycles: e.g., MicroStrategy ranged from 1.5× to 3× mNAV in 2021–22, hitting > 5× during peaks and < 1× in bear troughs. Smaller pure-plays often command higher mNAV when growing fast (investors pay for the BTC yield). But high mNAV is inherently unstable – it invites arbitrage (short stock vs long BTC) and prompts the company to issue shares (increasing NAV, thus tending to mean-revert the multiple).

Months to mNAV Cover: Adam Back introduced this metric to reconcile high premiums with growth. It’s calculated as: (mNAV – 1) * 12 / (monthly BTC-per-share growth rate), essentially asking: How many months of current BTC yield are needed to “earn” the premium?

For H100, let’s illustrate: At 3× mNAV and 100% quarterly BTC yield (roughly what it achieved in mid-2025), that’s ~4× premium, ~doubling per quarter → ~4–5 months to cover (similar to Metaplanet example Back gave). Indeed, investors were willing to pay 4–5× because H100 demonstrated it could increase BTC/share so rapidly that in <6 months, the underlying catch-up would justify the price.

If mNAV is now 1.5× and BTC yield slows to, say, 20% quarter (which is ~6% monthly), then Months-to-Cover = (1.5–1)*12/6% ≈ 12 months. That’s still reasonably short – indicating the premium could be earned in a year of current growth. This may justify some premium.

However, if BTC yield were to slip to, say, 5%/quarter (~1.6% monthly) and mNAV remained 1.5×, MTC would balloon (~30 months). Then the market might not justify paying 1.5× and mNAV would likely compress toward 1×.

Interpretation: A Months-to-Cover below ~18 months tends to be palatable; above that, premiums often shrink. For H100:

- During Q3, our estimate was ~5–6 months (hence 4–5× mNAV was arguably justified).

- Going forward, as growth rates normalize, we suspect the market will afford H100 a 1.5–3× mNAV if it maintains moderate yields (10–50% annually). In a bull BTC scenario, speculative premium could spike again.

Accretive vs Dilutive Funding Decision: A heuristic we use: If mNAV > 2×, equity issuance is likely accretive enough to pursue. If mNAV < ~1.2×, better to hold off or use convertibles. H100’s actions align with this: big equity at ~3×+, none at ~1×. The presence of the convertible at SEK 8.48 gives a hint – H100 locked in future equity at effectively ~1.7× current NAV (assuming BTC ~SEK 1 M, that strike equates to a modest premium on fully diluted basis). If the stock is below that, they’d rather not issue.

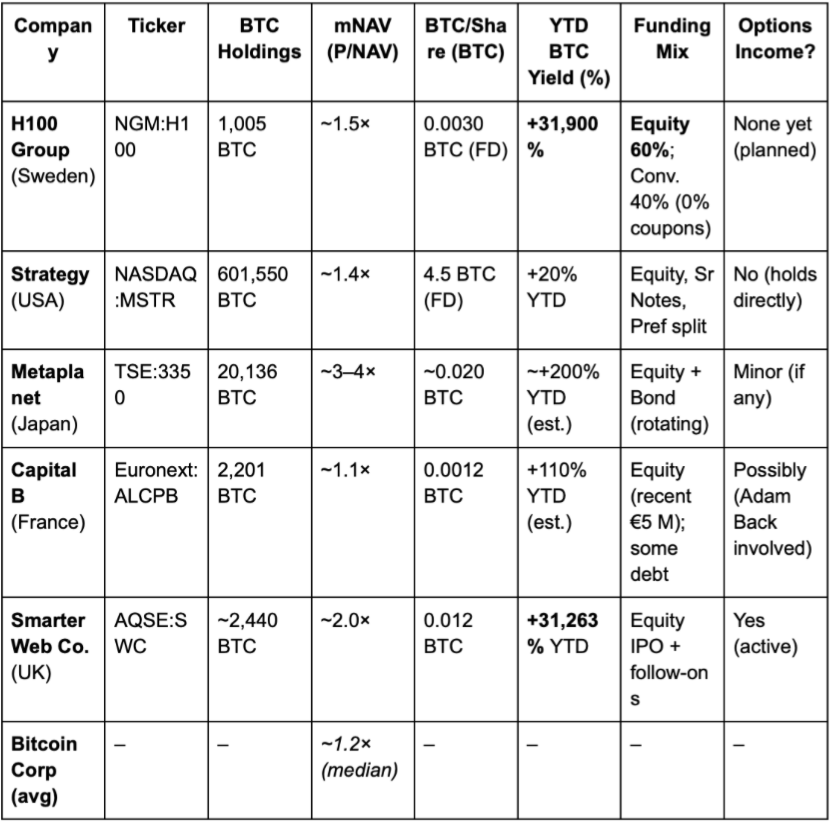

Peer Comparison – Valuation Multiples:

