H100 Group AB – Pioneering Sweden’s Bitcoin Treasury Strategy: Part 1

Executive Summary

Thesis: H100 Group AB is leveraging its dual identity as a health-tech operator and Bitcoin treasury to maximize BTC per share growth – effectively becoming Sweden’s “MicroStrategy-equivalent” with a Nordic twist. In just 104 days since pivoting to a Bitcoin reserve strategy, H100’s holdings surged above 1,000 BTC. Through timely equity issuances at premium valuations and strategic convertible financing, H100 has rapidly accreted Bitcoin per share while maintaining a lean, tech-oriented operating business. We believe H100’s “Bitcoin flywheel” – raising capital at market-to-NAV premiums and deploying into BTC – can continue to drive outsized BTC-per-share growth, justifying a speculative Buy despite inherent crypto and execution risks.

Key Takeaways:

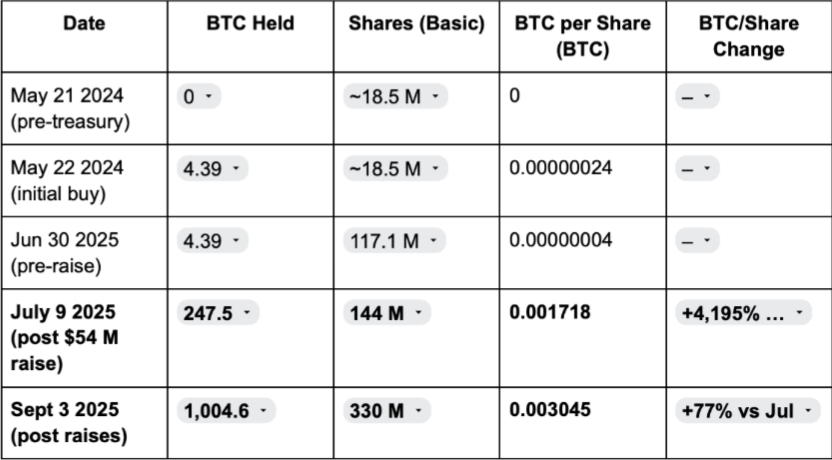

- Accelerating BTC Accumulation: H100 amassed 1,004.56 BTC in just over three months, becoming the first Swedish public company to adopt Bitcoin as primary treasury asset. Holdings jumped from 4.4 BTC in May to ~1,005 BTC by early September 2025 (see Exhibit 1). This equates to ~$108 million of BTC at cost, with a marginal profit <1% so far – implying substantial leverage to future Bitcoin price appreciation.

- BTC-Per-Share Accretion: Through carefully timed equity raises at high market-to-NAV (mNAV) multiples, H100 grew BTC per share by an estimated +44% QoQ in Q3 2025, far outpacing Bitcoin’s own performance. This BTC Yield (periodic % increase in BTC-per-share) is H100’s north-star metric, guiding capital markets strategy. CEO Sander Andersen explicitly prioritizes “increasing Bitcoin per share and creating lasting value” – signaling disciplined issuance only when accretive.

- Innovative Funding Strategy: H100 employs a multi-pronged financing program: directed equity issuances, 0% convertible loans, and cross-listings to tap new investor pools. In July 2025, it raised SEK 516 M ($54 M) via a share issue at SEK 6.38 and a convertible debenture at SEK 8.48. Additional placements in August (SEK 65 M) and September (SEK 10 M) were executed as stock traded at hefty premiums. Even after heavy dilution (shares up ~18× YoY to ~330 M), these raises were accretive – converting high-priced equity into more BTC per share for all holders.

- Why Now – Favorable Macro & Regulatory Opening: Bitcoin’s resurgence to ~$110K in 2025 and growing institutional acceptance create a ripe backdrop. Europe’s regulatory stance (MiCA) is clarifying crypto rules, and Sweden’s first-mover (H100) faces little domestic competition. H100 is positioning as a “Bitcoin pure-play” in Europe alongside peers like France’s Capital B (2,218 BTC) and the UK’s Smarter Web Company (SWC, 1,275 BTC by mid-2025). Its dual listing in Frankfurt (Ticker: GS9) and OTC US opens access to crypto-minded investors globally.

