Bitcoin Is the Hurdle Rate

What Changes When Stocks Are Priced and Measured in BTC

Roxom Insights

For most of financial history, the hurdle rate was implicit.

Investors measured success against inflation, interest rates, or market indices benchmarks rooted in fiat money. But Bitcoin changes that framework entirely.

For Bitcoin-native investors, the hurdle rate is no longer a bond yield, the S&P 500, or even the U.S. dollar.

Bitcoin itself is the hurdle rate.

If an investment cannot outperform simply holding BTC over time, it has failed not philosophically, but economically.

From Nominal USD Returns to BTC-Relative Performance

In dollar terms, performance can be misleading.

A stock may be:

- Up 15% in USD

- Beating its benchmark

- Delivering “strong” nominal returns

And still be down when measured in Bitcoin.

Bitcoin removes the distortion created by:

- Monetary expansion

- Dollar debasement

- Nominal return optics

What remains is a far more honest question:

Did this asset increase my Bitcoin, or not?

When BTC becomes the reference point, capital allocation stops being subjective.

Bitcoin as Capital at Rest

Holding Bitcoin requires:

- No management execution

- No reinvestment decisions

- No dilution risk

- No terminal decay

Bitcoin represents monetary inertia capital at rest that compounds relatively as dollar supply expands.

This makes BTC an unusually demanding benchmark.

Any asset that introduces leverage, operational risk, or time preference must justify itself by outperforming Bitcoin.

Doing nothing has never been harder to beat.