In this peer set, H100 stands out for its extremely high BTC yield (reflecting starting from near-zero) and heavy reliance on equity. Its current valuation (mNAV ~1.5×) is actually on the lower end among “active” BTC accumulators – likely due to the recent dilution and perhaps market caution until more track record is built. We see room for multiple expansion if H100 proves it can continue growing BTC/share in a steadier state (e.g. 50–100% p.a. yields). For example, SWC trades ~2× NAV even after huge dilution, because it articulated a 10-year plan and is generating cash via operations and options, giving investors confidence to pay a premium.

Premium/Discount Bands: Over the next 12 months, we expect H100’s mNAV to trade generally in the 1.2× – 3× range. Upside to >3× would likely require a major Bitcoin bull leg (where speculators bid up H100 in anticipation of further equity raises and BTC buys – essentially front-running its BTC growth). Downside to <1× could occur in a deep crypto bear or if H100 hits an execution snag (e.g., unable to raise when needed, or a sudden regulatory barrier).

Investors can monitor this via a simple metric: Market Cap vs BTC Value (updated daily on sites like BitcoinTreasuries). If H100’s price deviates, arbitrage or mean reversion tends to follow. Indeed, one could argue a floor for H100’s stock is the NAV of its BTC (minus a haircut for any distress) – as long as BTC remains liquid, that provides asset backing. Conversely, the ceiling in normal times might be ~3–4× until new info (like accelerated BTC accumulation) justifies more.

Heuristic – “Months to Cover” as Buy/Sell Signal: If H100’s months-to-cover mNAV falls <6 (meaning the premium would be earned in <6 months of current BTC yield), it likely indicates undervaluation (or high growth ahead) – a buy signal. If it rises >24, likely overvaluation – a caution to trim. At present (mNAV 1.5, quarterly yield ~44%), MTC ~4. So by that measure, the stock might be cheap if one believes H100 can keep even a fraction of that growth rate.

When to Pivot Funding Strategy: A crucial valuation consideration is accretive vs dilutive funding. As noted, at high premium, equity issuance is accretive (benefiting holders by boosting BTC/share). But if H100’s mNAV fell close to 1×, issuing equity would dilute BTC/share – at that point, the company should pivot to alternative funding (like issuing a convertible or even halting treasury growth temporarily). We suspect management’s threshold is ~1.2×. Below that, they might tap the remaining Back loan (150 M guarantee) rather than equity, or structure a new deal (perhaps a convertible with warrants to entice investors at a higher effective strike).

SOTP (Sum-of-the-Parts): It’s easy to overlook H100’s operating business amid the Bitcoin focus. While negligible now, it does have some value (tech IP, small revenues, perhaps worth a few million SEK on its own). If H100’s market cap ever fell to exactly its BTC NAV, investors would get the operating segment “for free”. Conversely, at high premiums, one might argue the market is pricing some success of the health business too (though more likely the premium is for BTC growth). For now, SOTP is essentially NAV + growth option premium.

Valuation Conclusion: We value H100 on a market-to-NAV basis. Our base case assumes BTC price ~$100k in 12 months, H100 holding ~1,800 BTC by then, and trading at ~2.5× mNAV (given continued 50%+ BTC/share growth). That yields a target market cap of SEK ~5.4 B (NAV ~2.16 B * 2.5). If our share count forecast is ~400 M by then (from further raises), that implies a share price target ~SEK 13.5. In a bull scenario (BTC $200k, 6× mNAV), upside could be multiples of that; in a bear scenario (BTC $50k, 1× mNAV), downside could be SEK ~2 (roughly value of BTC per share). This wide range reflects the high-risk, high-reward nature.

At present ~SEK 5, H100 trades at a reasonable ~1.4–1.5× mNAV, which we see as a fair entry assuming the company will execute further BTC accretion. The stock offers leveraged exposure to BTC’s price (beta >1) plus an alpha from increasing BTC holdings. As long as management maintains BTC yield positive, H100 should intrinsically outgrow Bitcoin’s own returns.