- Balanced with Operating Business: Unlike some “crypto holding” companies, H100 retains an operating core in health-tech (AI-driven longevity services). While the legacy business is nascent (2024 revenue ~SEK 3 M, EBIT margin –171%), it provides a strategic narrative and potential future cashflows. Importantly, it keeps H100 classified as an operating company (not an investment fund), broadening investor eligibility. Management frames Bitcoin as complementary to its mission: “Bitcoin is long-term health for your wealth, just as preventive health is wealth for your life” – underscoring a thematic link between its two pillars.

Why Now? Macro tailwinds and European first-mover advantage. Bitcoin’s 2025 rally and inflation-hedging narrative have revived corporate interest in BTC treasuries. H100 seized this moment to become Sweden’s pioneer, catalyzing a 40% share price surge on its initial BTC purchase in May 2024 The EU’s relative openness – with no prohibitions on corporate BTC holdings and improving custody infrastructure – provides a conducive environment. H100’s competitive positioning is strong: it’s one of only a handful of pure Bitcoin treasury plays globally, in league with MicroStrategy (638,000+ BTC), Metaplanet (20,000 BTC), SWC UK (now ~2,470 BTC), and Capital B (2,201 BTC). Among these, H100 offers high “torque” a smaller base that can grow BTC per share at triple-digit rates, guided by Bitcoin luminaries like Blockstream’s Adam Back (an H100 investor and advisor). In our view, H100 represents a unique, high-growth vehicle to play the Bitcoin corporate treasury theme, especially for investors seeking exposure outside the U.S. market.

Company Overview & Strategy

Origins & Pivot: H100 Group AB’s roots trace back to a smallcap tech entity (formerly eBlitz Group AB) with a focus on digital services and gaming. In 2022, the company acquired Healthy to 100 AS, a Norwegian longevity-tech startup, and rebranded as “H100” – symbolizing the mission to help people live healthy lives to age 100. Throughout 2023–24, H100 built out an AI-driven platform for health service providers, while raising equity in Sweden’s Nordic SME market to fund development (share count jumped from 18.5 M to 117 M in a 2025 rights issue tied to the Healthy to 100 deal).

In May 2024, H100 made a radical strategic pivot: adopting Bitcoin as its primary treasury reserve asset. On May 22, 2024 it purchased 4.39 BTC (≈$0.49 M) – a modest start that nonetheless crowned H100 “Sweden’s first publicly listed company to hold Bitcoin in its treasury”. This bold move, aimed at enhancing “financial sovereignty” of the firm, ignited investor interest. It also put H100 on the map as Europe’s second-ever public Bitcoin treasury company, closely following France’s “Capital B” which began its BTC reserve in late 2024.

Bitcoin Treasury Thesis: Management’s explicit objective is to maximize long-term BTC per share. H100’s CEO articulates Bitcoin as “digital gold” and a hedge against inflation that complements the core health-tech mission. By bolstering its balance sheet with BTC, H100 aims to preserve and grow shareholder equity in real terms, leveraging Bitcoin’s asymmetric upside. The company’s strategy is not to be a passive holder, but an active accumulator continuously raising capital when advantageous and converting it into BTC.

Importantly, H100 still operates as an “operating company” rather than a closed-end fund. It maintains and grows its Health & AI segment (still pre-profit, but strategic). This structure provides two advantages:(1) it widens the investor base (some institutional mandates forbid investing in pure investment companies or ETFs), and (2) it allows H100 to use operating cash flows (eventually) or strategic partnerships to support the BTC program. In practice, H100’s operations remain small relative to the treasury: LTM revenue was only ~SEK 3 M. But the company’s vision is to scale both sides of the enterprise, potentially using Bitcoin-backed strength to fund growth acquisitions in health-tech (creating a virtuous cycle).

Strategic Goal & Targets: While H100 has not publicly published a hard BTC target (e.g. X BTC by 2030), management’s commentary and actions imply ambitious aims. By comparison, peer Sequans Communications (Europe’s largest BTC holder) set a goal to accumulate 100,000 BTC by 2030. H100’s rapid sprint to ~1,000 BTC suggests it aspires to join the top tier of corporate holders (perhaps 5,000–10,000 BTC in coming years, depending on market conditions). The pace will likely depend on maintaining accretive issuance conditions (discussed below). As CEO Andersen stated after topping 1,000 BTC, “this is only the beginning” and H100 is “well-positioned to continue scaling [its] Bitcoin Treasury in a disciplined way.” The treasury mandate from the Board is clear: grow Bitcoin per share over time, even if short-term accounting results fluctuate.

