Gold Is Melting: Hard Money's Migration to Bitcoin

Executive Summary

The world's oldest store of value is quietly dissolving in real time. Gold, the anchor of wealth for more than five years, has lost almost 75% of its value against Bitcoin since 2021.

This chart isn’t merely a trade signal; it’s a monetary migration map, a visualization of capital moving from the analog world to the digital. For the first time in history, the physics of money is shifting.

Gold’s traditional strengths, scarcity, neutrality, physical permanence, once made it essential. In the 21st century, those same qualities are now liabilities. It’s slow, bulky, costly, and trust-dependent.

Where matter once ruled, math now dominates. Bitcoin is a closed, incorruptible, self-auditing monetary network that can't be inflated, seized, or faked. What gold was to the industrial era, Bitcoin is to the information age, only faster, smarter, and exponentially more secure.

I. The Commodity Trap

Gold, like all commodities, lacks an issuer and therefore yields nothing. It can be mined, stored, and sold, but it can’t grow or compound.

Commodities store energy, but they don’t generate capital. Gold simply decays more slowly than oil or wheat, the least-bad among poor choices.

No billionaire built their fortune on gold. They built it on productive networks, not inert matter.

Bitcoin is the first commodity to behave like a network, scarce, scalable, and able to grow via adoption.

II. Inflation from Supplies: The Bleeding

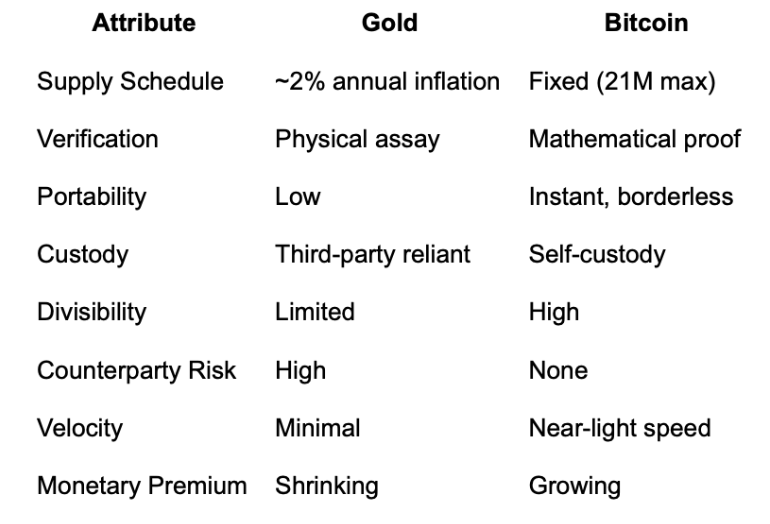

Gold’s scarcity isn’t absolute. Roughly 2% of new supply is mined annually, diluting existing holdings.

At that rate:

- Purchasing power halves every 35 years

- 87% erodes over a century

A $100 million gold hoard in 1900 would hold just $13 million in purchasing power today, assuming no wars, confiscations, or defaults.

By contrast, Bitcoin’s issuance is mathematically fixed. Its total supply caps at 21 million coins, enforced by code, not trust.

Post-2028, annual inflation drops below 0.2%, effectively ending the age of elastic money.

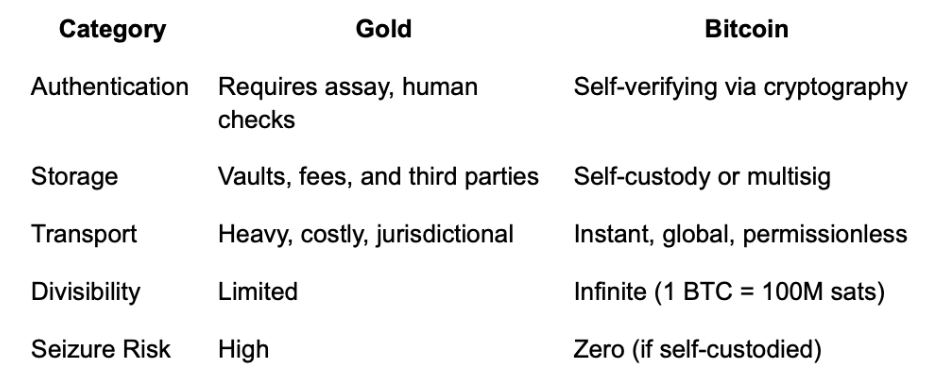

III. Friction, Custody, and Counterparty Risk

Gold’s physical form makes it expensive, slow, and insecure.