Scenario Analysis: BTC Price, mNAV, Funding Mix

To appreciate the range of outcomes, we analyze three scenario paths through FY2026, varying (A) Bitcoin price trend, (B) market premium (mNAV multiple), and (C) H100’s funding approach (equity-heavy vs hybrid). For each scenario, we project key metrics: BTC acquired, BTC/share, BTC yield, share count, and any added burdens (interest if debt, etc.).

1. Bear Case: “Crypto Winter Redux” – BTC drifts down to ~$50k by end-2026 (averaging $60k in 2025, $50k in 2026). Market confidence wanes; H100’s mNAV oscillates around 1.0–1.5× (no big premium). Funding mix: H100 curtails equity issuance (to avoid dilution) and leans on convertibles/loans to continue modest accumulation.

- BTC Acquired: ~+300 BTC total next 1.5 years (ending ~1,300 BTC by 2026). Lower price means each SEK raised buys more BTC, but raising capital is hard with low premium.

- BTC/Share: Little change or slight uptick. Shares might rise to ~350 M (some convertibles, minimal new equity). BTC/share 0.0037 by 2026 (+20% vs now). BTC yield: slows to low-teens % annually.

- Months to Cover: ~N/A (stock likely ~1× NAV). H100 becomes basically valued at BTC holdings; any issuance is at NAV so doesn’t improve per-share much.

- Dilution & Burdens: Minor dilution. Possibly one secured loan (e.g., borrow $5 M against BTC) to supplement – interest cost negligible relative to treasury size. Company stays solvent (no debt except convertibles which might not convert if stock stays low, meaning they’d roll or repay from operations or minor BTC sales).

- Investor Implication: Stock trades like a closed-end BTC fund at NAV. Upside comes only if BTC price recovers. H100 bides time, preserving BTC.

2. Base Case: “Steady Accumulation” – BTC in a moderate bull: reaches ~$100k in 2025, $120k in 2026. H100’s mNAV stabilizes ~2–3× (investors reward its growth with a premium). Funding mix: Balanced – periodic equity raises when premium >2×, plus opportunistic convertibles.

- BTC Acquired: +1,500 BTC by 2026 (to ~2,500 BTC total). With rising BTC price, each round raises more cash in SEK terms (and management times them well). They perhaps do one large equity raise in late 2025 at mNAV ~3×, and another in mid-2026.

- BTC/Share: Even with share count growing to ~500 M, BTC/share would rise substantially. We’d see ~0.005 BTC/share by end-2025, ~0.007 by end-2026 (roughly +130% from current). BTC yield: ~50% in 2025, ~40% in 2026 – strong compounding.

- Months to Cover: stays ~6–12 months – investors comfortable with premium.

- Share Count & Dilution: ~500 M basic (~50% dilution from today, but much of it accretive). Fully diluted maybe ~550–600 M if convertibles also exercised.

- Accretion Thresholds: H100 issues equity only when stock >2× NAV, otherwise uses remaining convertibles (maybe a Tranche 9 at an even higher strike) to keep momentum.

- Interest/Dividend: none – still 0% debt, maybe new convertibles if needed.

- Investor Implication: Steady share appreciation likely, tracking BTC price and BTC/share growth. At ~$120k BTC, NAV/share ~SEK 6; at 2.5× mNAV, stock ~SEK 15 – aligning with our earlier target.

3. Bull Case: “Hyper-Bitcoinization Rally” – BTC rockets to $200k+ by 2026 amid ETF approvals, macro demand. H100’s stock becomes a frenzy, trading at mNAV 5–6× or higher (as seen with some crypto plays in 2021). Funding mix: Maximal equity issuance – H100 sells shares aggressively into strength, and may consider preferred equity to raise huge sums fast.

- BTC Acquired: potentially +10,000 BTC (!) by 2026. How: If stock runs to say SEK 50 (on NAV maybe 10, so 5×), H100 could issue e.g. 300 M shares (~60% dilution) at those lofty levels raising ~SEK 15 B, and deploy a few billion SEK into BTC. This is similar to how MicroStrategy scaled up massively during crypto mania.

- BTC/Share: Though dilution is high, the accretion could be higher. If done right, BTC/share could double or triple. E.g., end-2026 maybe 10,000 BTC over 800 M shares = 0.0125 BTC/share, ~4× current. BTC yield: might hit >100% for 2025 and >50% 2026.

- Months to Cover: single-digit months – essentially the market is looking ahead and paying a premium even beyond immediate cover, speculation rules.

- Share Count & Dilution: Could approach 800 M or more (if including some pref shares, etc.). But no one minds if BTC is also through the roof.