H100’s next milestones to watch:

- Bitcoin holdings: crossing 2,000 BTC (which would place it among Europe’s top 3, after Sequans and Capital B) and 5,000 BTC (a medium-term stretch goal, in our view).

- BTC per share: surpassing 0.01 BTC/FDS (currently ~0.003, so that would require ~3× accretion from here).

- Operating breakeven: using minimal cash burn on health operations so that external funding can focus on BTC buys.

In essence, H100’s strategy is a hybrid of tech startup and BTC holding company: pursue growth opportunities in its niche industry, but always with an eye to denominating success in BTC accumulated per share.

Treasury Flywheel & KPI Framework

H100 follows a Bitcoin Treasury “flywheel” model similar to MicroStrategy’s: issue equity (or other capital) at a premium → buy BTC → increased BTC assets drive more investor interest → share price stays at premium → rinse and repeat. The effectiveness of this flywheel is best tracked by a set of Key Performance Indicators (KPIs) that H100 has begun to disclose, mirroring emerging best practices in Bitcoin-treasury reporting:

- Bitcoin Holdings (BTC): Total BTC on the balance sheet. H100 reports this figure frequently via press releases (often after each significant purchase). It climbed from 4.39 BTC in May 2024 to 1,004.56 BTC by Sept 3, 2025. Exhibit 1 (above) illustrates this exponential growth. We expect H100 to report official quarter-end holdings in its financial statements; for Q3 2025 the figure was ~1,005 BTC. Going forward, we anticipate quarterly transparency on any changes (sales, though unlikely, or additional buys).

- Issued Shares Outstanding (Basic) & FDSO: Shares outstanding surged in tandem with BTC acquisitions. Basic shares rose from ~18.5 M (start of 2024) to 245 M by mid-2025 (after a major rights issue), and further to an estimated ~354 M by Sept 2025 after multiple directed issues and conversions. Fully Diluted Shares Outstanding (FDSO) includes the impact of in-the-money convertibles. After H100’s July convertible issue (Tranche 7 with strike SEK 8.48), an additional ~40 M shares are potentially issuable upon conversion (14.3% dilution if fully converted). As of Sept 2025, those were not yet converted (share price ~SEK 5, below the SEK 8.48 strike), so FDSO ≈ basic shares. All prior convertibles (Tranches 1–5, with strikes around SEK 1.75) were converted in August (6.28 M shares issued). Key point: H100 actively manages issuance; it had no warrants or options outstanding as of June 30, 2025, using primarily new share issues and convertibles to raise capital. This simplifies the share count calculation – essentially all dilution comes from new issuance (when convertibles trigger, they immediately convert, as we saw in Tranche 1–5).

- BTC per Share (BTC/FDS): This is the north-star metric for management and investors. BTC per share = BTC holdings / FDSO. We calculate:

- End of Q2 2025 (June 30): ~200.21 BTC / 117 M shares ≈ 171 sats per share

- End of Q3 2025 (Sept 30): ~1,025 BTC / ~309.7 M shares ≈ 331 sats per share

- Despite the massive share dilution, BTC per share still rose ~44% QoQ in Q3 – a remarkable achievement. This was driven by raising capital at high mNAV multiples (3–5×, see below) such that each new share issued was “backed” by more than one share’s worth of BTC. BTC per share growth is essentially value creation for shareholders in this context, analogous to EPS growth for a profitable company. H100’s management publicly emphasizes this metric; Sander Andersen noted the company’s mission to “increase Bitcoin per share and create lasting value”. We expect H100 to start formally reporting BTC/share in investor materials, as peers like SWC do.

- BTC Yield (%): This KPI measures the period-over-period percentage increase in BTC per share. It is the treasury equivalent of same-store sales growth or organic growth rate, capturing how efficiently the company is increasing Bitcoin per share. For Q3 2025, we estimate BTC Yield = +44.1% (from 0.00211 to 0.00305 BTC/share). Year-to-date (Jan–Sept 2025), the BTC/share has exploded (from effectively 0 to 0.00305), which is not a meaningful percentage (SWC, for example, reported a 31,263% YTD BTC yield after a similar pivot). Going forward, investors will watch this yield normalize – e.g., can H100 sustain, say, ~10–20% BTC-per-share growth per quarter? That will depend on market conditions and issuance opportunities. Management likely has an internal target (perhaps ~100% annual BTC yield in early phases). For context, Strategy achieved ~20% BTC yield YTD in mid-2025 while operating at ~ 1.5 to 2× mNAV. Smaller players like Metaplanet and Capital B had triple-digit yields due to aggressive accumulation. H100’s 44% in Q3 suggests it’s in the high-growth camp.

