BTC per Share vs. Balance Sheet Risk: Decoding Metaplanet’s January Financing

In late January 2026, Metaplanet executed a third-party allotment of common shares and stock acquisition rights that, at first glance, looked like another aggressive Bitcoin accumulation raise.

The structure was premium-priced. The warrants were independently valued. Dilution was contained.

But the updated allocation schedule tells a more nuanced story.

This was not primarily a Bitcoin expansion transaction.

It was a balance sheet recalibration designed to protect BTC per share by reducing leverage risk.

The Transaction in Brief

Metaplanet issued:

- 24,529,000 common shares

- 159,440 stock acquisition rights (25th Series)

- Issue price: ¥499 (105% of prior-day close)

- Warrant exercise price: ¥547 (115% of prior close)

- Warrant term: 1 year

- Standalone dilution: 3.54%

Total estimated net proceeds: ¥20.74 billion

The warrants were priced at fair value using a Monte Carlo simulation assuming 116.7% volatility not a discounted sweetener. This matters: the economics were structured around volatility monetization rather than visible price concessions.

On structure alone, this was disciplined capital engineering.

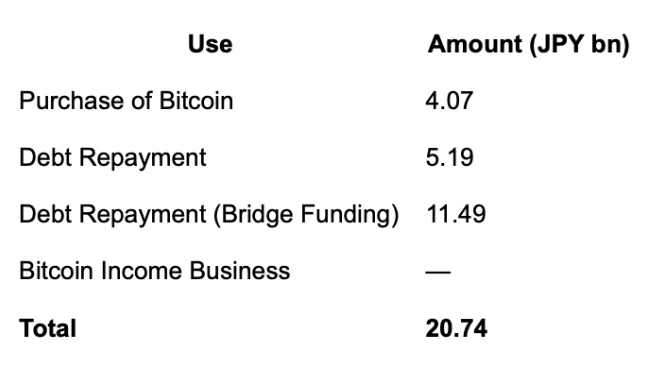

The use of proceeds shifts the narrative.

The Capital Allocation Pivot

The revised allocation schedule shows:

Roughly 80% of proceeds are allocated to debt repayment.

Only ~¥4.1B is earmarked for immediate Bitcoin purchases.

This is not leverage expansion.

It is deleveraging.

The Balance Sheet Context

Metaplanet currently operates with:

- USD 500M credit facility

- USD 280M drawn

- Bitcoin NAV ≈ USD 3.1B

- Leverage ≈ 9% of BTC NAV

The January raise effectively:

- Repays bridge borrowings immediately

- Reduces outstanding facility usage

- Restores borrowing headroom

This converts short-term leverage into permanent equity capital.

In institutional terms:

The company is terming out bridge financing into permanent capital.

That lowers refinancing risk and strengthens capital durability.

The Strategic Tradeoff

For a Bitcoin treasury company, the core metric is BTC per share.

There are two ways to grow it:

- Issue equity aggressively and buy BTC

- Optimize capital structure to preserve flexibility and reduce downside risk

The original narrative implied path #1.

The updated allocation reflects a temporary emphasis on path #2.

By reducing leverage:

- The company reduces forced-sale risk

- Preserves credit facility optionality

- Improves resilience if Bitcoin corrects

- Strengthens optics for future preferred issuances

This is less aggressive but more durable.

Dilution vs. Accretion

Standalone dilution from this raise is modest at 3.54%.

The company’s thesis remains:

If BTC per share grows faster than dilution, shareholders benefit.

However, since only ¥4.07B goes to new Bitcoin purchases, immediate BTC-per-share acceleration is lower than previously assumed under the earlier ¥14B allocation plan.

Instead, the value creation comes from:

- Lower leverage risk

- Preserved future borrowing capacity

- Improved capital stability

This is a slower, but structurally safer path.

Why This Makes Sense Now

Bitcoin treasury equities globally have entered a volatility phase.

Raising capital purely to increase exposure in that environment increases balance sheet fragility.

By contrast, Metaplanet’s move:

- Monetizes equity volatility at premium pricing

- Uses permanent capital to reduce bridge leverage

- Keeps debt as a flexible tool rather than primary fuel

This is capital-cycle discipline.

It suggests management is optimizing long-term survivability rather than maximizing short-term leverage.

What Happens Next Matters

The key forward-looking question is how management deploys restored borrowing capacity.

If they:

- Re-draw the credit facility during market weakness → This raise becomes strategic dry powder creation.

If they:

- Maintain lower leverage structurally → This signals a more conservative treasury evolution.

Either path improves resilience relative to an all-in leverage expansion.

The Broader Implication

Metaplanet has grown Bitcoin holdings from 1,762 BTC at end-2024 to over 35,000 BTC by end-2025 with reported BTC-per-share growth of 568% year-over-year.

The January financing suggests the company is entering a second phase:

From aggressive accumulation To capital structure optimization

For a company whose equity volatility is structurally tied to Bitcoin, managing balance sheet risk is as important as maximizing exposure.

Bottom Line

Metaplanet’s January 2026 financing was not a simple Bitcoin buying spree.

It was a deliberate tradeoff:

- Accept 3.5% dilution

- Replace bridge leverage with permanent equity

- Preserve borrowing headroom

- Allocate modest new capital to BTC

- Reduce structural risk

The headline tension is clear:

BTC per Share vs. Balance Sheet Risk.

In January 2026, Metaplanet chose to protect the balance sheet.

Whether that proves conservative or prescient will depend on what Bitcoin does next.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.