- Funding choices: At such high valuations, all equity issuance is accretive. H100 likely sticks to common stock (fastest), maybe issues a small preferred if institutions want yield. It wouldn’t need debt; it’s flooded with investor cash chasing exposure.

- Interest/Dividends: Possibly if a preferred issued, a dividend but easily serviced from small % of treasury sold periodically.

- Investor Implication: The stock could overshoot fundamental NAV significantly. Expect volatility – e.g., it might trade 8× NAV at peak and then fall. In this scenario, H100 could firmly establish itself as a top global BTC holder, which might have strategic premium (buyout target or index inclusion etc.).

Across these scenarios, note a pattern: funding mix flexes with mNAV. In bull times, equity is king (cheapest cost of capital). In tough times, avoid dilutive equity, hunker down or use credit lines. This dynamic risk management is key to the “treasury flywheel”.

Additionally, watch interest burdens if any debt: in our base case none, bull case none; in bear, maybe minor. H100 smartly has 0 interest on converts, so its only “carry cost” of BTC is negligible (just storage fees perhaps).

Finally, “Months to Cover” sensitivity: If BTC yield slows, premium shrinks, self-correcting. If yield accelerates (like bull case with tactical moves), premium can widen but likely capped by issuance. We foresee H100 actively managing to keep itself funded while aiming not to dilute existing holders’ BTC/share.

In summary, H100’s future trajectory has a high beta to Bitcoin’s price (naturally), but also a critical alpha lever – its issuance strategy. In bull scenario, that alpha amplifies returns hugely; in bear, it could cushion by pausing issuance.

We believe the base case of steady BTC and moderate premium is most probable near-term, but the option value of H100 in a full bull cycle is tremendous (as is downside if BTC collapses – though even then, one still holds the BTC assets as a floor).

Financials & Segment Economics

While the Bitcoin treasury dominates the narrative, we must evaluate H100’s financial statements to identify any risks or support from the operating side:

Revenue and Segments: H100 currently reports one operating segment: Digital Health & AI Services. In 2024, revenue was a modest ~SEK 3 M. This likely comes from pilot projects, perhaps SAAS fees or consultancy to wellness providers. Cost of sales and R&D far exceeded this, resulting in heavy operating losses (EBIT margin –171%). For 2025, we anticipate slightly higher revenue (some growth from the Healthy to 100 platform roll-out) but still negligible relative to treasury gains. There is also a possibility of other income from Bitcoin activities (for instance, if they sold a small portion of BTC at profit or earned option premiums – though none known in 1H 2025).

Operating Expenses: As a tech startup, H100’s OpEx includes development costs, staff (engineers, presumably a small team in Sweden/Norway), and now some corporate overhead associated with being a Bitcoin holding company (e.g., custody fees, regulatory costs). In H1 2025, we estimate operating expenses around SEK 10–15 M (implied by the negative EBIT). Much of this is likely fixed cost investment in the platform. Importantly, once H100 pivoted to Bitcoin in Q2, we suspect some expenses may have been cut or refocused. The company may choose to run the health business relatively lean, using Bitcoin-backed credibility to form partnerships rather than heavy internal spend.

Non-Operating Items: Here’s where Bitcoin’s impact shows:

- Under IFRS/Swedish GAAP, Bitcoin is treated as an intangible asset (absent specific trading intent). That means no mark-to-market gains are recorded if BTC price rises; only impairments if it falls below cost. As of Q3 2025, H100’s average BTC cost basis is ~$110,500. If BTC’s market price drops below that on a quarter-end, H100 must book an impairment charge for the difference on all holdings (and cannot write it up later if price recovers, unless they sell).

- E.g., if BTC ended Q4 at $90k, H100 would take a hit of ~$20k * 1,005 = $20.1 M (~SEK 220 M) impairment on intangibles – a huge paper loss. Conversely, if BTC is above cost (as it was Q3, $111k vs $110.5k cost, giving that tiny +0.53% unrealized profit), they record nothing (they do not mark up).

- Unrealized P/L volatility: This accounting quirk means H100’s IFRS profit could swing wildly and not reflect operational reality. Q4 2025 might show a big loss even if H100 gained BTC per share (should BTC price at 12/31 be below Q3 levels). We caution investors to focus on comprehensive income that includes any fair value notes, or simply track the BTC metrics rather than GAAP net income.

- If H100 were to sell some BTC at a gain (not currently planned), that realized gain would hit P&L. To date, they haven’t sold any (and they frame themselves as long-term HODLers, so unlikely unless for strategic reasons).