- BTC Gain (absolute BTC added): In Q3 2025 H100 added ~758 BTC (from ~247 to ~1,025). We foresee absolute BTC additions as a supplementary metric (though less important than per-share metrics, since growth by dilution alone is not beneficial). For reference, H100’s Q3 net BTC gain of +758 BTC was one of the highest among public companies globally for that quarter, rivaling much larger firms. It reflects both capital raised and deployment efficiency.

- BTC ¥/€/$ Gain (translated to SEK or USD): Essentially the increase in treasury value in fiat terms. For Q3 2025, H100’s BTC holdings increase (758 BTC) at quarter-end price (~SEK 1.05 M per BTC) is SEK 800 M ($75 M). This economic “gain” is not an accounting profit (since BTC is likely carried at cost under accounting rules), but it signals the growth in underlying asset value. It also roughly matches the capital raised during Q3 (SEK 75 M from equity, plus convertible drawdowns), indicating the capital was efficiently converted to BTC with minimal slippage or idle cash.

H100 plans to update these KPIs quarterly, if not more frequently via investor presentations. We expect an inaugural “Bitcoin KPI dashboard” in its year-end 2025 report. This transparency will be crucial to maintain market trust in the flywheel.

Disclosure Cadence: H100’s practice so far is to disclose every significant BTC purchase via same-day press release (often tagged as regulatory releases). It entered a pattern of announcing incremental buys (46 BTC, 102 BTC, etc.) in August, and we anticipate similar regular updates going forward, especially as it helps reinforce investor enthusiasm. One important policy: H100 does not carry derivative positions over quarter-end. We infer this from their stated strategy of using only cash (or cash-settled instruments) to generate income (see next section) and the clean cut-off of holdings (e.g., 0 open BTC put positions at quarter-end). This means the reported BTC figure at each quarter’s end is the final, actual holding, simplifying analysis (no in-flight contracts to account for).

In summary, H100’s treasury management framework is all about maximizing BTC per share. The KPIs above will tell the story: if BTC/share keeps climbing each quarter, the strategy is succeeding. If it stagnates or falls (which could happen if the stock trades at a discount to NAV or if poor capital allocation occurs), that would be a warning sign. Thus far, H100’s scorecard is impressive – triple-digit BTC/share growth and disciplined use of funding.

Capital Markets Program & Instruments

To fund its Bitcoin accumulation, H100 has created an innovative capital markets program that rivals much larger peers in complexity. The company effectively uses every funding rail available for a microcap, while carefully managing dilution. Below we map out each instrument and its mechanics:

- At-The-Market Equity Issuance (ATM) – via Directed Issues: While H100 doesn’t have a U.S.-style continuous ATM facility, it achieves a similar outcome through frequent directed share issues authorized by shareholder meetings. In 2025, the Board was empowered (EGM Mar 7 2025) to issue shares without pre-emption rights. H100 has repeatedly tapped this:

- Tranche 6 (July 9, 2025): 27.17 M new shares at SEK 6.38, raising ~SEK 173 M (10.1% dilution at the time). This was done via private placement to institutional investors at a small discount to the market.

- Directed Issue (Aug 13, 2025): ~9.3 M shares at ~SEK 7.00 (est.) for SEK 65.3 M.

- Directed Issue (Sept 3, 2025): ~2 M shares at ~SEK 5.00 for SEK 10 M.