Each extra ton of gold adds friction. Each new terabyte of Bitcoin adds security.

IV. The Violence Premium

Gold’s legacy is soaked in conflict. It has long been a magnet for theft, conquest, and seizure, from Rome’s sack to Spain’s gold rush.

Bitcoin flips that equation. It’s money that can’t be stolen, wealth that can’t be located, value that can’t be forced.

Gold made men targets. Bitcoin makes them sovereign.

In today’s shifting geopolitical landscape, possession isn’t nine-tenths of the law. Private key control is.

V. The Myth of the Gold Standard

The romantic idea of a universal gold standard is a myth.

Historically, gold-backed systems were credit regimes resting on a metal base. All collapsed under the weight of war, debt, and inflation.

Bitcoin ends that cycle. It’s the first fully collateralized, non-expandable monetary base with no counterparty, no custodian, no state backing.

In short:

- Gold was trust in metal.

- Bitcoin is trust in math.

VI. Gold Has No Application Layer

Gold’s physical nature makes evolution impossible. It can’t plug into global payment rails, settle instantly, or be used as programmable collateral.

Bitcoin fuses asset and network:

- Base Layer: Immutable ledger of monetary truth

- Settlement Layer: Lightning Network for instant payments

- Collateral Layer: Bitcoin-backed credit and treasury markets

This makes Bitcoin the first self-contained financial organism, an autonomous monetary system able to scale globally without intermediaries.

VII. Comparative Integrity Framework

Gold was ideal collateral for a slow-moving world. Bitcoin is ideal for a fast one.

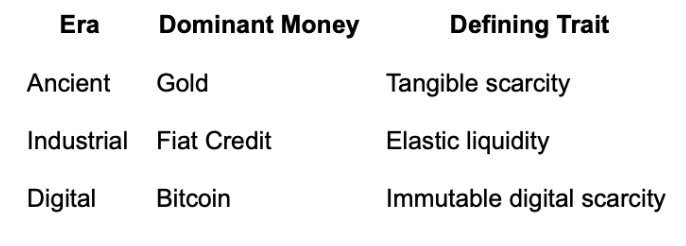

VIII. The Evolution of Money

Money evolves through technology, not ideology.

Gold flourished when communication was slow and trust was local.

Bitcoin thrives when communication is instant and trust is global.

IX. From Fort Knox to Cyberspace

Fort Knox is energy frozen in place, inert, locked, and lifeless.

Bitcoin nodes are energy in motion, auditable, mobile, and compounding.

Remove gold’s flaws, inflation, custody risk, friction, and poor divisibility, and what remains is Bitcoin.

Gold was money for empires. Bitcoin is money for networks.

“Gold was the money for soldiers. Bitcoin is money for civilizations.”

X. Investment Implications

For institutional investors, the performance divergence is sharp:

- Gold down ~75% vs. BTC since 2021

- Annual gold inflation: ~2%

- Bitcoin inflation (post-2028): <0.2%

- Custody cost: 0.3–0.5%/yr for gold, near zero for Bitcoin

- Liquidity: 24/7, global, instant

Bitcoin has become the hard-money benchmark.

Gold is now a relic, an antique liquidity hedge in an era demanding speed and scale.

Conclusion

Gold served humanity for 5,000 years, but its physics are no longer fit for purpose.

It can’t move fast enough, divide small enough, or scale wide enough to anchor wealth in a digital-first world.

Bitcoin is not “digital gold.” It is digital monetary truth, the first form of wealth to transcend matter entirely.

Gold is melting. Bitcoin is hardening. The migration is irreversible.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.