Adjusted Earnings / Cash Flow: We will likely strip out intangible impairments to calculate an adjusted net income that reflects operational burn. That burn is perhaps SEK –20 M/year currently (covering salaries, etc.). H100’s capital raises have more than covered this. In fact, they might periodically convert a tiny portion of BTC to fiat to cover expenses if needed (though equity raise proceeds can also fund operating cash burn). As of now, treasury gains dwarf operating losses. For instance, in Q3, the increase in BTC value (~SEK 800 M) hugely outweighs any SEK 5 M operating loss. This is why traditional P&L analysis is less meaningful – one impairment could make it appear the company lost tens of millions, even as their BTC stack grew.

Cash Flow: We anticipate the cash flow statement to show:

- Operating CF: Negative ~SEK –10 M/year (till/if the health biz scales).

- Investing CF: Dominated by BTC purchases. These appear as cash outflows investing (purchasing intangible assets). E.g., ~SEK 800 M outflow in Q3 for BTC.

- Financing CF: Huge inflows from share issuances and convertibles: +SEK 921 M raised by Sept 2025. Minor outflows for issue costs. No dividends (none planned).

- Net change in cash: likely a small net balance (they try to invest quickly). At Q3 end, H100 probably had a small cash buffer (a few million SEK) – enough for working capital.

8-Quarter Projection (2025Q4–2027Q3): We model:

- Revenue: grows from ~SEK 5 M in 2025 to ~20 M by 2027 (if health platform gains some traction, possibly by onboarding clinics or licensing AI tech). Still trivial relative to BTC assets.

- OpEx: remains ~SEK 20–25 M/year, maybe increasing modestly with expansion (if they integrate any acquired companies – they did mention growth via acquisitions).

- Operating profit: negative ~SEK 15 M in 2025, narrowing to ~–10 M by 2027 (assuming some revenue ramp).

- Treasury effects: highly scenario-dependent. In base case (BTC ~120k end of 2026), no impairments in 2025 (since price rose), possibly an impairment in mid-2026 if price dips in between rallies. These could swing reported net profit by ±SEK 100 M easily.

- Net income: meaningless to forecast due to above. We instead focus on BTC/share and cash:

- BTC/share projected: 0.003 → 0.005 (2025) → 0.0065 (2026) in base case.

- Cash: always keep ~SEK 10–20 M buffer.

- Debt: remains 0 (converts either convert or are extended).

One interesting accounting note: if H100’s BTC income generation yields realized gains (premiums), those will show up as other income, potentially making H100’s operating results look better. For instance, if they made SEK 5 M from option premiums in a quarter, it might offset the –5 M OpEx, giving a near-zero operating profit (despite still being economically an accumulation).

Bridge from Accounting to Economic BTC Growth: It’s critical to reconcile H100’s reported earnings with the economic increase in BTC holdings:

- Q3 2025 example: Likely reported an IFRS loss due to negative operating profit and perhaps some impairment if BTC dipped end Sept (if it did). But economically, H100 added ~758 BTC. We therefore create an “economic profit” metric: increase in BTC value + operating result. In Q3, that would be +SEK 800 M (BTC added) minus ~SEK 5 M (ops loss) = +SEK 795 M. This reflects the true augmentation of shareholder wealth (ignoring the intangible accounting).

- Shareholders should focus on growth in BTC NAV per share, not EPS. Traditional EPS will be very volatile and not correlated with success of strategy.

In sum, financial modeling for H100 diverges from normal companies. We’re effectively modeling balance sheet growth (in BTC) more than income statement flows. We expect the company and analysts to adopt metrics like “BTC-adjusted EBITDA” or similar, which add back impairments and mark holdings to the market to give a clearer picture.

Risks in financials: The biggest risk is if operating expenses were to balloon (say H100 embarks on an expensive expansion or acquisition spree in health). That could drain cash or force selling BTC to fund it, hurting the thesis. So far, they have kept that side modest. Another risk: taxes (discussed next) realizing any BTC gains could incur tax, but they likely won’t sell BTC for a long time, deferring taxes.

To conclude, we treat H100’s Bitcoin Treasury as effectively the core of its “economic financials”. The health segment remains an early-stage venture that could, in the best case, become self-funding and even contribute to buying more BTC (e.g., future profits could be invested in BTC). In the worst case, if it fails, H100 might wind it down to focus purely on BTC (which would actually simplify the story akin to a closed-end fund, albeit losing some strategic narrative). For now, we ascribe minimal value to the operating business in our valuation, but also minimal drag (it’s a small cash burn relative to capital raised).

-> Read Part 3