- These issues were executed swiftly, often in a day, leveraging strong demand. Notably, H100 times issues after positive news (e.g., hitting a BTC milestone) to ensure market absorption. Daily trading liquidity in H100’s stock (often >1 M shares, or >SEK 5–10 M on active days) has so far been sufficient to absorb these placements without crashing the price – an important point. In August, the stock peaked at SEK 16.45 on heavy volume, providing an opening for H100 to raise capital at 3–5× NAV. As one measure, issuance pace vs. trading liquidity has been reasonable: the largest single issue (27.17 M shares) was roughly 15–20 days of trading volume, a level that the market digested given the bullish sentiment.Dilution Math & Accretion: When H100 issues shares at a price significantly above its NAV/share, it is accretive to BTC/share. For example, in July the NAV/share (pre-raise) was ~SEK 2 (based on BTC holdings ~247.5 BTC = SEK 300 M over ~117 M shares). Issuing at SEK 6.38 meant each new share brought in value ~3× higher than the BTC backing of an existing share. When that cash was converted to BTC, it raised BTC/share for all holders. We illustrate this in Exhibit 2: before the Jul 9 raise, BTC/share ≈0.000037 (BTC) – essentially negligible; after raising SEK 173 M and buying ~140 BTC, BTC/share jumped to 0.0017 – a 45× increase (accretive). Each subsequent raise has shown similar math: the Aug 13 issue at ~SEK 7 was ~2× NAV at the time, and Sept issue at ~SEK 5 was ~1.5× NAV (still mildly accretive).The key risk is if the stock trades below NAV (mNAV <1×). In that case, issuing equity would dilute BTC/share (each new share would contribute less BTC than existing shares have). H100’s policy is effectively to stop equity issuance if mNAV ≤1×, and pivot to other instruments (like debt or converts) until the premium returns. This implicit discipline is echoed by Adam Back’s guidance on treasury companies: issuance is accretive when stock trades at a sufficiently high premium to its BTC NAV. We estimate H100 needs mNAV >~1.2× to break even on BTC/share after fees; all its 2025 issues were well above this threshold (3×, 2×, 1.5× respectively).

- Convertible Debentures (“Moving-Strike” Convertibles): H100 has creatively used zero-coupon convertible loans to secure funding with preset conversion prices that ratchet higher in stages:

- Tranche 1–5 (May–June 2025): A total of SEK 21 M in 0% loans (largely from Adam Back and co-investors) with conversion at SEK 1.75. These were fully converted into ~12 M shares by Aug 2025, after the stock soared well above the strike. This early funding effectively gave H100 seed capital to kick-start BTC buys with minimal interest burden.

- Tranche 6/7 (July 2025, part of the $54 M raise): Tranche 6 was the equity portion (discussed above). Tranche 7 was a SEK 342.3 M convertible note with conversion price SEK 8.48. It carries 0% interest and matures in a few years (not publicly detailed, but likely 2–3 year tenor). If fully converted, it would add ~40.36 M shares (14.3% dilution). This conversion is in-the-money only if H100 trades > SEK 8.48. The stock hit that level in August (briefly up to 16.45), but has since fallen back. Investors holding these convertibles may choose to wait for the stock to recover (or even push for strategic moves to boost it) – aligning their interests with equity holders. Notably, conversion is one-way (debt to equity), so if the stock languishes, H100 would need to repay in cash at maturity (a risk if BTC prices crash; H100 might then lack cash).

- Tranche 8 (Planned): As an inventive twist, the July financing agreements gave investors rights to a future convertible (Tranche 8) at a strike 33% above Tranche 7. That implies a strike of ~SEK 11.3. This acts like “moving-strike warrants” – if H100’s stock appreciates, it can draw another ~SEK 150–200 M on favorable terms without additional negotiation. Indeed, H100 announced a SEK 150 M “convertible loan guarantee” from Adam Back in June, likely linked to this tranche. This facility means H100 has dry powder to deploy if market conditions support further BTC buys at higher share prices, without immediate dilution.

- In effect, H100’s convertibles serve as deferred equity: they bring in cash now, but add shares later only if the value creation (BTC purchases) succeeds in lifting the stock. This is an anti-dilutive mechanism if the stock fails to rise, H100 keeps a cheap loan (0% interest, which they could otherwise repay via other means or renegotiate), avoiding issuing undervalued shares. If the stock rises, conversion happens but presumably in a context where BTC/share has grown anyway.

- Vendor Equity & Advisory Shares: As a minor note, H100 did issue ~1.42 M shares in August as payment for advisory services (to an advisor of Healthy to 100 AS) at SEK 1.00–1.50. This is a form of non-cash expense and a way to conserve cash. It’s immaterial to the big picture (under 0.5% dilution), but it shows management is willing to use stock as currency for strategic purposes if it aligns incentives.