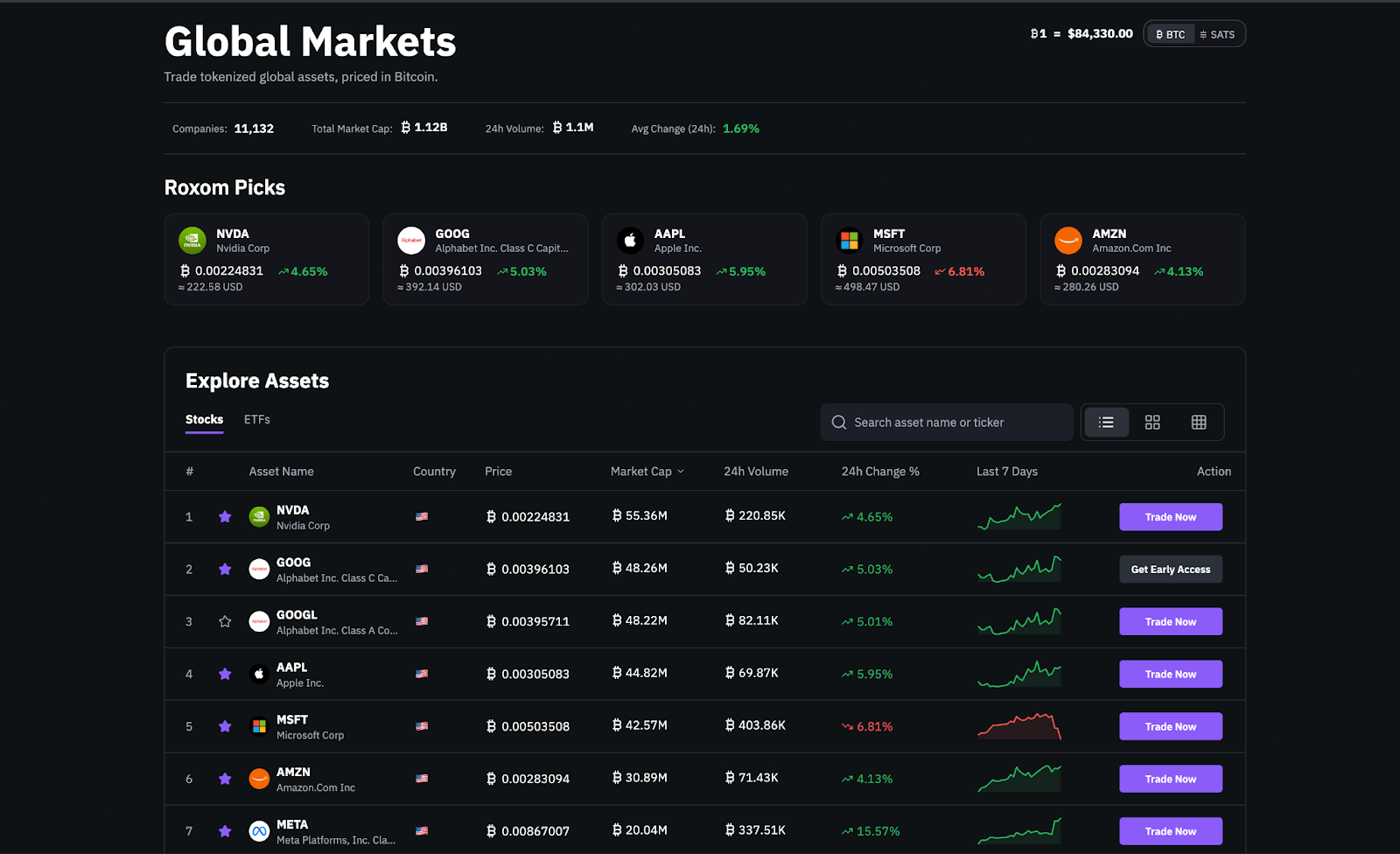

A Thought Experiment: Stocks Priced in Bitcoin

Now imagine a simple structural shift:

- Stocks are priced in BTC

- Trades settle in BTC

- Portfolios are measured in sats

Instead of:

“This stock trades at $120”

You see:

“This stock trades at 0.0014 BTC per share.”

That single change forces a re-evaluation of what equity ownership actually means.

What BTC-Denominated Stocks Reveal

1. Dilution Becomes Immediately Visible

In BTC terms, dilution cannot hide.

If a company issues shares without generating BTC-accretive value, the BTC price per share falls clearly and directly.

No adjusted earnings.No accounting narratives.Just fewer sats per share.

2. Capital Allocation Is Fully Exposed

Every management decision collapses into one question:

Did this increase BTC per share?

This applies to:

- Equity issuance

- Acquisitions

- Buybacks

- Treasury strategy

Bitcoin becomes the universal scoreboard for capital discipline.

3. Time Preference Compresses

Quarterly earnings volatility matters less.

Long-term Bitcoin accumulation matters more.

BTC-denominated markets naturally favor:

- Long-duration thinking

- Scarcity-aligned strategies

- Balance-sheet strength over financial engineering

Equities Stop Being Stores of Value

In a Bitcoin-referenced world, equities are no longer treated as monetary assets.

They become productive instruments held only if they outperform BTC on a risk-adjusted basis.

Every stock competes against the same alternative:

Hold Bitcoin and do nothing.

That is the hardest benchmark capital markets have ever faced.

How BTC-Denominated Markets Emerge

This transition will not happen overnight.

BTC-denominated equities are likely to emerge in stages:

- Synthetic BTC-priced instruments

- BTC-settled equity wrappers

- Native Bitcoin capital markets

- BTC-based portfolio reporting

- BTC-first capital allocation frameworks

Each step reduces dependence on dollar benchmarks and increases monetary clarity.

Why This Matters

Bitcoin is not just another asset class.

It is a new unit of account one that enforces discipline without regulation, narratives, or trust.

When assets are measured in Bitcoin:

- Dilution is punished

- Capital misallocation is exposed

- Monetary truth becomes unavoidable

The Roxom View

Bitcoin represents the most stringent hurdle rate ever introduced to capital markets.

As equities and financial instruments begin to reference BTC rather than USD, markets evolve toward:

- Higher capital efficiency

- Lower monetary illusion

- Clearer long-term value creation

In a Bitcoin-denominated world, the question every investor must answer is simple:

Does this asset earn more Bitcoin over time or should capital remain in BTC?

If not, the decision is obvious.

FOLLOW US ON:

X (Twitter), Youtube, Instagram, Linkedin

Access to these products and services is restricted to non-U.S. persons and may not be available in certain jurisdictions.