Issuance-to-BTC Conversion Efficiency: A critical aspect of H100’s program is how efficiently it turns raised capital into BTC. Thus far, execution looks solid:

- After the July $54 M financing, H100’s BTC went from 247 to 510 (add ~263 BTC). At Bitcoin prices ~$110 K, that implies ~$29 M was spent on BTC, meaning ~54% of funds raised were immediately deployed to BTC. The remainder likely went to fees, reserve cash, or was subsequently used in August buys.

- By the end of August, virtually all raised capital was converted into BTC. H100 held 957.5 BTC total, valued ~$107 M. Cumulatively, it raised ~$96 M in capital through various instruments. After transaction costs, essentially the entire amount is reflected in the BTC holdings (957 BTC * ~$111k avg cost = ~$106 M, which is roughly the capital raised plus some initial equity). This ~100% conversion efficiency is impressive; there’s no sign of capital sitting idle or being diverted. It also suggests minimal market slippage – H100 likely executed purchases OTC or via algorithms to avoid moving the BTC price.

BTC-per-Share Bridge: To illustrate the accretion effect of H100’s raises, consider the BTC/share before and after a major capital event:

- Pre-May 2024: 0 BTC/share (no BTC held).

- Post-initial 4.39 BTC buy (May 2024): 4.39 BTC / ~18.5 M shares = 0.00000024 BTC/share – essentially zero.

- Post-rights issue & pre-July raises (June 2025): 4.39 BTC / 117 M shares = 0.00000004 BTC/share (diluted down by acquisition financing; effectively nil).

- After July 9, 2025 raise & buys: ~247.5 BTC / ~144 M shares = 0.001718 BTC/share. Accretion: +4,195% vs pre-raise. (The stock’s mNAV was ~3× during the raise, hence the huge jump).

- After July 21, 2025 raise & buys: 510.3 BTC / ~159 M shares = 0.00321 BTC/share. Accretion: +86.7% vs prior step (mNAV ~2× during issuance).

- After Aug 13 & Aug 20 raises/buys: 911.3 BTC / ~320 M shares (including converts) ≈ 0.00285 BTC/share. This step saw a slight dilution temporarily (BTC/share down ~11% vs post-July21) because the August 13 issue at 7 SEK was less premium (and heavy conversion added shares). However, subsequent BTC price appreciation into late Aug likely restored some per-share value.

- After Sept 3, 2025 raise & buy: 1,004.6 BTC / ~330 M shares = 0.00305 BTC/share. Accretion: +7% vs pre-Sept.

The overall bridge from early May to early Sept is 0 → 0.00305 BTC/share – pure value creation for shareholders who held through the issuances. Exhibit 2 below summarizes two key stages of this journey (July and Sept endpoints).

Exhibit 2: H100’s BTC per share accretion through 2025 capital raises.

The table underscores H100’s disciplined execution: only during a brief August window did BTC/share dip (due to timing of conversion ahead of deploying all funds), and by quarter-end it hit a new high. This showcases management’s ability to manage the timing of raises such that existing shareholders benefited overall.

Anti-Dilution in Practice: H100 essentially followed an unwritten rule: Only raise equity when mNAV > ~1.2×. When the stock shot to 3–5× NAV in July–Aug, they aggressively issued stock. As the premium narrowed by September (to ~1.4×, see Exhibit 3), they pulled back – only a small SEK 10 M round was done at ~1.5× NAV. We expect this discipline to continue. If the stock were to trade at or below 1× NAV, management would likely cease equity issuance entirely (and possibly look at alternative funding like asset-backed loans or simply wait).

Exhibit 3: H100’s Market-to-NAV (mNAV) multiple spiked in mid-2025 and later normalized. A higher mNAV (premium) enables accretive equity raises. By Sept 2025, mNAV ~1.5× – down from ~4–5× at peak – suggesting a more measured issuance approach near-term.

Comparative Funding Mix: Versus peers, H100’s capital strategy is among the most equity-heavy – by necessity as a small cap. For instance, Strategy at times used ~60% equity / 40% preferred in a major raise, and holds outstanding debt (2027 notes). Metaplanet (Japan) issued both equity and bonds (redeeming some via BTC gains). Capital B (France) similarly raised equity (€5 M in Sept 2025) to strengthen its treasury and has strategic investments from figures like Adam Back. H100 so far avoided long-term debt and has leaned on dilutive but accretive instruments (shares, converts). This is appropriate for its stage – maintaining flexibility and no fixed interest burden.

In the future, if H100’s stock ever trades at a sustained discount (mNAV <1×), we might see a pivot: perhaps issuing a convertible with a lower strike (closer to market), or even a secured loan using some BTC as collateral, to continue accumulation without selling cheap equity. Another lever is strategic partnerships – e.g., raising funds from a tech or crypto industry partner in exchange for equity at a premium (similar to how some miners have secured capital).

Bottom Line: H100’s capital markets program is an example of how a microcap can harness market enthusiasm to build a Bitcoin war chest rapidly. The company has diluted nominal ownership significantly (total shares ~18× higher YoY), but each share now represents far more BTC than before – a trade-off that long-term holders have welcomed (reflected in the stock still trading above its underlying BTC value). The next test will be whether H100 can adapt if conditions change – e.g., if Bitcoin’s price corrects or if investor appetite for new issues wanes. For now, H100 has sufficient funding (some cash on hand plus the potential Tranche 8 ~SEK 150 M) to opportunistically add to its treasury, and it can wait for windows of strong mNAV to issue more equity.

Case Study – Hypothetical Q4 2025: Suppose Bitcoin is trading around $100k and volatility is high. H100 might sell cash-secured puts at a strike 20% below spot, expiring in 1 month, for a premium of 5% of notional. If BTC stays flat or up, they earn the premium (which they could then convert to ~5% more BTC). If BTC falls >20%, they would buy at the strike (effectively acquiring BTC at a 15% discount versus initial spot, considering the premium). Either outcome increases BTC holdings. The risk is if BTC free-falls far below the strike, they still have to buy at the strike (but since H100 is structurally bullish and wants more BTC, that’s an acceptable outcome within reason – as long as they sized appropriately).

Real Example – Q3 2025: H100 has not publicly confirmed any option trades, but peers have:

- SWC (UK) disclosed it earned premium income via covered calls/puts to boost its BTC position.

- Capital B similarly emphasized “Bitcoin yield” through active treasury management (though details were scant). Given H100’s rapid share issuance and deployment, it likely had little idle cash to run an options strategy in Q3. But going forward, as treasury grows, dedicating a portion to generate yield could meaningfully boost BTC per share.

Potential Impact: If H100 allocated, say, 10% of treasury (~100 BTC worth of cash) to an options program, targeting a conservative 10% quarterly yield on that capital, it could add ~10 BTC per quarter (~1% of holdings) without additional dilution. Over a year, that compounding could add ~4–5% to BTC per share – not game-changing, but valuable incremental gain. Furthermore, executing such trades signals to sophisticated investors that H100 is maximizing every avenue to increase its BTC stack.

One illustrative outcome: In a volatile quarter, H100 sells BTC put options that end up exercised – acquiring, say, 50 BTC at an effective cost 10% below market thanks to premium. Those 50 BTC are essentially “free” of dilution and immediately accretive. Conversely, if options expire unexercised, H100 might pocket premiums (in cash or BTC).

For risk management, H100 will likely keep strict limits: e.g., notional of sold puts < 20% of cash, collateralization 100%+. We expect them to avoid selling calls on a large portion of their BTC – they wouldn’t want to cap too much upside. If any calls are sold, they would be far OTM and on a small % of holdings (monetizing some extreme upside scenarios while retaining most exposure).

Accounting Treatment: Premiums from option sales would count as other income (likely realized P&L when options expire or are closed). If they acquire BTC via put assignment, the BTC is booked at the strike price net of premium (i.e., at a discount). Importantly, these activities could introduce some P&L noise – realized gains from expired options or possibly losses if they close positions early. H100 will likely footnote these in reports.

Conclusion: BTC income generation is a supplementary lever for H100. It won’t overshadow the core strategy (direct BTC purchases funded by capital raises), but it can enhance yields at the margin. We view positively that H100’s team has the capital markets savvy (including hiring a Head of Bitcoin Strategy in Aug 2025) to implement such tactics responsibly. Going forward, investors should watch for any disclosure of option strategies – it could signal H100’s intention to squeeze out additional BTC growth even when not issuing new shares.

-> Read Part 2